On May 14, the United States Patent and Trademark Office (USPTO) published a patent application filed by the payment giant Visa - mainly for the "central bank use case" proposed a "digital fiat currency" (digital fiat currency) patent application, using Blockchain technology creates digital assets on centralized computers.

The patent application was originally filed by Visa in November 2019. Visa will use Ethereum as its blockchain technology network, and the patent discloses the technology and operation process for the central entity computer to accept requests for issuing digital assets.

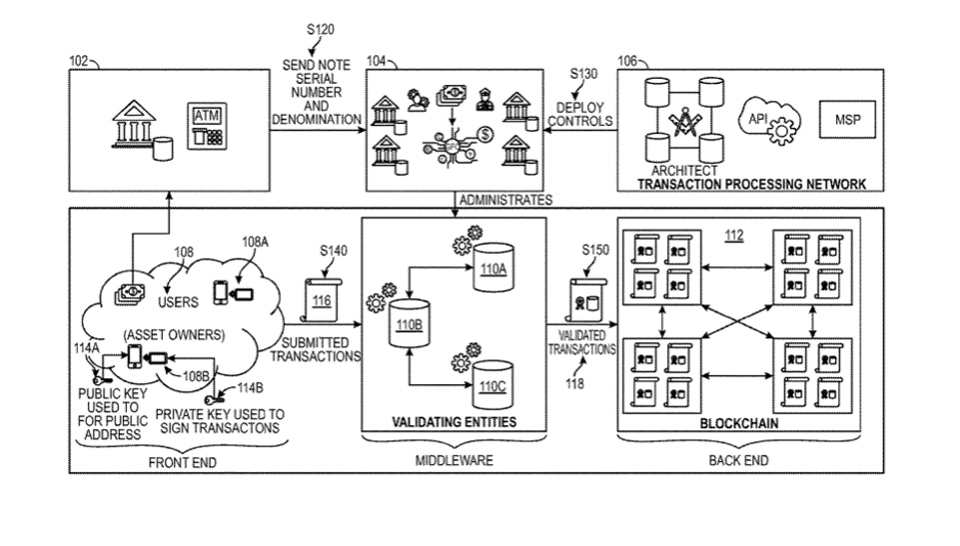

The central entity computer can generate a digital asset corresponding to the denomination of the entity currency and link it to the serial number of the entity currency. After generating the digital asset, the central entity computer will further record the digital asset on the blockchain. In addition, the central entity computer can also remove physical currency from the circulation channel of the fiat currency system.

In the patent application, Visa believes that the digital asset system has advantages over the legal currency system. First, digital asset remittances can be faster than conventional fiat currency remittances; second, based on the fact that digital assets themselves are issued on the blockchain, and the blockchain is an immutable transaction record, users will have more trust in such digital assets .

At the same time, despite the above-mentioned advantages of the digital asset system, digital assets are usually not regulated like legal tender, and the circulation of digital assets requires certain electronic equipment and hardware. At present, there may still be a part of the population without electronic equipment. Therefore, a country It is not realistic to completely convert the fiat currency system into a digital asset system.

From this, Visa created the "Serial Number Mechanism". The "serial number mechanism" means that digital assets are associated with the serial number of physical currency, and the serial number of physical currency can be used to track digital assets.

This allows the regulatory authorities to manage the quantity and value of digital assets. In addition, the setting of the serial number can also prevent the digital asset network from issuing the same physical currency twice.

To avoid exchange rate fluctuations, digital fiat currencies can remain pegged to the fiat currency exchange rate. Visa believes that this patented technology can further improve the ecological payment system.

In fact, Visa was the first batch of members to join Libra, but later withdrew due to regulatory and other issues. But Visa has not given up its efforts in financial services. In early 2020, Visa acquired financial technology company Plaid for US$5.3 billion, with a view to providing more valuable services to financial institutions and consumers. On May 12, Visa also gained aToken-off systemsystemsystemAssets locked in token format can be redeemed.

Of course, just because Visa filed this patent application doesn't mean it necessarily intends to develop a digital fiat currency system. However, it does show that existing e-payments companies, not only have done a great job with legacy systems, but are now exploring innovations in the currency space as well.

During a question-and-answer session at JPMorgan Chase’s annual tech conference, Visa CEO Alfred F. Kelly acknowledged that digital assets complement rather than compete with its existing payment systems. When talking about the company's overall strategy in terms of digital assets and stablecoins, Alfred F. Kelly said that digital assets backed by fiat currencies are a very real and promising emerging payment technology. “We actually believe that digital assets can be complementary to the payment ecosystem, not any substitute or negative thing.”

Currently, Visa can process 160 different currencies globally, and there is no reason why digital assets should not be part of it. Visa's patent may also be applicable to other central bank digital assets, such as the British pound, Japanese yen and euro, and thus realize the digitization of currencies around the world.