first level title

1. YAM

YAM,YFI+AMPL。

(1) What is YAM

Specifically, it uses YFI’s mining output method, but supports almost all mainstream DeFi tokens;

Then the mined YAM has the same inflation-deflation mode as AMPL.

Don’t buy it,(2) 100 times instant annualization

YAM is different from YFII and YFI, the total amount is 5 million, and the price has reached hundreds of dollars, which is obviously unsustainable. The high probability of buying in the secondary market is to take over. The specific strategy is as follows:

as form,

as form,

First, there are eight pools, each with an average of 250,000 YAM, so the annual hua is different, and the highest COMP annual hua is 22,000%;

Second, AMPL is mined with AMPL/Auntie, the uni-v2 that performs liquidity proof on Uniswap;

Third, the first reBase (inflation and deflation) will start at about 3:00 pm on August 13, 12 hours after the start of the second pool;

Fourth, part of reBase will buy yCRV;

Fifth, reBase once every 12 hours, once at 4 am and once at 4 pm;

Sixth, now, YAM has been opened on Uniswap, about 70U;

Seventh, the current TVL is 200 million U.

Available in yam.tools, view.

first level title

2. Machine gun pool

In one sentence, it is clear how to participate in complex YAM mining:https://vault.yfii.finance1. to go

Deposit (COMP, LINK, LEND, SNX, MKR, YFI, WETH, AMPL)

2. YFII smart pool mines for you

3. Automatically withdraw cash for you and convert it into YFII income (repurchase from the market)

Let's talk about it in detail.

YFII has been reported many times before. YFII is a fork of the YFI project following YIP-8 (Yearn Finance No. 8 Improvement Proposal). A distinctive feature of this project is the exploration of DAO by a community of industry leaders. , contract audit team, etc., all gather top talents in the industry to actively provide voluntary services. Compared with YFI, YFII is more focused on the business line, which is equivalent to a wealth management fund. Here is an excerpt from the evaluation of Mr. Xu Chaoyi:

Since its launch on July 27, the distribution of 40,000 YFII is close to completion (more than 80%) after two halvings. The new product DeFi mining revenue aggregator "DeFi Smart Pool (yVault)" has completed community audits and is now online.

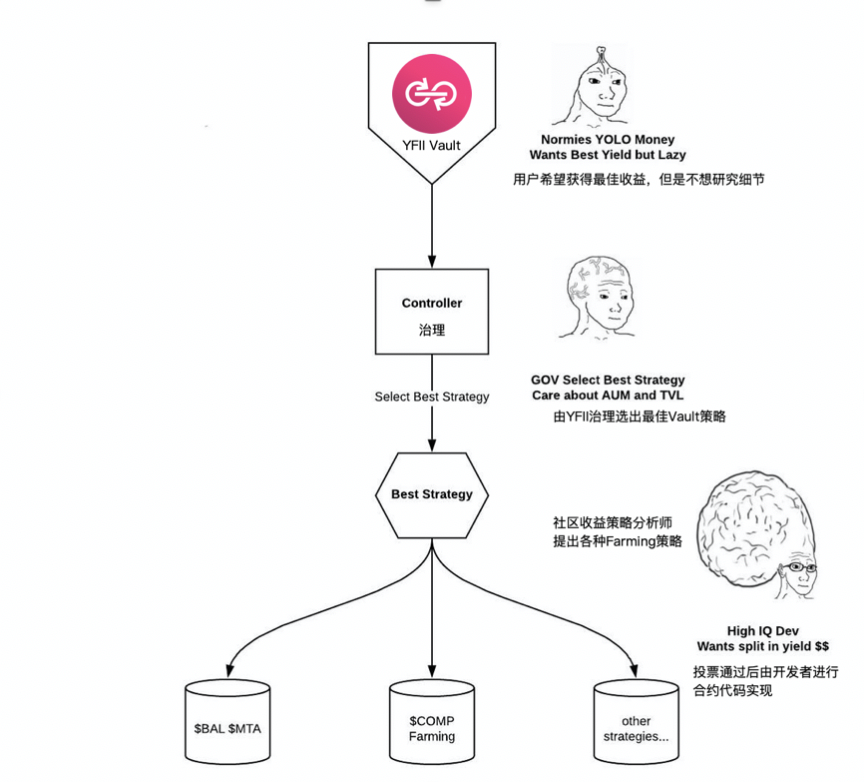

The smart pool is actually a product in the previous planning. The investment elites design the investment strategy, choose the optimal mining strategy and save the high gas fee for mining for retail investors. The project has been deeply participated by more than 80 industry leaders and investment elites, including well-known entrepreneurs in the currency circle "Lao Bai" and "Gao Jin", Cao Yin, managing director of the Digital Renaissance Foundation, and Dovey Wan, founding partner of Primitive Ventures.

