The development of DeFi is hot, and with the hot development of DeFi, the demand for DeFi insurance is also increasing rapidly, because it is obvious that using DeFi products is a high-risk behavior, and it is wise to buy an insurance for funds.

first level title

1. What is Nexus Mutual?

Nexus Mutual is a mutual insurance platform that can provide risk protection for DeFi products. Nexus Mutual is the hottest DeFi insurance platform.

first level title

2. What kind of insurance can Nexus Mutual provide?

The insurance coverage provided by Nexus Mutual is limited. Currently, it mainly provides insurance for losses caused by loopholes in the smart contract itself and hacker attacks.

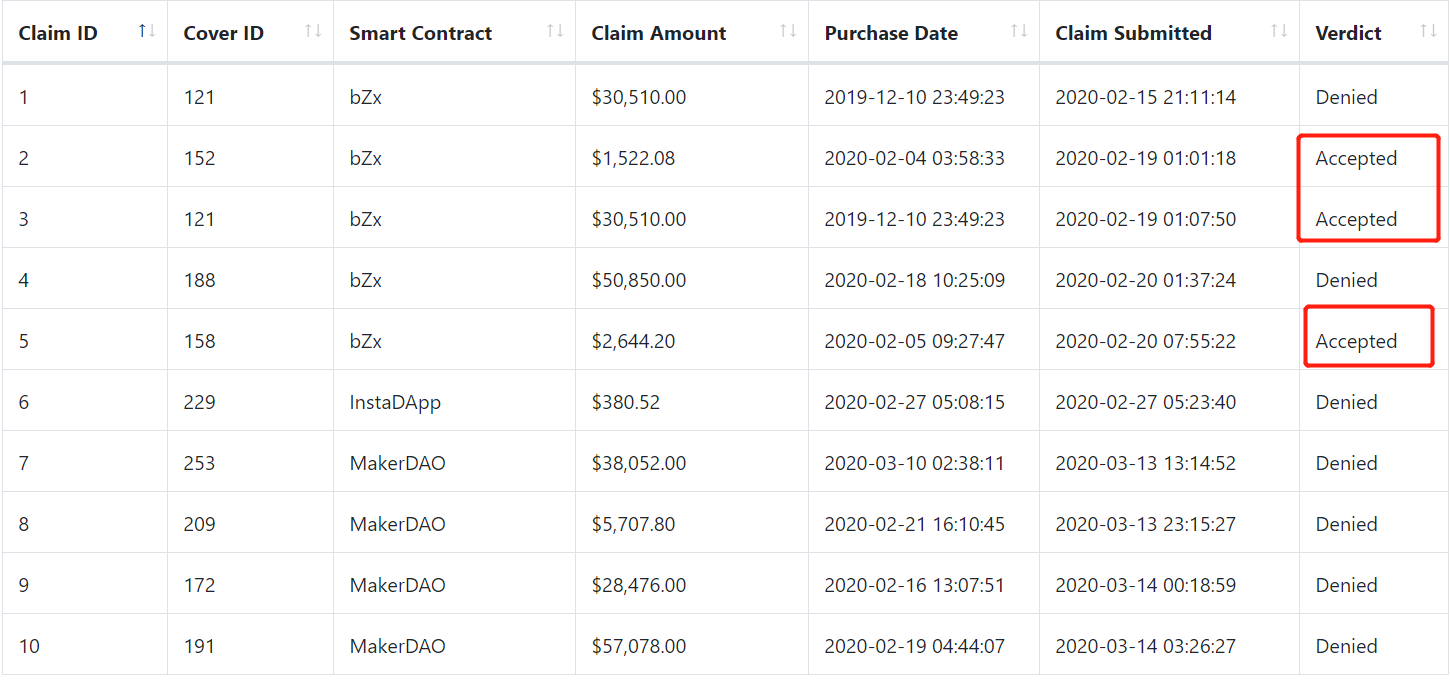

For example, Nexus Mutual paid for the losses caused by the attack on bZx in February this year.

