This article is reproduced from the YFII Chinese community (little assistant WeChat myGrassU) with authorization, please contact the original author for reprinting.

first level title

1. From YFI to YFII

Source: TradingView

Source: TradingView

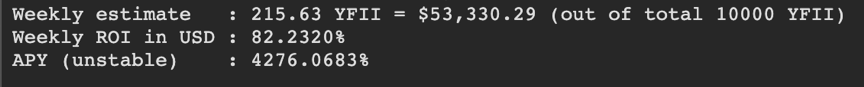

Liquidity mining (yield farming) income is thriving. The initial annualized income (APR) was once as high as 2000%. If the income continues, the reward of tokens dug back in a week is equivalent to more than 50%. Of course, the mining mode, the more participants , the relative income will be lower. In fact, most of the miners have obtained more than 20% income even if they did not sell at the high point of the currency price.

Due to token distribution design issues, YFI tokens have been distributed on July 26. In order to ensure that liquidity is not withdrawn from mining on a large scale, the community governance YIP-8 proposal proposes an additional issuance proposal, using a Bitcoin-like halving mechanism to halve the weekly additional issuance of each mining pool. However, the YIP-8 proposal was not passed due to the insufficient number of voting participants (approval rate was 80%). Therefore, the community members who agreed with the proposal initiated a hard fork and created a new project YFII that is basically the same as YFI.

The total amount of YFII is 40,000, and each of the two liquidity pools is 20,000. The output of each Pool is 10,000 in the first week, and the output is halved every 7 days. YFII. YFII will complete all distributions within the next 10 weeks.

Like YFI, YFII has no pre-mining, no crowdfunding, no founder rewards, and can only be obtained by providing stable currency liquidity for YFII to mine. YFII has community governance functions and integrates mining revenue from various DeFi platforms. As a follow-up project income distribution and participation in community governance, it has the voting rights of YFII DAO.

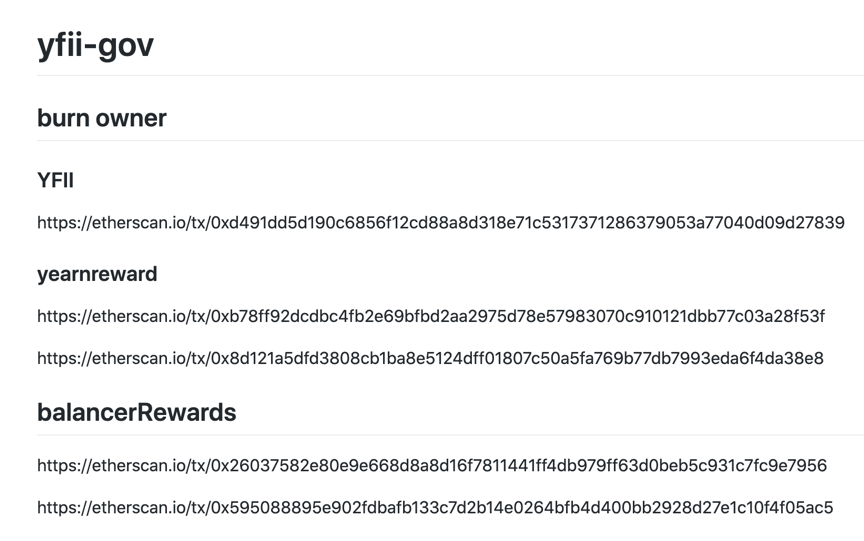

image descriptionhttps://burn.yfii.finance。

YFII Destruction Permission Certificate for Additional Issuance

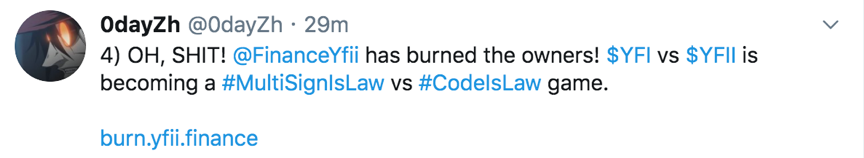

Source: Twitter

Source: Twitter

Due to the duplication of collateral assets between Pool1 and Pool3, the community decided not to open Pool3 for the time being. The upper limit of the total amount of YFII will be set at 40,000, which is another 20,000 less than the original YIP-8 plan of 60,000. The YFII governance contract will be created at the right time, and YFII token holders can vote on the community governance plan at that time. According to the contract address provided by YFII, as of press time, more than $14 million in assets have been locked in YFII.