The name Smart Pool probably means that it is similar to PoW mining Smart Pool. Community elites conceived a plan with the highest income, mining, withdrawing and selling a specific currency to exchange for the highest quality currency, similar to Binance Mining Pool, which was once the largest BSV mining pool (Binance’s views on BSV are well known), because BTC/BCH/BSV use the same mining algorithm, why not mine when mining BSV can be exchanged for more BTC. The same is true for YFII's DeFi smart pool. Mining, withdrawing and selling projects with the highest instantaneous income and security, and repurchasing YFII in the market, can greatly reduce the investment of GAS fees for ordinary liquid mining participants (playing DeFi Mining tossing back and forth consumes a few ETH handling fees, which is not enough at all, and the mining pool can evenly share this cost), and can obtain the highest income.

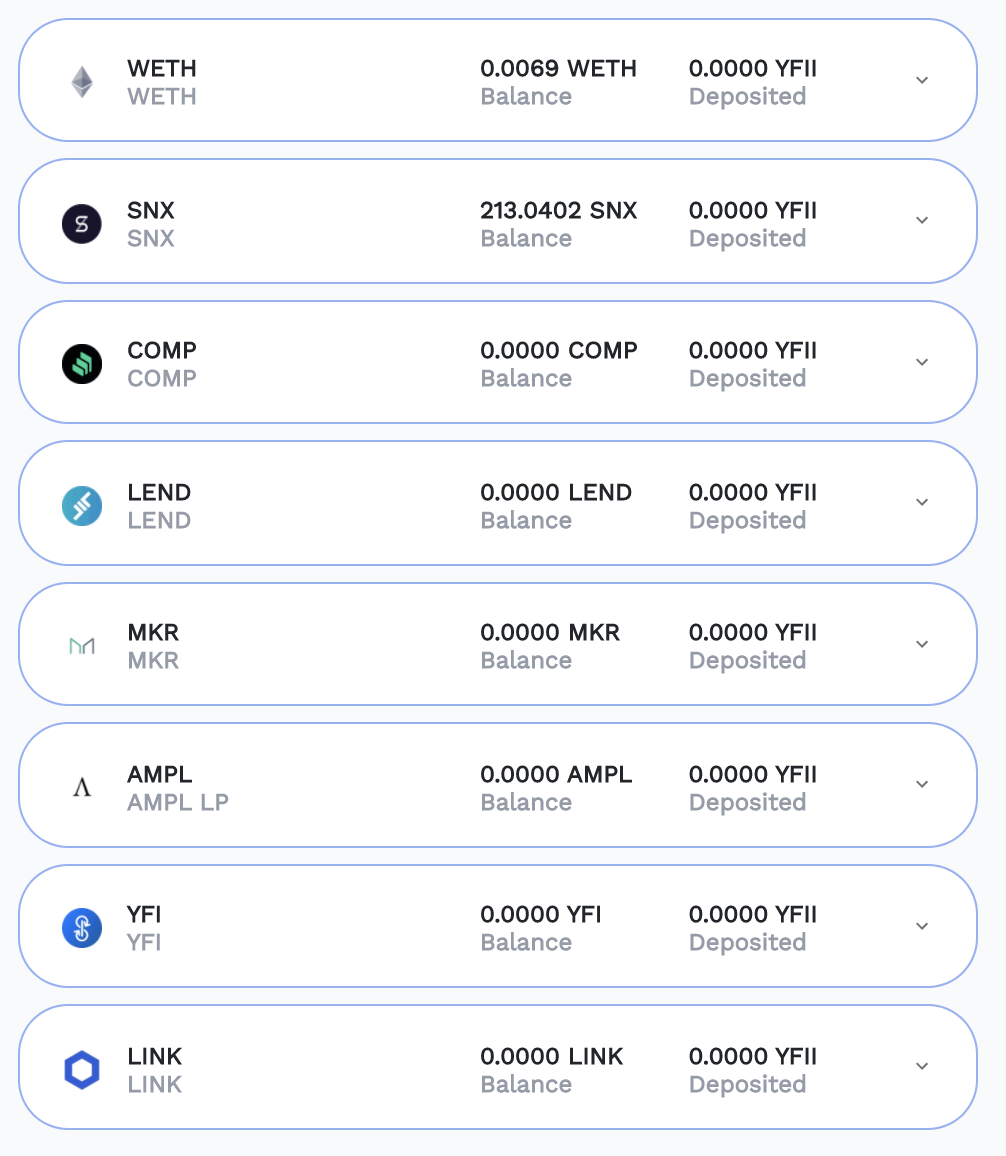