Losses that are not caused by smart contract vulnerabilities or hacker attacks, such as losses caused by private key security vulnerabilities, phishing, oracle machine price feeding errors, and underlying public chain security issues, will not be compensated. Of course, whether we can provide richer insurance products in the future depends on the development of the platform.

first level title

3. How does Nexus Mutual work?

Nexus Mutual is a mutual insurance platform. Members (KYC is required to become a member) bear insurance risks and enjoy premium income. This relationship is realized through its token NXM.

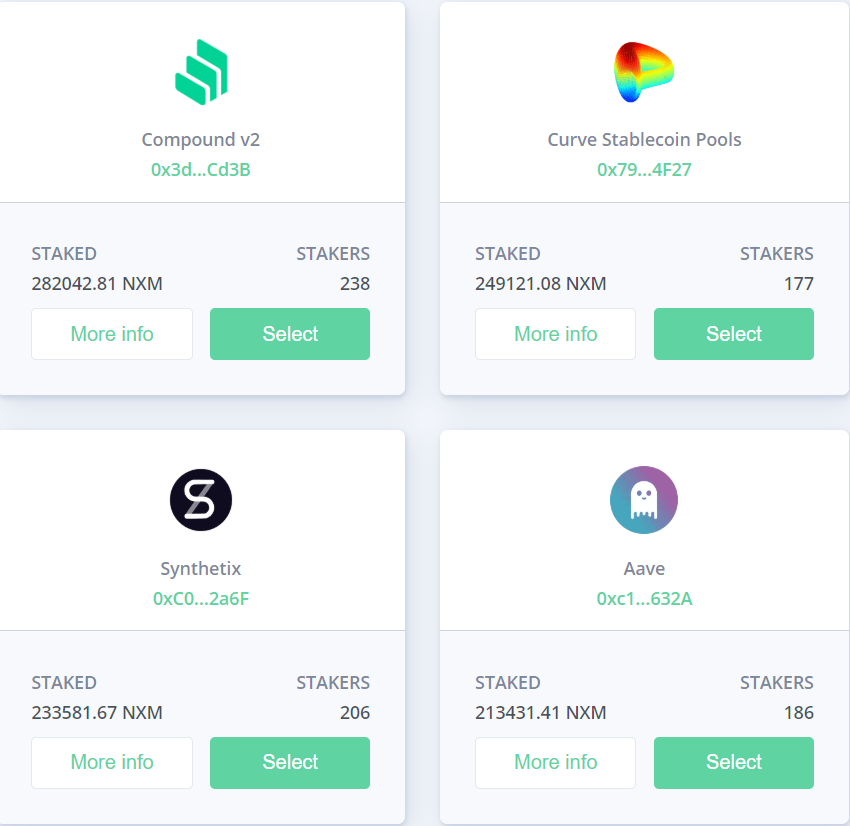

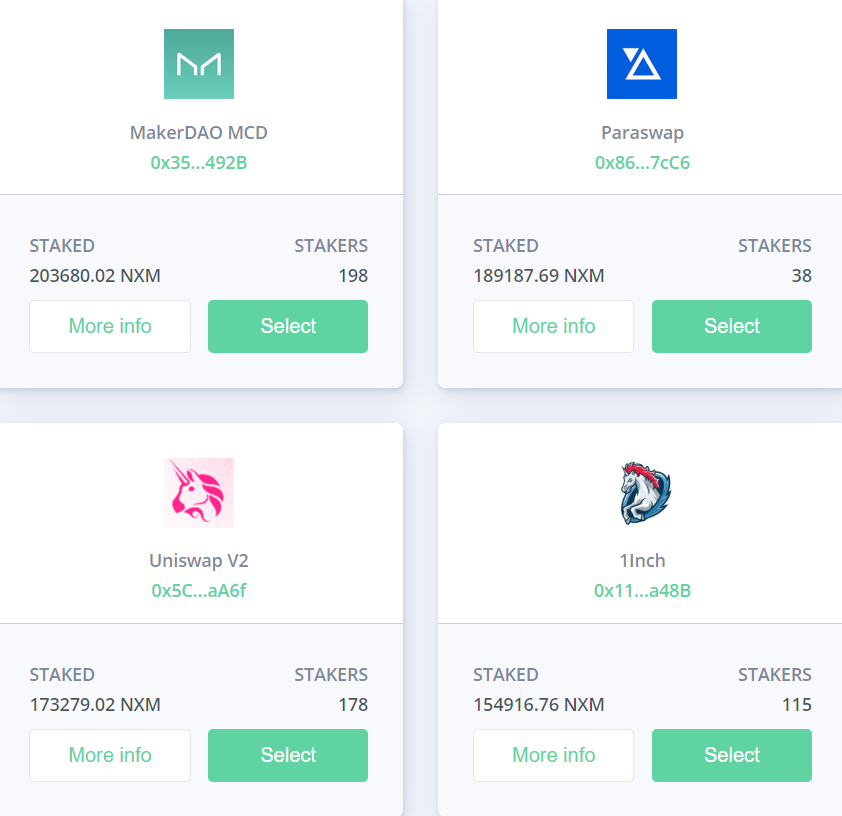

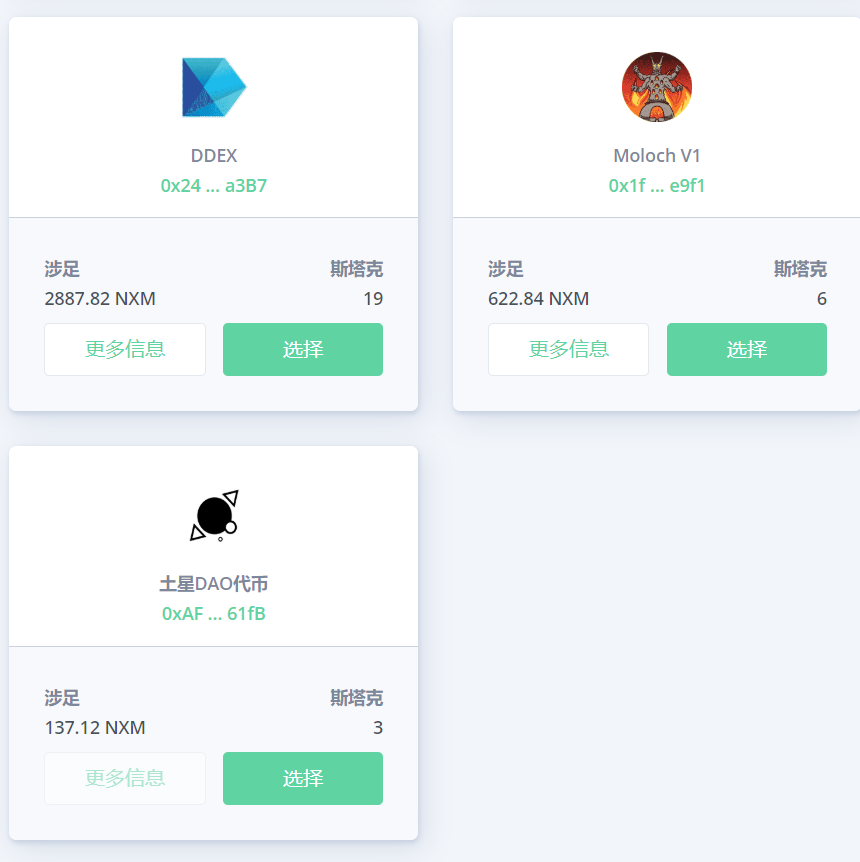

NXM holders can stake NXM tokens for projects they think are safe. Staking tokens means that members recognize the security of the project, and the amount of Staking tokens also determines the purchase amount of the project.

The picture below shows the projects with the most staking NXM, which means that the most people/funds recognize their security, and it also means that these projects have the most amount of purchases.

Members' pledge of NXM means their recognition of the security of the project. Nexus Mutual allows NXM tokens to be staking in 10 projects at the same time, and can get 50% of the premium income. Once the staking project is successfully claimed, the NXM tokens of staking will be destroyed in proportion to compensate the policyholder.

