Tokens with the concept of DeFi have skyrocketed recently.

Tokens with the concept of DeFi have skyrocketed recently.

Not only the Yield Farmers in the Ethereum ecosystem are "farming and harvesting", but even EOS, which is located in the "parallel universe", has recently improved.

After a long absence, the EOS REX resource pool has almost been borrowed again.

The latest EOS REX data shows that the leased EOS resources in the resource pool have reached 73.61%. In the past few weeks, the EOS lending volume of the REX resource pool has actually been stable at between 40% and 50%. The price of EOS CPU also fluctuated significantly in the range of 11.1111 - 12.5 EOS/ms a few days ago.

The emergency of the resource pool this time may be related to a new DeFi project "DeFis" on the EOS network.

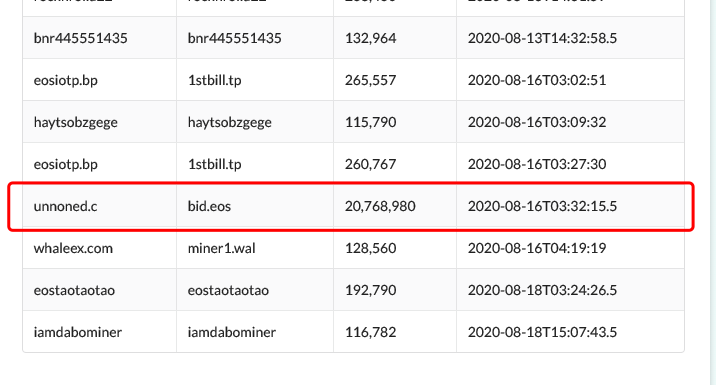

According to EOS GO reports,An account named unnoned.c called bid.eos leased about 20 million EOS on REX, which was the largest single loan since REX was launched, which led to a substantial increase in the annual interest rate of REX to 4 %.image description

(picture from bloks.io)

You must know that the last project that made EOS resource leasing so popular was EIDOS half a year ago. At that time, the mechanism of "transfer is mining" was once so popular that the REX pool was borrowed.

secondary title

DeFis, which is crazily touted by the community, wants to do Uniswap+Comp+Snx+Nxm+Mkr?

DeFis has a high voice in the Chinese community.

In the community, many people regard DeFis as: "the DeFi project that may make EOS shine again". Although this statement is a bit exaggerated, DeFis itself is not lacking in highlights.

DeFis, also known as "Big Harvest" (good meaning), is a DeFi project developed based on EOS.Its team claims to be a collection of several of the hottest DeFi products on Ethereum such as Compound, Uniswap, Balancer, and Synthetix.DeFis received support from Newdex DeFi Fund and Hufu Fund before it went live. At present, major wallets such as MYKEY, MEETONE, and TP have opened DeFis entrances to support DeFis applications. Hufu Exchange, Whale Exchange, Newdex and many other exchanges have also launched the DeFis platform currency DFS trading pair.

From the official website, the DeFis project has launched SWAP and BANK functions, and it is expected to launch LEND and SYNTHETIX functions in the future.

The DeFis network currently issues two tokens—the stable currency USDD and the platform currency DFS.

How to get USDD:The user sends the collateral EOS to the smart contract, and will immediately get the newly issued USDD.

How to get DFS:Released linearly through the mining algorithm (that is, transaction mining).

secondary title

How does DeFis work?

mortgage

mortgage

image description

transaction mining

transaction mining

Friends who have experienced EIDOS mining may mistakenly think that DeFis and EIDOS have similar routines. In fact, DeFis is more like the popular DAPP mining before. The biggest difference from the previous EIDOS is that DeFis adopts the transaction mining model instead of Simple transfer mining.

DeFis plans to distribute its token DFS to users through the mode of transaction mining starting at 3 pm today (July 20, 2020). The total amount of DFS issued is 1 billion, and all DFS tokens are obtained through transaction mining.

It is estimated that 10 tokens will be released per second, of which 2 will be allocated to the team account to support the long-term development of the project, only participate in voting, not participate in mortgage dividends; 8 will be accumulated in the mining reward pool for mining distribution. The token release period is 3 years. In other words, 864,000 DFS will be released every day, of which 69.12 will be allocated to the mining pool.

Users need to conduct token transactions in DeFis Swap to participate in transaction mining. As long as the transaction amount is greater than or equal to 1 EOS, you can get mining rewards. The larger the transaction amount, the greater the mining weight. According to the data in the white paper, the current mining weight of the EOS/USDD trading pair is 1, and the mining weight of other trading pairs is 0.3. Subsequent coefficient adjustments will be decided by community votes.

In fact, the mining rules can be more simply understood as "pay the service fee to get tokens". In fact, every exchange transaction is initiated to mine DFS coins, and it also needs to pay a service fee, each transaction fee is 0.3 %.

market making

As mentioned above, there is a 0.3% fee per transaction. According to the official statement:

image description

(The picture of the market-making operation interface comes from: DeFis official website)

image description

(The picture of the dividend operation interface comes from: DeFis official website)

At present, the dividend distribution time designed by the project party is 24 hours, which needs to be collected manually by the user, or by a third-party contract. The unmortgaged DFS will arrive in the account three days later, and there will be no dividends during the unlocking period.