The first batch of supported projects are the eight trading pairs under today's popular project YAM. Users only need to deposit any currency in COMP, LINK, LEND, SNX, MKR, YFI, WETH, AMPL into the YFII machine gun pool, and you can Automatically obtain YFII income (from the secondary market repurchase), the current highest static yield exceeds 10,000% annualized.

The basic setting of the mining pool is to deposit a certain coin (COMP, LINK, LEND, SNX, MKR, YFI, WETH, AMPL), and dig out YFII, so the dividends are all YFII (this is for depositing WETH, mining YFII, no loss of principal)

first level title

3. How to use YFII Vault

Step 1: Prepare to mine the basic assets, supporting the following 8 currenciesVault ( https://vault.yfii.finance/ )Step Two: Enter

Interface, and connect to metamask or Ethereum wallet

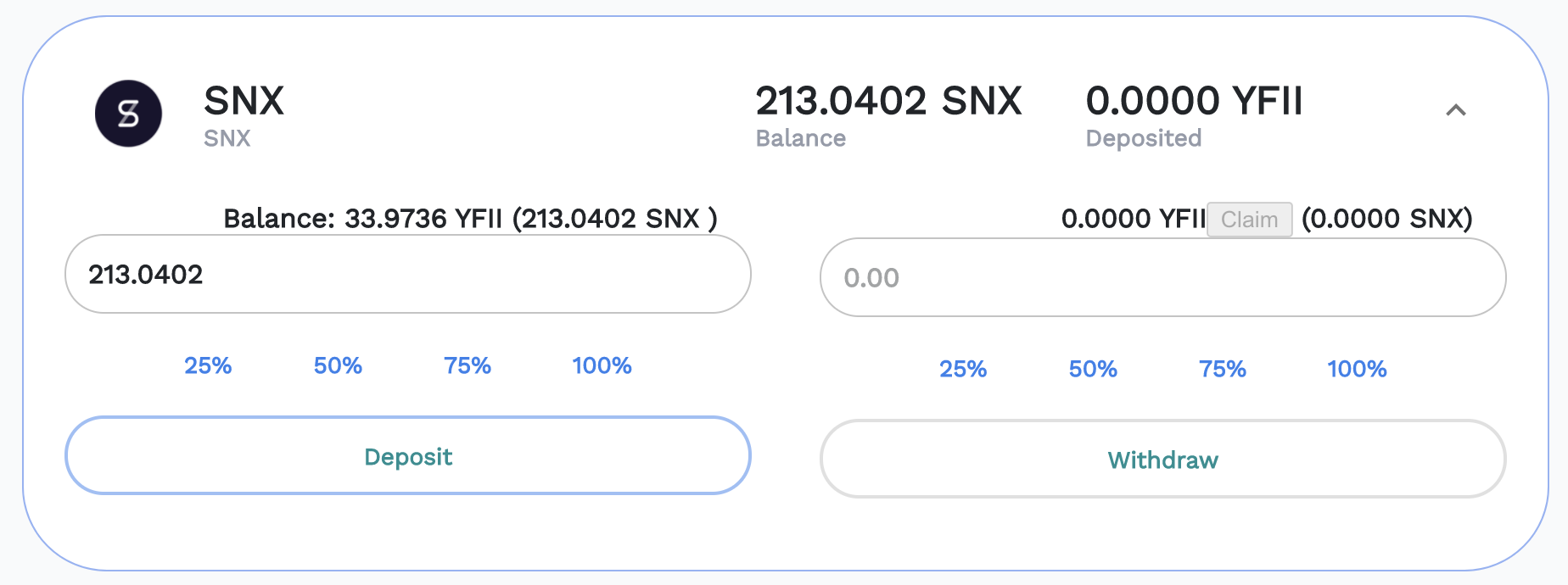

Step 3: Enter the currency details interface. Take SNX as an example: enter the amount on the left, and click Deposit, first complete the first transaction to authorize the Vault, and complete the second transaction to recharge, then complete the deposit process and start DeFi mining.