Whether the claim application is approved or not is decided by NXM holders through voting, and the voting needs to lock NXM, and if the option opposite to the final result is chosen, its NXM tokens will be locked for a longer period of time.

Nexus Mutual is a community-based insurance platform, where token holders are both beneficiaries and risk takers. At the same time, the tokens they hold are used to determine how much insurance a certain project can have, and to decide whether to approve the claim.

first level title

4. NXM model

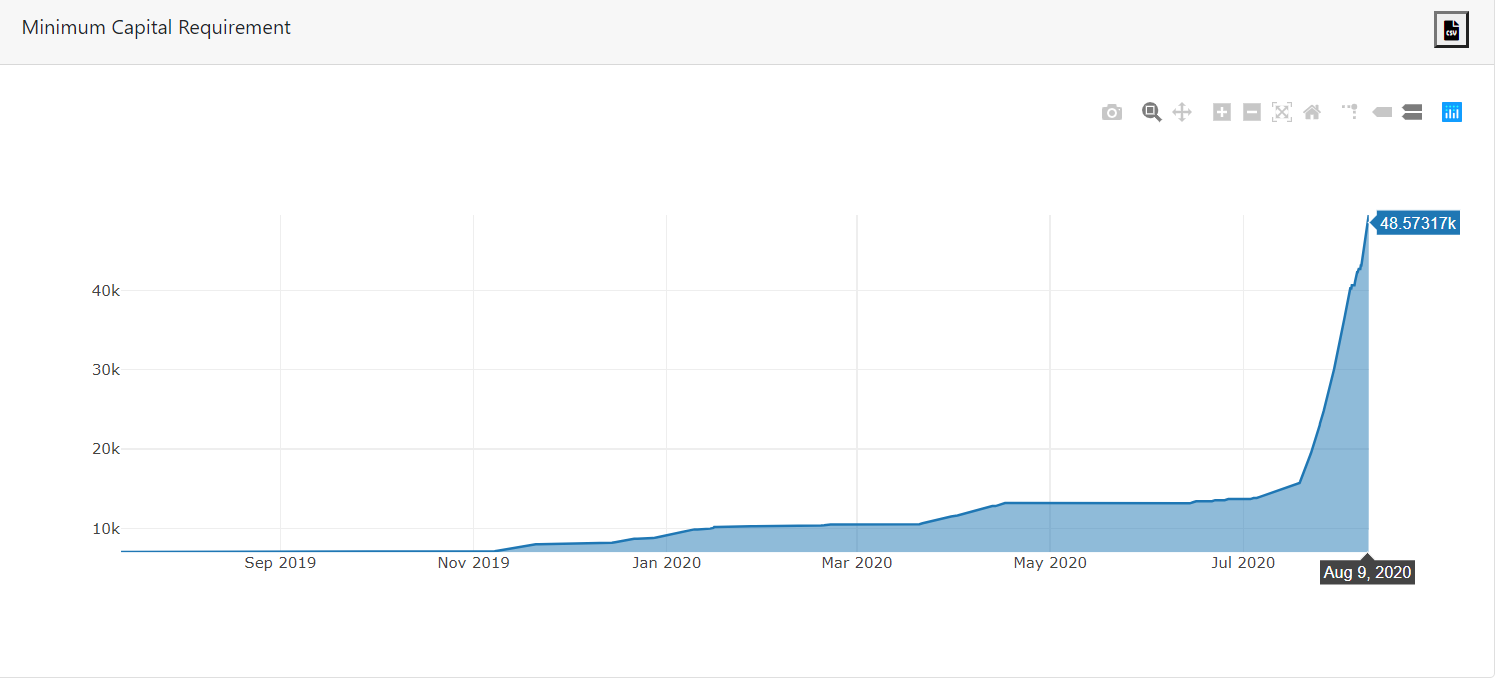

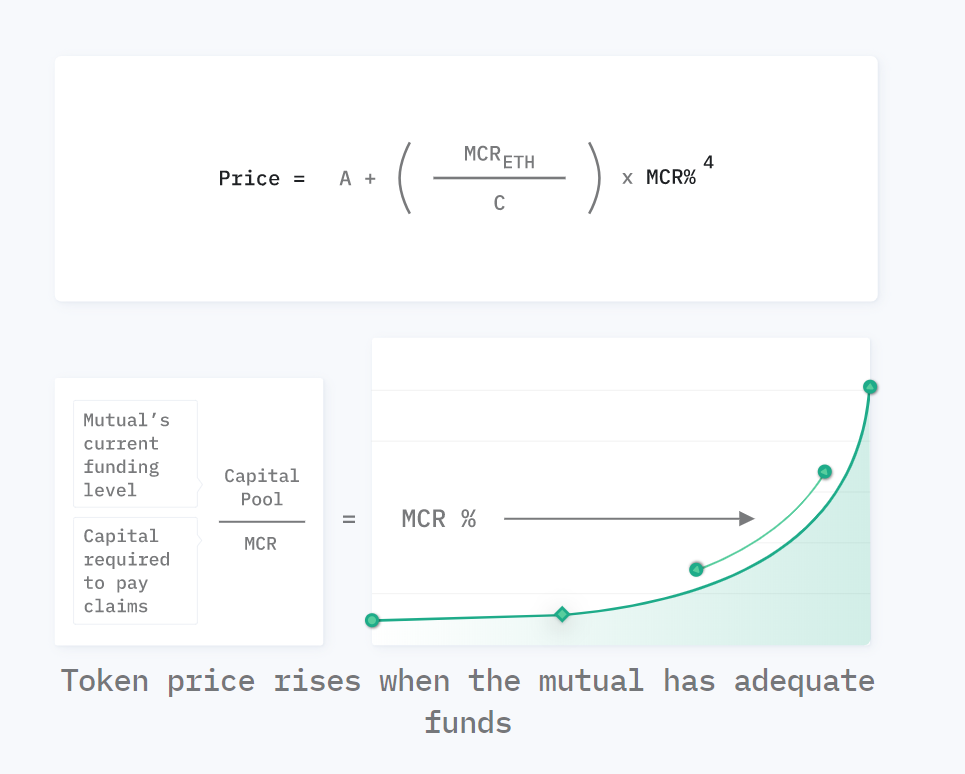

Nexus Mutual has a minimum capital requirement MCR, which can be understood as the minimum requirement to meet the claim liabilities within a certain period of time within the system. Every time a policy is sold, the MCR value increases because it implies an increase in claims liability.

The current value of MCR is 48,500 ETH. ETH is calculated at 390 US dollars, and MCR is about 19 million US dollars.

