secondary title

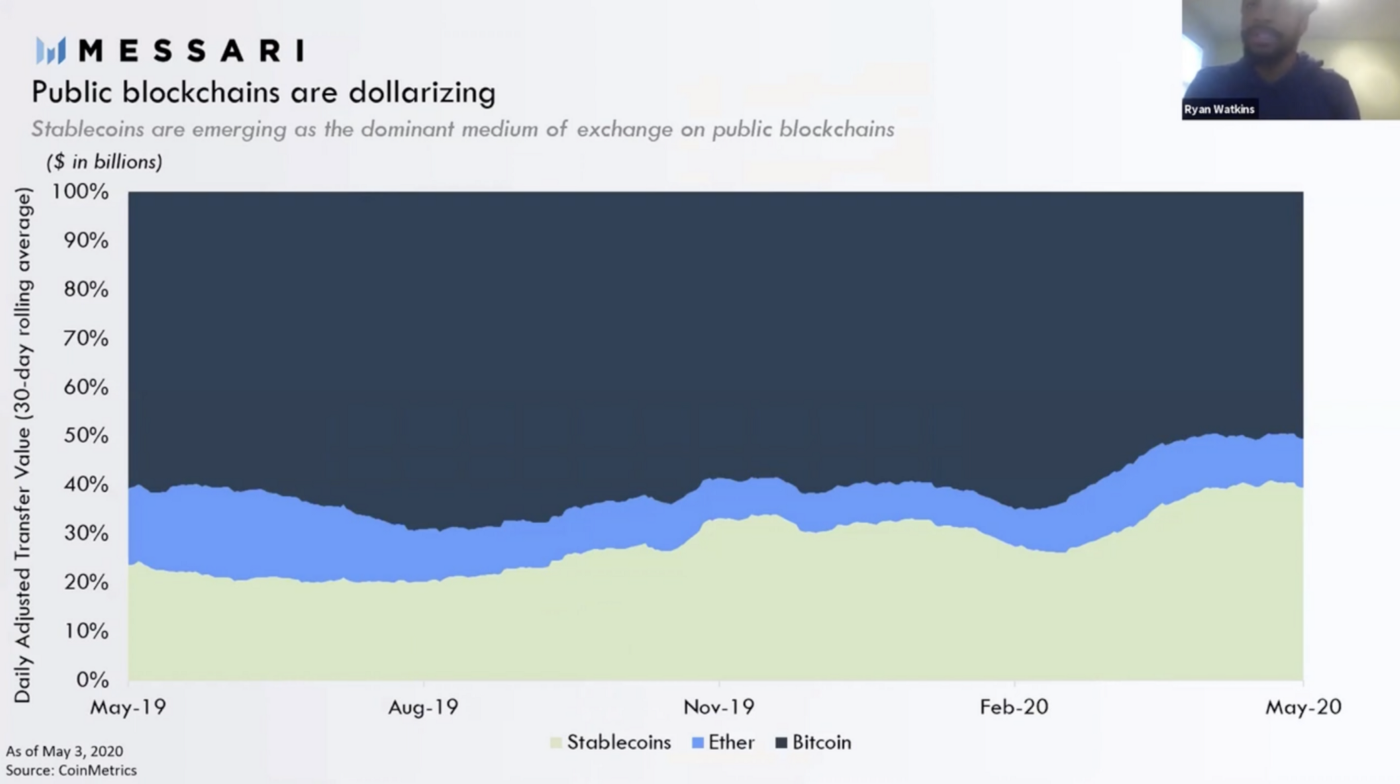

#1 USD is being ported to the public chain

secondary title

#2 COVID-19 Greatly Accelerated Stablecoin Growth

secondary title

#3 The top three stablecoin winners in the first quarter are Tether, BUSD (Binance), & DAI

Binance’s BUSD grew the fastest in the first quarter, mainly because Binance Exchange was promoting the BUSD trading pair, and the BUSD base was small before.

Maker's DAI growth is mainly due to the introduction of multi-collateral DAI in January.

secondary title

#4 Circle’s market research prior to launching USDC in late 2018 showed that the market’s biggest concern was counterparty risk

Prior to launching USDC, Circle conducted market research using its exchange network with traders, investors, and market makers. The biggest concern of potential USDC users is counterparty risk. What if Circle or the bank holding the reserves goes bankrupt?

secondary title

#5 The biggest event of 2019 was the migration of Tether to Ethereum

Tether has been using the Omni protocol for 5 years since its launch in 2014. The Omni Protocol is a second-layer protocol on the Bitcoin blockchain. In mid-2019, a day after Binance announced that it would stop supporting the Omni protocol, Tether announced that it would begin issuing ERC-20-compliant Tethers.