Other functions:

The small Claim button on the right is the function of receiving YFII income, which does not affect the principal to continue mining

Enter the amount on the right and click Withdraw to withdraw the principal

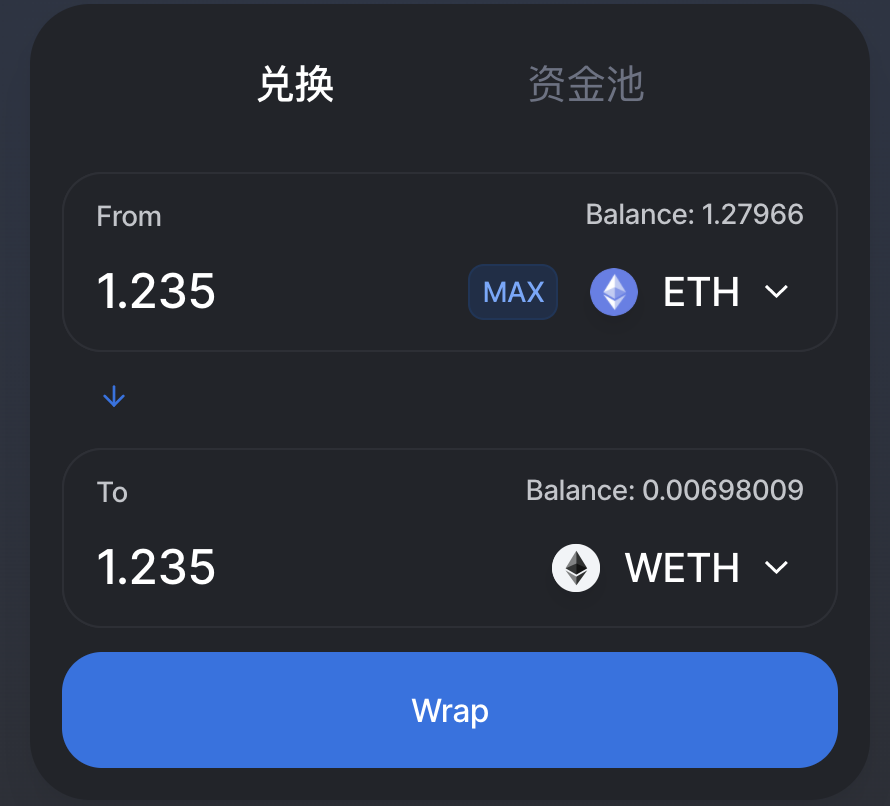

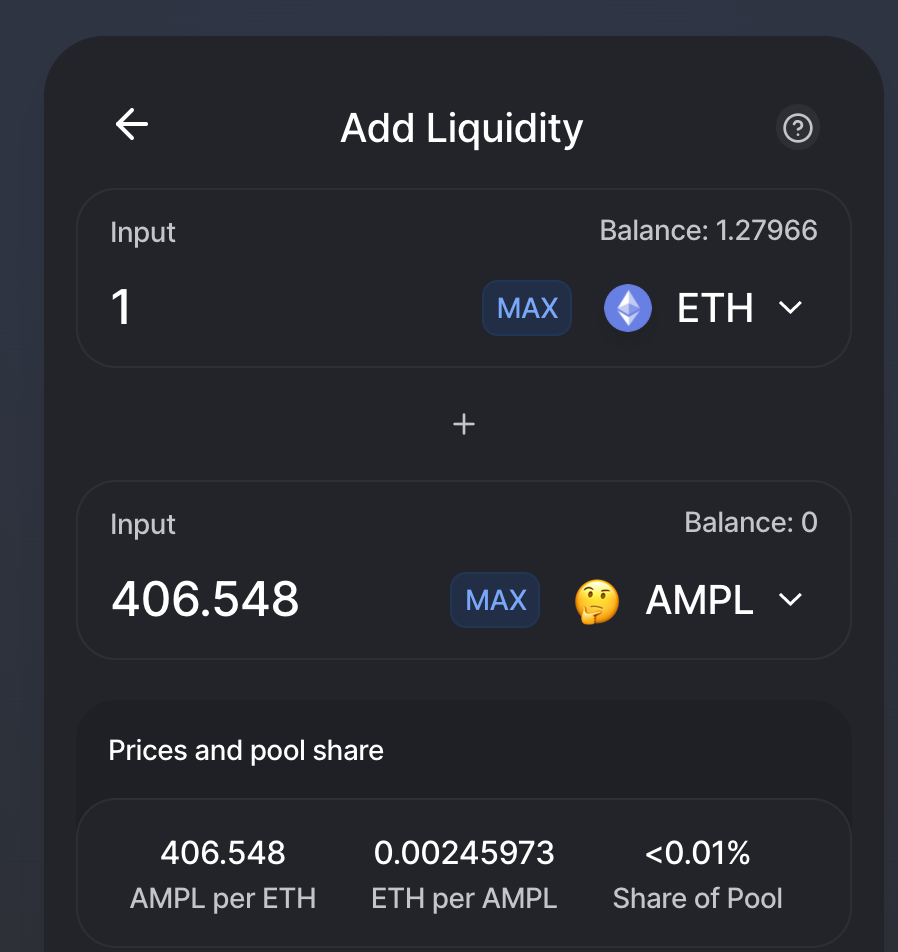

How to exchange WETH and get LP(AMPL-ETH)?UniswapWETH is the tokenized ETH of ERC20. In terms of price, 1ETH is always equal to 1WETH. Through

two-way exchangeUniswapObtaining LP (AMPL-ETH) needs to pass

Provide liquidity of AMPL and ETH to generate

Operation method:Uniswapenter first

text

text

§ 0.1-0.2 ETH (used to pay the gas fee, actually do not need so much, but it is recommended to prepare more)

secondary title

4. Introduction to Vault

What is YFII Vault?

YFII Vault is a smart contract that focuses on DeFi, one-key gold automatically configures the best DeFi mining income in the market. Users only need to deposit the corresponding currency into the Vault to obtain the highest DeFi mining income in the market without any contract operations. Vault is a popular DeFi wealth management protocol developed by the YFII team, which supports the free integration of wallets and exchanges.

What are the advantages of YFII Vault?

At present, the GasPrice of Ethereum transactions has reached as high as 200 gwei, and the cost of each operation is as high as 5 to 10 US dollars. At the same time, the design of high-yield DeFi projects is complicated, and multiple operations are required to start mining, resulting in high user fees, which is especially unfavorable for small funds. On the other hand, YFII Vault only needs one-step recharge to start project mining.

What currencies does YFII Vault currently support? What is the mining annualized rate of return (APY)?

COMP 6200% MKR 4900% SNX 3900% LP(AMPL-ETH) 3800%

LEND 3200% LINK 1600% YFI 1000% WETH 800%