Regarding the security of the contract, on the one hand, YFII is only a fork (Fork) of YFI, and the change is only in the halving mechanism. YFI itself has completed the contract audit, and has experienced the test of hundreds of millions of dollars in lockups. Weak links, on the other hand, it is said that YFII is undergoing an audit by Ambi Labs, the top international contract security audit team.

image description

first level title

secondary title

Step 1: Prepare wallet, DAI and ETH

Before starting liquidity mining, you first need to prepare:

Stable currency, preferably above 2000 U, otherwise it may not be enough to hedge gas expenditure

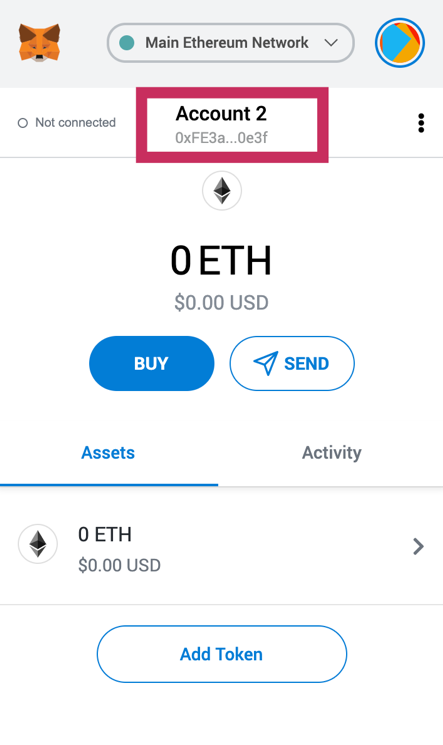

MetaMask browser plug-in wallet (recommended to operate on the computer)

0.3-0.5 ETH (used to pay the gas fee, not so much, but it is recommended to prepare more)

After exchanging USDT, you need to convert it to DAI before you can participate in mining. One option is to exchange directly on the exchange (Binance, OKex, and Biki all have DAI/USDT trading pairs), and the other is throughMakerProtocol mortgage assets generate DAI (requires familiarity with DeFi operations).

secondary title

Step 2: Mortgage assets to generate BPT

If there is a problem in the operation of mining, you can add the small assistant WeChat myGrassU of the YFII Chinese community to pull you into the YFII Chinese community WeChat group to ask questions.

Up to now, Pool2 has higher income than Pool1 (because the locked amount is less), so let's take Pool2 as an example and start mining.