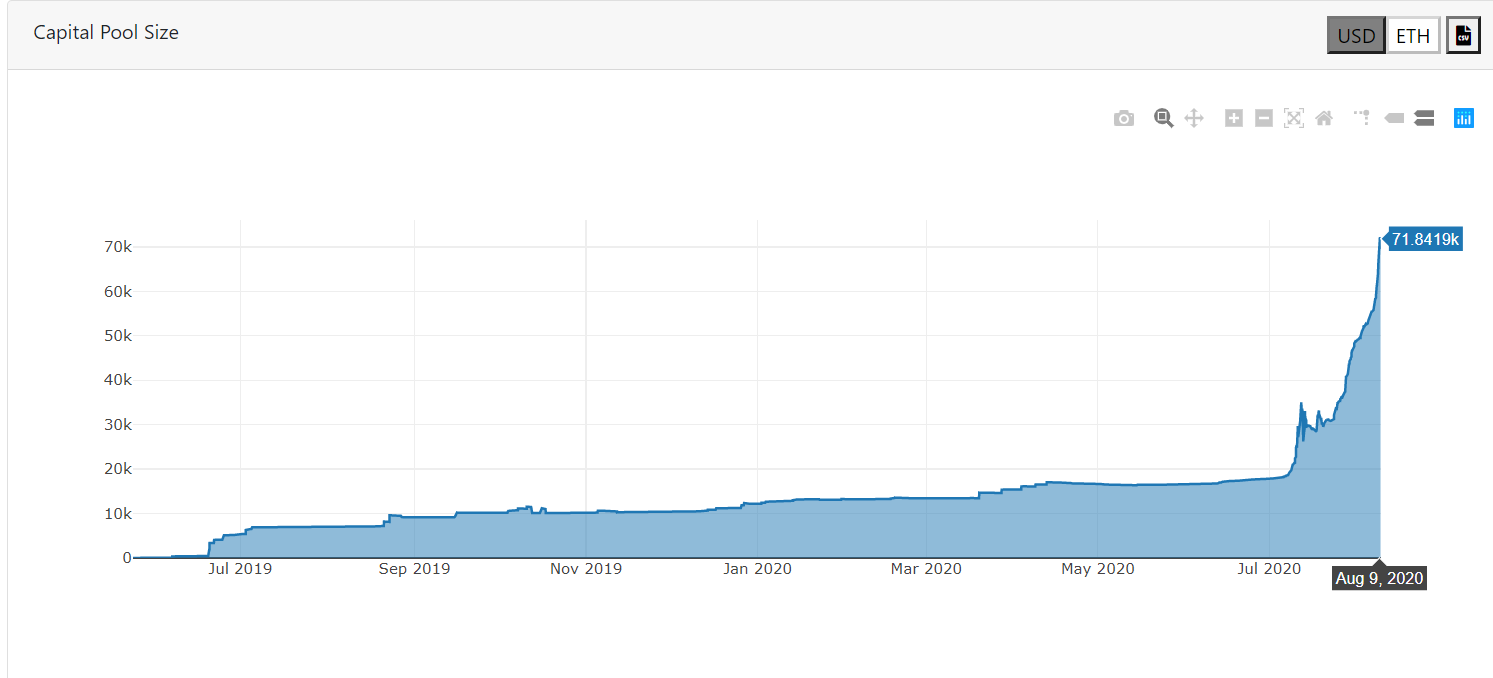

The total asset size in the capital pool is 71,000 EHT, and ETH is calculated at 390 US dollars, which is about 28 million US dollars, which is the maximum guarantee amount of the platform.

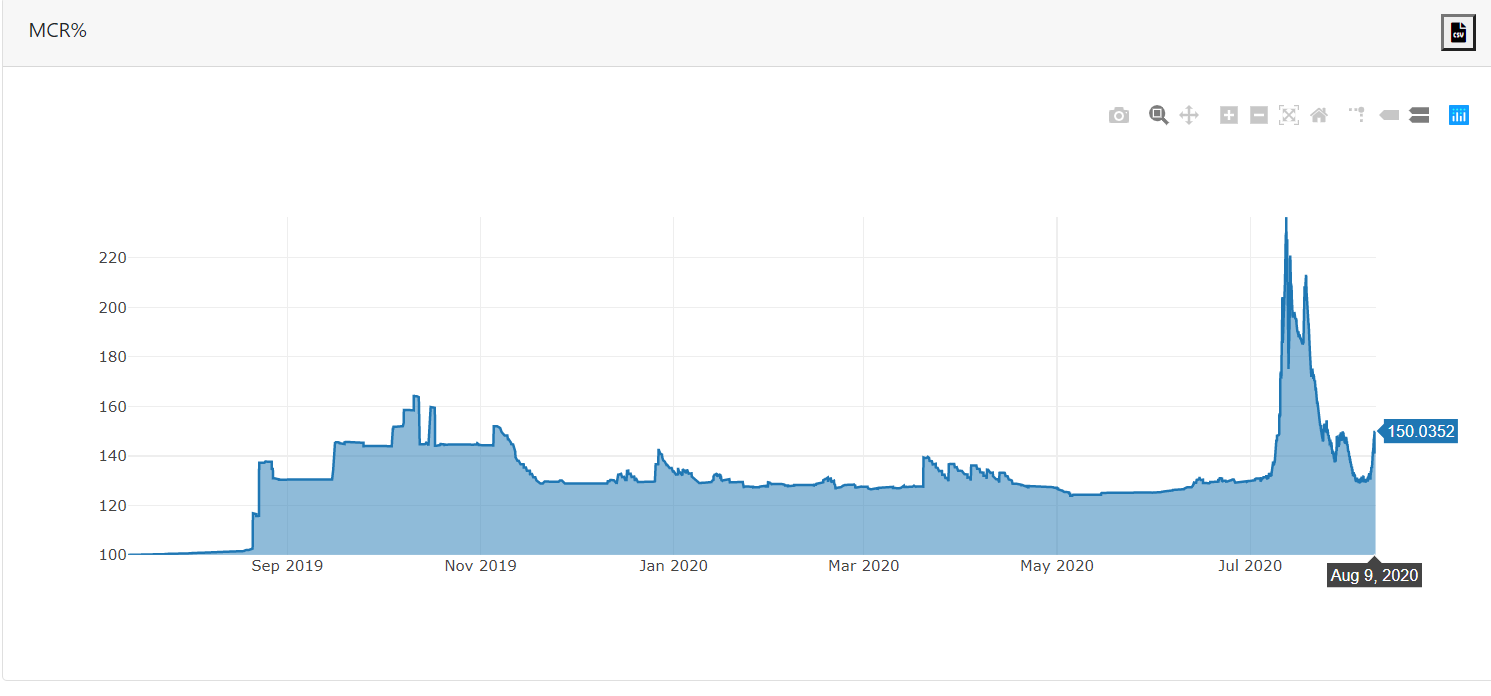

The ratio of capital pool to MCR is called MCR%, and the current value of MCR% is 150%, which means that the platform has sufficient capital and can achieve good risk protection.

first level title

Five, some data

We can find a lot of valuable information from Nexus Mutual's data.