In addition, according to the roadmap on the official website, there are currently two functions of DeFis that have not yet been launched.

Lending Agreement: DeFis Lend is a digital asset lending platform based on smart contracts

Deposit currency to earn interest + digital currency over-collateralized lending.

Asset Synthetic Protocol: DeFis Synthetix

Mortgage platform currency DFS synthesizes a variety of offline assets. And you can be short-term and long-term on these high-quality assets on the platform.

During the process, the synthetic assets sold by the user will be directly converted into the bearish version of the synthetic asset that the user needs to buy, which makes the transaction almost unlimited liquidity.secondary title

Is DeFis really worth participating in?

Above we have analyzed the various ways to earn money on DeFis. Next, we can further analyze what we can expect from DeFis in addition to the ways to play.

The price of EOS, which was squeezed out of the top ten market capitalization rankings this month, performed unsatisfactorily last week and continued to be in a downturn for a week. However, after the official announcement of DeFis, the price of EOS still rebounded slightly in the past two days. Before the press release, today's increase also reached 3.55%, almost returning to the closing price two weeks ago.

Although EOS doing DeFi is actually going back to the old way of Ethereum, DeFis is the first DeFi project with such a huge momentum on EOS after all. At present, various EOS community leaders are updating their interpretation and analysis on DeFis.

But EOS42'sJing Kai dug out a few relatively novel points in his article, and I will list them here for you:

The Defis team once signed up to participate in the BlockOne EOSIO online virtual hackathon under the name of JIN Network. The product at that time had already taken shape. Although there was no way to mortgage DFS token dividends + DFS transaction mining, it already had the functions of exchange, transaction, and treasury.

Team Defis may be closely related to FOMO game ITE Stargate.

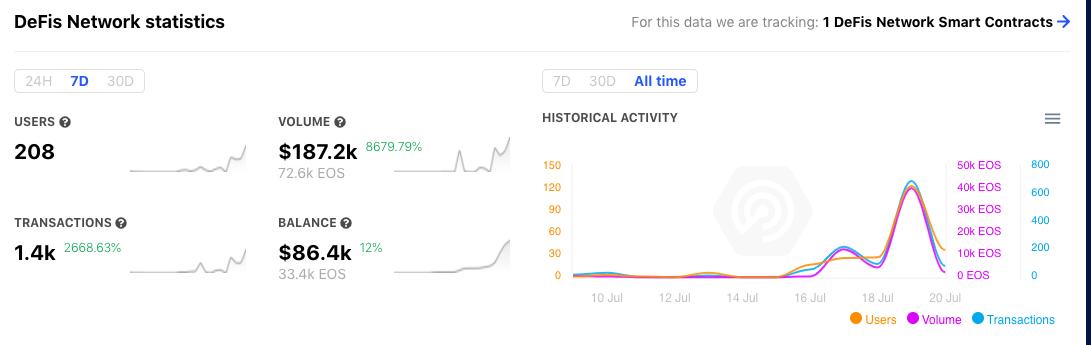

We also looked at the performance of Defis from the data.

According to the data on the chain, 352 transactions have occurred in the contract named bankofusddv1, and the contract account balance is 118,211.9796 EOS, which is about 306,000 US dollars.

image description

(Image source: DappRadar)

Of course, the explosion of DeFis is also inseparable from the behind-the-scenes promotion of bigwigs.

Data on the chain shows that Wang Ruixi, the founder of Hufu Wallet and a large EOS RAM owner, took out 10,000 EOS to participate in the USDD mortgage.

We also chatted with Wang Ruixi, the owner of Hufu Wallet. His expectation and interpretation of DeFis are as follows:

The 20 million EOS resources were borrowed by people in the community, not by the DeFis team.DeFis has also received relatively high attention at home and abroad, and some users may have purchased some CPUs.

DeFis solves the problem of interest between users and market makers.

The biggest advantage of composite DeFi such as DeFis is that all benefits are shared with DFS token. After integrating multiple functions, DFS has a greater value space.

secondary title

For more about the gameplay and analysis of DFS, you can read the following reference articles from community leaders, which are full of dry goods:

Why did the DFS excavated tomorrow rent out most of the resources of EOS?

https://www.eosgo.io/news/most-eos-resources-rented-what-will-happen

The Secret Story of EOS Explosive dApp Dafengshou (DFS): I bet you have never heard of 80% of the content in this articlehttps://bihu.com/article/1929631806?i=1x77&c=1&s=26AxnE&from=groupmessage

EOS Almighty Defi Project DFS (Dafengshou) will be excavated tomorrow, and the mining rules will be fully interpreted as soon as possible

https://bihu.com/article/1062950017?i=QVe&c=1&s=19W1R7

One of the most popular projects on EOS at present, DeFis Detailed Explanation: DFS Allocation Scheme and Mining Rules Pinduoduo DeFi Application

https://bihu.com/article/1012479247?i=1otM&c=1&s=16wg6r

Why did Defis Network's USDD fail?