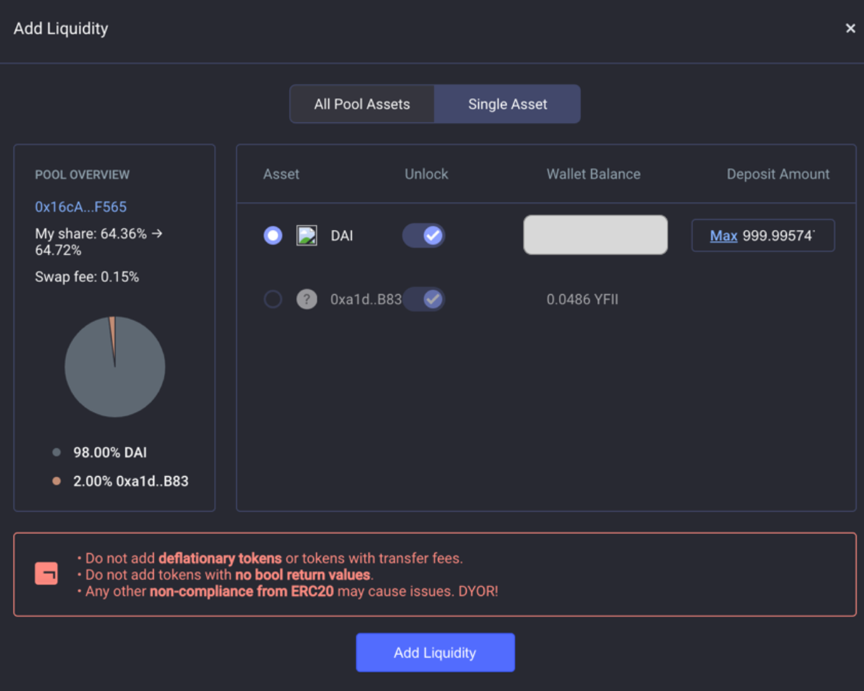

1. Clickhttps://bal.yfii.finance/#/pool/0x16cAC1403377978644e78769Daa49d8f6B6CF565Enter the mortgage page, connect to the MetaMask wallet, and follow the prompts to create a Balancer Proxy first. At this time, the wallet will ask to pay the gas fee. Don’t ask why, just pay directly as you do (you can’t care too much about the gas fee when playing DeFi, facing thousands of years. There is a high probability that you will earn back, but if there is a handling fee higher than 1ETH, there must be a problem with the operation, so don’t pay)

secondary title

Step 3: Mortgage BPT to start mining

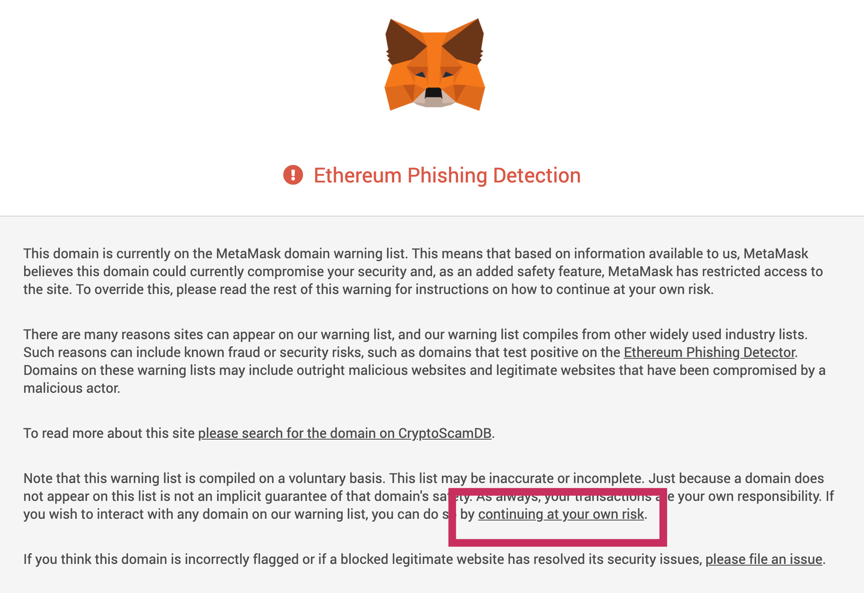

open firsthttps://yfii.finance/, if you receive a risk warning from MetaMask, please ignore it directly, because the initial name of the project is similar to the original project YFI, and was misjudged by MetaMask as a phishing website. It is currently in the appeal process, click "continue at your own risk" to continue.

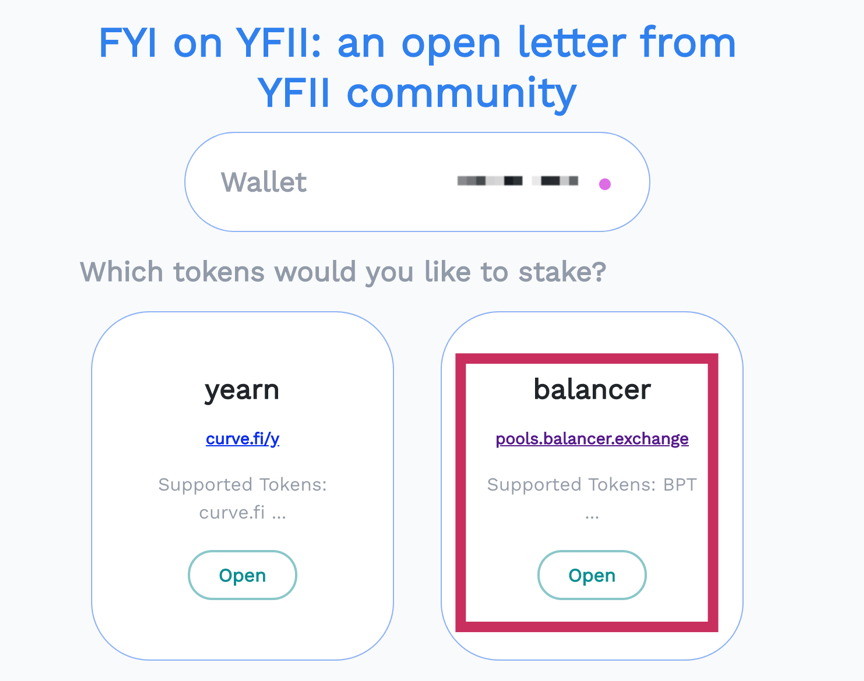

Select stake, enter YFII's balancer pool (Pool2), and click Open.

After completing the second step, you can see your BPT balance, select Stake Tokens, click on the balance above the input box to automatically fill in the pledge amount after entering, click on the mortgage token, pay the gas fee, and mining will start successfully.

secondary title

Spoiler: YFII/DAI transaction

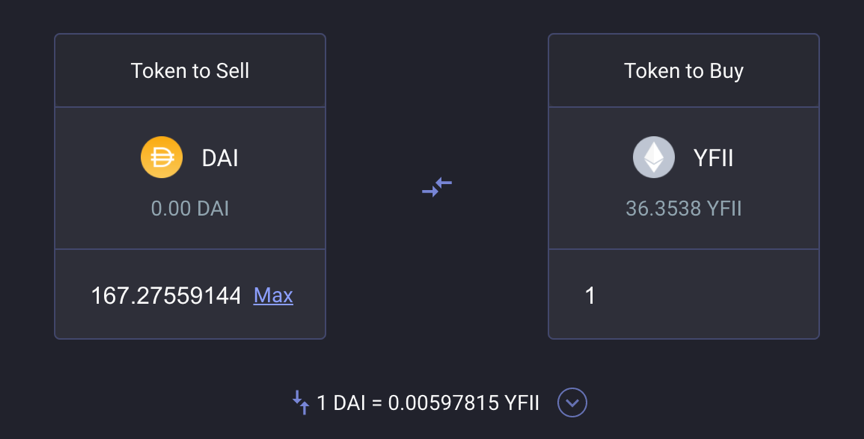

If you feel that mining is not exciting enough, YFII may also have the opportunity to reproduce the story of YFI’s ten times and hundred times. If you want to buy YFII, or want to sell YFII, enterhttps://balancer.exchange/#/swapfirst level title

3. Let’s talk about risk again

Still at the beginning, liquidity mining is essentially a bowl of deterministic soup in an uncertain game. As long as there is no problem with the contract, the biggest loss is only the gas fee of ETH. In addition, when injecting liquidity into Balancer When the time comes, 2% of YFII will be purchased at the same time. Compared with the current 80% weekly income, it is not worth mentioning, and it can offset half a day to one day's income at most.

I wish you all a good risk control, and you can get a certain share of this bull market.

In addition, if there is a problem in the operation of mining, you can add the little assistant WeChat myGrassU of the YFII Chinese community to pull you into the YFII Chinese community WeChat group to ask questions.