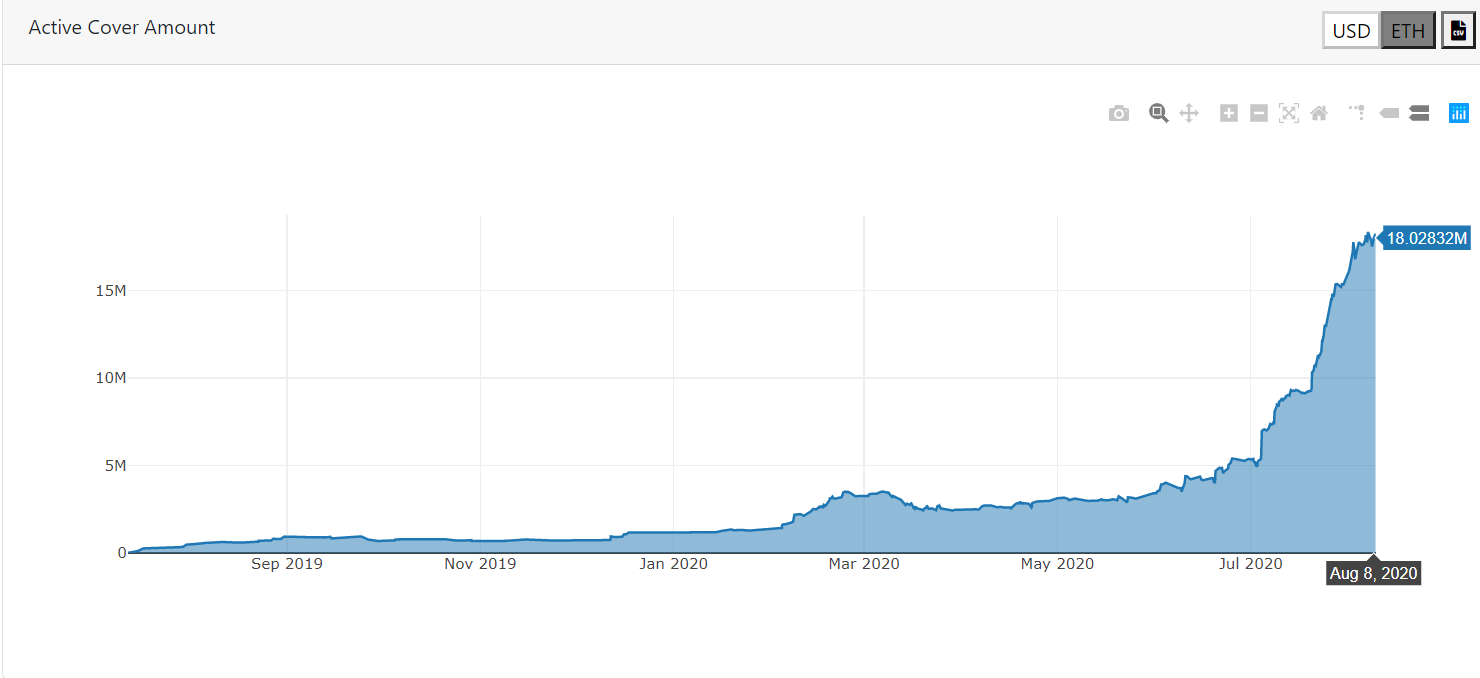

The first is the effective insurance coverage. According to the data, it has ushered in explosive growth in the near future. This is directly related to the newly released Staking mechanism of Nexus Mutual, and is also related to the hot DeFi market and the prevalence of liquidity mining.

From the perspective of the guarantee amount of a single project, the top three are Curve, Compound and Yearn, the rising stars, with guarantee amounts of US$2.15 million, US$1.77 million and US$1.7 million respectively.

Total insurance premium income reached 180,000 US dollars

The figure below shows the premium paid for each project, and the figure below deliberately indicates the premium paid by Compound. It can be seen from the figure that the insurance premium paid by Compound is not high, but from the above insurance amount chart, it can be seen that the insurance amount of Compound ranks second, and the reason why the insurance premium is small is that the insurance premium paid by different projects different.

From the actual measurement, the insurance premium of Compound is the lowest among all projects, so although the insurance amount is high, the premium is not high.

first level title

secondary title

overcollateralization problem

In order to increase the insurable amount in Nexus Mutual, members need to use NXM for staking. The user's staking amount determines the insurable amount. In the event of a claim, the staking NXM will be destroyed to pay the claim.

The new staking mechanism of Nexus Mutual allows members to staking for 10 projects at the same time, which can increase the income and increase the insurable amount of the project. But there will also be a problem here, that is, the total value of staking NXM will be lower than the insured amount, and there will be insufficient collateral.

The current total amount of Staking NXM on the platform is 3.39 million pieces

Before the platform released the new staking mechanism in July, there were only 490,000 NXM mortgaged on the platform. After July, the number of staking has achieved explosive growth.

This is because the new mechanism allows 1 NXM to be pledged for 10 projects at the same time, and the premium income that Staking can obtain has increased from 20% to 50%.

Therefore, the number of staking has grown rapidly, the amount of insurance that the platform can provide has also risen sharply, and the overall data of the platform has achieved a sharp rise, and the sharp rise in platform data has led to a rapid increase in the value of platform tokens.

Now the total number of staking NXM is 3.39 million, but many of them must be staking to different projects at the same time, so the actual staking NXM is likely to be much less than 3.9 million, and there may be cases where the mortgaged assets are less than the guaranteed amount Condition.

secondary title

Large payment problem

So far, the platform has only approved three payments in the bzx flash loan incident, totaling 34,000 US dollars, while the platform's current premium income is 188,000 US dollars. The compensation amount accounts for nearly 20% of the premium income.

If a project with a high insurance amount is stolen, millions of dollars need to be paid. Although the platform can pay the full amount, it will be a serious blow to the members of staking NXM tokens.

scalability issues

scalability issues

The increase of the insurance coverage of the Nexus Mutual platform requires users to stake NXM tokens. However, if the purchase demand surges in the short term, but the number of Staking NXM tokens does not increase simultaneously, this will result in insufficient insurance coverage for users to purchase. It will restrict the development scale of the platform.

Disclaimer: This article is the author's independent opinion, and does not represent the position of the Blockchain Institute (public account), nor does it constitute any investment opinion or suggestion.

References:

https://nexusmutual.gitbook.io/docs/docs

-END-

Disclaimer: This article is the author's independent opinion, and does not represent the position of the Blockchain Institute (public account), nor does it constitute any investment opinion or suggestion.