Current market APYhttps://yieldfarming.info/yam/comp/

Real-time yield query URL:

Profit settlement method of YFII Vault?

Vault uses YFII as the standard settlement profit, and the strategic income will automatically pass through the optimal DEX path, and be converted into YFII through smart contracts as income. Since YFII’s strategy is designed to be continuously repurchased, there will be an expectation of rising prices. At the same time, the mining currency is under continuous selling pressure from miners, and the price is expected to fall. The timely exchange of mining currency into YFII by the Vault strategy is conducive to the appreciation of user assets.

product details:

The income calculator of each mining pool and the latest UI are under development

YFII community contact information:

YFII Chinese community assistant WeChat myGrassU

Twitter: https://twitter.com/FinanceYfii

Telegram: https://t.me/yfiifinance

Discord: https://discord.gg/tpHWz4

Note:

Note:

YAM was developed by four well-known DeFi developers. It has not yet undergone strict audits and is only in the community audit stage. Please pay attention to risks.

Yearn Finance is a DeFi income aggregator. After launching the governance token YFI on July 17, it quickly detonated the liquidity mining market because of its novel distribution mechanism and governance scheme. YFII is a fork of the YFI project, following YIP-8 (Yearn Finance Improvement Proposal No. 8), implementing a Bitcoin-like halving mechanism.

Excluding the YFII and YFI projects, other projects called Y**I have nothing to do with the original YFI community, and have not undergone code audits, private key destruction/multi-signatures, and it is possible to pre-excavate and issue infinitely at any time. It is extremely risky, and someone has already been scammed, please avoid participating.https://www.odaily.com/post/5154104

YFII has passed the contract audit of Ambi Lab: