"To strengthen financial support for stable enterprises, we must significantly increase the availability of loans for small, medium and micro enterprises, and must significantly reduce the cost of comprehensive financing." The 2020 "Government Work Report" has clearly pointed out that the key to "stabilizing enterprises" is Reduce financing costs, and supply chain finance is considered a key model to help small and medium-sized enterprises reduce financing costs.In the "post-epidemic era", how can supply chain finance innovate and develop to cover better small and medium-sized enterprises, and how can small and medium-sized banks catch up with the train of this era?

The Internet Finance (Shenzhen) Alliance of Small and Medium-sized Banks joined hands with OneConnect and "Trade Finance" magazine to set up a research group, and under the guidance of the China Association of Small and Medium-sized Enterprises, launched the "China Small and Medium-sized Bank Supply Chain Financial Innovation Development Report" (hereinafter referred to as the "Report"). It is hoped that through an all-round interpretation of technology empowerment, it will guide the innovation and development of supply chain finance for small and medium-sized banks, counterattack and break through in the current increasingly complex environment, break through the predicament, and usher in a new blue ocean of its own.

secondary title

Supply chain finance: rooted in industry, thriving in technology

Focusing on the theme of helping small and medium-sized banks innovate and develop supply chain finance, the content of the "Report" is divided into the development status of supply chain finance, the pain points of small and medium-sized banks in promoting supply chain finance, the way for small and medium-sized banks to break through the supply chain financial business, and The future trend and competition layout of supply chain finance and other four major sectors. In the form of theory combined with cases, it provides multiple practical experiences for small and medium-sized banks looking for development direction during the transformation period, and is an important reference for them to build their core competitiveness.

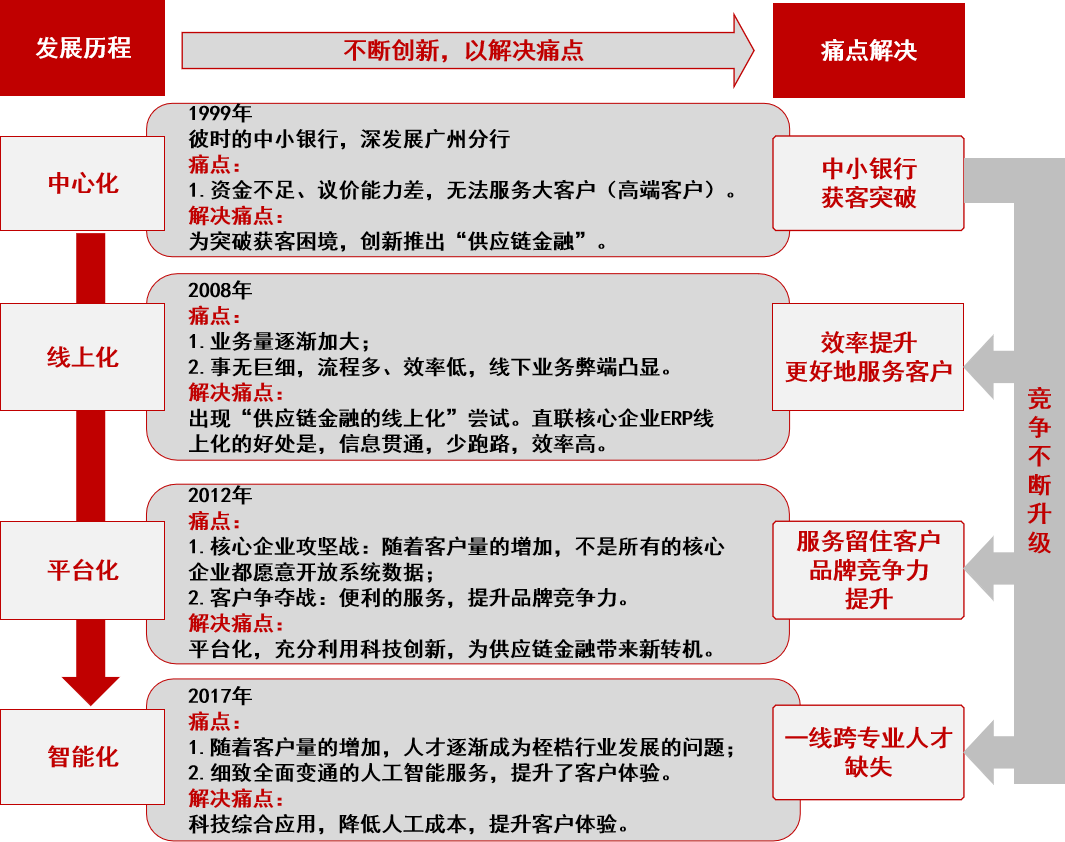

With the support of technology, the supply chain finance industry is undergoing tremendous changes, new products and new models are emerging, and the efficiency of the industry continues to upgrade. Regarding the overall trend of the industry, the "Report" pointed out that at present, supply chain finance has completed the development of centralization, online, and platformization, and has begun to evolve towards intelligence.

image description

Development history map of supply chain finance in China

secondary title

Four major pain points: Weak risk control ability and lack of industrial scenarios lead to difficulties in the development of supply chain finance

In the face of opportunities, many small and medium-sized banks are eager to try, trying to use technology to expand the boundaries of supply chain financial business, but limited by factors such as resources, scale, funds, policies, and technological strength, most of them are in the development path of supply chain finance. It is inevitable that the pace will be staggered and lag behind others. Through detailed research, the "Report" summarizes four major pain points for small and medium-sized banks to develop supply chain finance.

Customer pain points. Due to the lack of their own competitive advantages and risk control capabilities, the lack of customer acquisition methods, and the innovation of financial technology companies, small and medium-sized banks are faced with customer acquisition difficulties such as fewer core corporate customers, difficulties in developing new customers, and continuous loss of old customers.

Product and service pain points. Due to the lack of timely changes in product logic and product form, small and medium-sized banks have mismatched supply and demand issues such as "customers need, not what I provide" and "agile services, not what I can" in the current layout of supply chain financial products.

Tech pain points. Due to the insufficient amount of funds invested in technology, the difficulty in balancing the cost and efficiency of technology applications under the rapid iteration of technology, and the difficulty in recruiting and retaining core talents, small and medium-sized banks have insufficient technological capabilities.

Pain points of ecological co-construction. To make supply chain finance bigger and stronger, in addition to promoting the integration of industry and finance, what is more important is the collaborative participation of more institutions. The construction of data ecology and credit ecology is not only urgently needed by middle and lower banks, but also the foundation and guarantee for the rapid development of China's supply chain finance in the future.

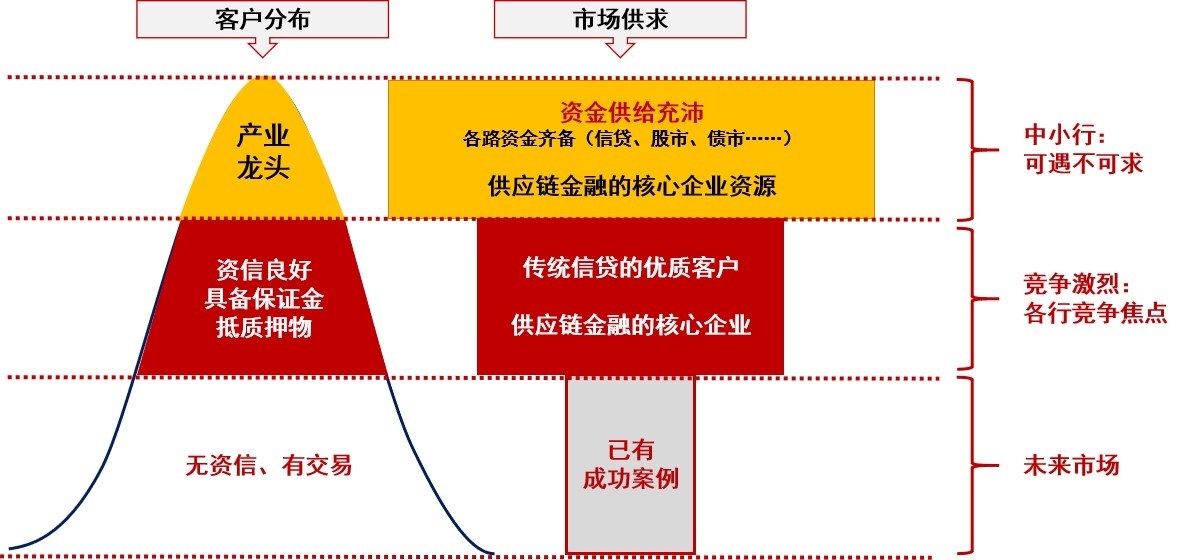

These pain points come down to two points, one isNeed to solve the problem of risk control, and the second is to solve the industrial sceneimage description

secondary title

The way to break the situation: technology + industry injects dual impetus into the development of supply chain finance

On the basis of a detailed analysis of the pain points, the "Report" pointed out that the way to break the supply chain finance of small and medium-sized banks must grasp two key points, one is to empower supply chain finance with technology to break through risk control, and the other is to empower industries A breakthrough in supply chain finance scenarios.

The "Report" clearly pointed out that the breakthrough of risk control of small and medium-sized banks must rely on the help of technology. The "Report" also listed in detail the role of each new technology in risk control:Big data can help customer acquisition and credit stratification; blockchain can realize multi-party verification and lock consensus; Internet of Things can obtain multi-dimensional information through the Internet of Everything; artificial intelligence can use experts in various industries to serve customersimage description

Application of technology in risk control

For example, the "customer portrait" analysis of MYbank based on big data technology and the "Ping An Good Chain" supply chain financial platform of Ping An Bank based on blockchain technology are small and medium-sized banks that use technology to empower supply chain finance and effectively improve risk control security , A classic case of increasing customer acquisition.

The "Report" also pointed out that a single technology cannot perfectly solve all practical problems, and the comprehensive application of various technologies is more in line with the requirements for the steady development of banks. For example, OneConnect's "One Enterprise Chain" smart risk control system realizes financial services such as identity verification, risk warning, dynamic monitoring, and transaction verification by integrating core technologies such as big data, blockchain, artificial intelligence, and biometrics. The intelligence of the whole process has become a convenient and efficient risk control tool for financial institutions, leading the transformation of bank risk control work from post-remedial to pre-warning.

On the basis of risk control breakthroughs, combined with industrial forms and characteristics to achieve scene breakthroughs, it is another indispensable boost for the rapid development of small and medium-sized banks.

image description

Scene Logic Diagram of Supply Chain Finance Industry

The "Report" takes Foton Motor, the largest and most comprehensive commercial vehicle company in China, as an example, and analyzes the whole process of its cooperation with OneConnect to solve credit problems through the "electronic certificate + blockchain" technology.

In the traditional supply chain financial business, there are problems such as impenetrable credit and narrow financing coverage between Foton Motor, suppliers and dealers. In this regard, OneConnect has built an electronic payment voucher tool using blockchain technology to strengthen data confidentiality and enable consistent transmission of receivables and payables information between suppliers and distributors. At the same time, the electronic payment certificate can become a valuable certificate for suppliers to pay upstream companies, so that Foton Motor's core corporate credit can be transferred to suppliers step by step, greatly reducing the lack of liquidity of small enterprises.

The "Report" believes that if you want to do a good job in the supply chain financial business, the core is to grasp the concept of risk control and combine the actual application of the industry. Appropriate supply chain financial products. The "Report" listed several small and medium-sized banks cooperating with financial technology companies, using new technologies to open up the entire supply chain process, and turning traditional areas considered "unable to lend" into supply chain financial beneficiaries. It is very good for the industry enlightenment.

For example, in the field of agriculture and breeding, for ordinary farmers, due to high investment risks and insufficient funds, the project is often stranded. The core enterprise CP Group considers using bank funds to solve their capital needs and build a upstream supply of raw materials to farmers. , the farming supply chain that purchases finished products from farmers downstream. After hearing the news, Wuhan Rural Commercial Bank cooperated with OneConnect to add financial services to this supply chain. By innovating risk control and creating a structured solution, while ensuring the safety of risk control, it realized the supply chain financial inclusiveness upstream and downstream. Purpose.

secondary title

Trend: Under the wave of "integration of industry and finance", small and medium-sized banks leverage technological innovation to upgrade

After proposing a way to break the situation, the "Report" also forward-lookingly summarized the future trends of the supply chain finance industry. The "Report" believes that the great development of supply chain finance is an inevitable trend in the future, "The premise of great development is the sense of mission of finance returning to the real economy; the boost of great development is the continuous landing of financial technology; the quality of great development is the The construction of credit ecology with the participation of the whole society", the future supply chain finance will move towards the center of the 10 trillion financing market in the form of industrial finance.

How can small and medium-sized banks find their new blue ocean in this wave? In this regard, the "Report" recommends that small and medium-sized banks use technological innovation and upgrading to completely change the traditional public credit system; actively participate in the construction of credit ecology, create a good industrial atmosphere, and form a positive feedback mechanism for orderly economic development.

Ye Wangchun, chairman and CEO of OneConnect, executive vice chairman of the Internet Finance Alliance of Small and Medium-sized Banks, and director of the Supply Chain Finance Working Committee of the China Association of Small and Medium Enterprises, Ye Wangchun also gave his thoughts on the future of the industry in the "Report": through financial technology Promote the realization of five major changes in the traditional supply chain, that is, use blockchain technology to solve the problem of multi-level credit penetration, and use advanced blockchain technology to change upstream financing; redefine core enterprises, and more high-quality large enterprises will become the core of the supply chain to help supply Chain model reform; use intelligent "five control" technology to solve downstream financing problems, boost core enterprise revenue upgrade; dock domestic and international platforms, break through cross-border trade problems, reform and innovate global supply chain financial services; build a bank trade financing alliance, Solving cross-regional financing problems, promoting bank linkage and cooperation, and service upgrades, and achieving the above points will definitely enhance the competitive advantage of small and medium-sized banks in the SME financial business sector.