Less than a year after Tether created a stablecoin option for value transfers on Ethereum, Tether’s value transfer on Ethereum has reached parity with Bitcoin.

secondary title

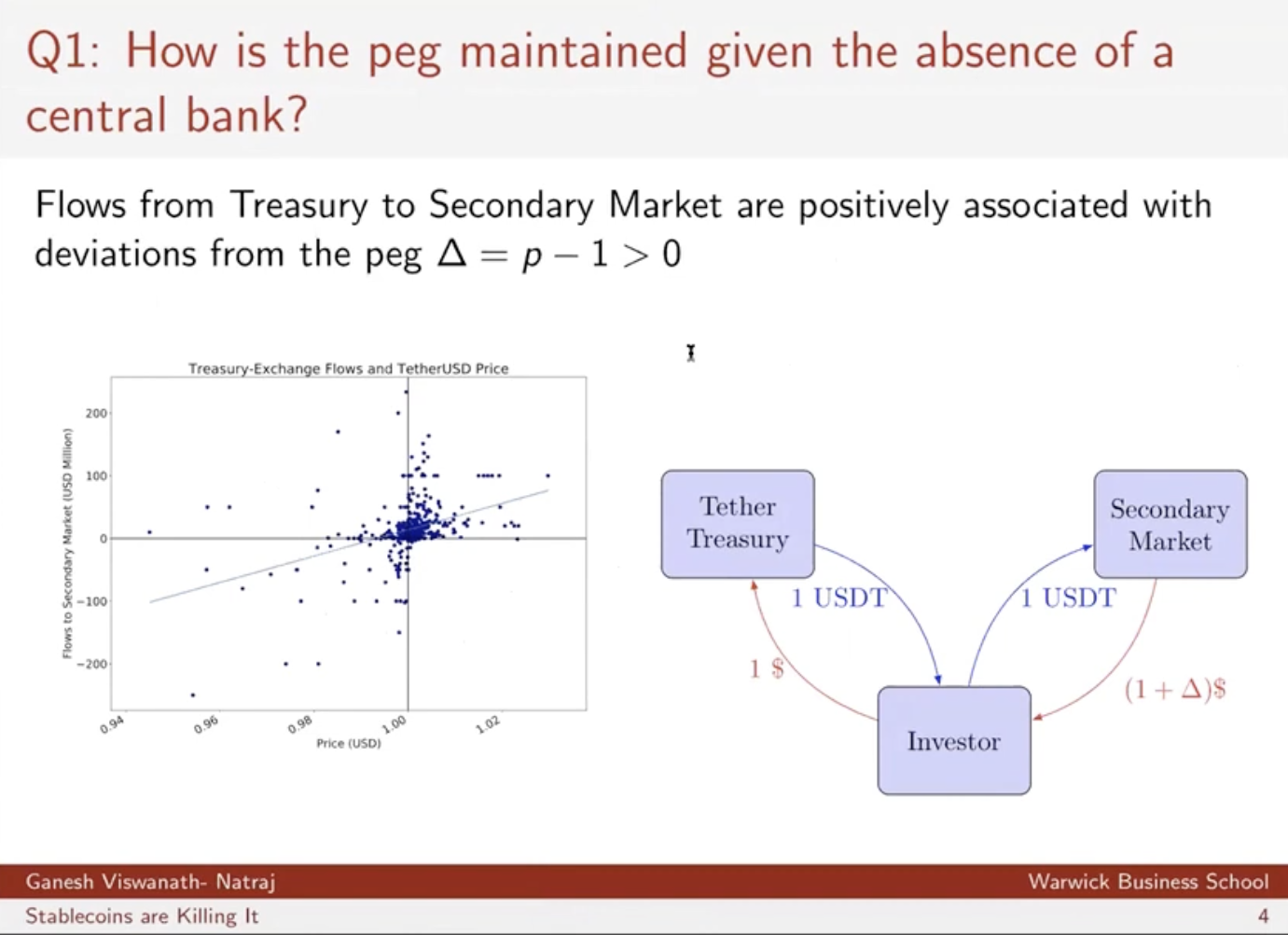

#6 Study shows arbitrageurs buy stablecoins from Tether treasury when price exceeds $1

secondary title

#7 Tether migrates to the Ethereum blockchain, reducing deviation from pegged assets and accelerating regression

secondary title

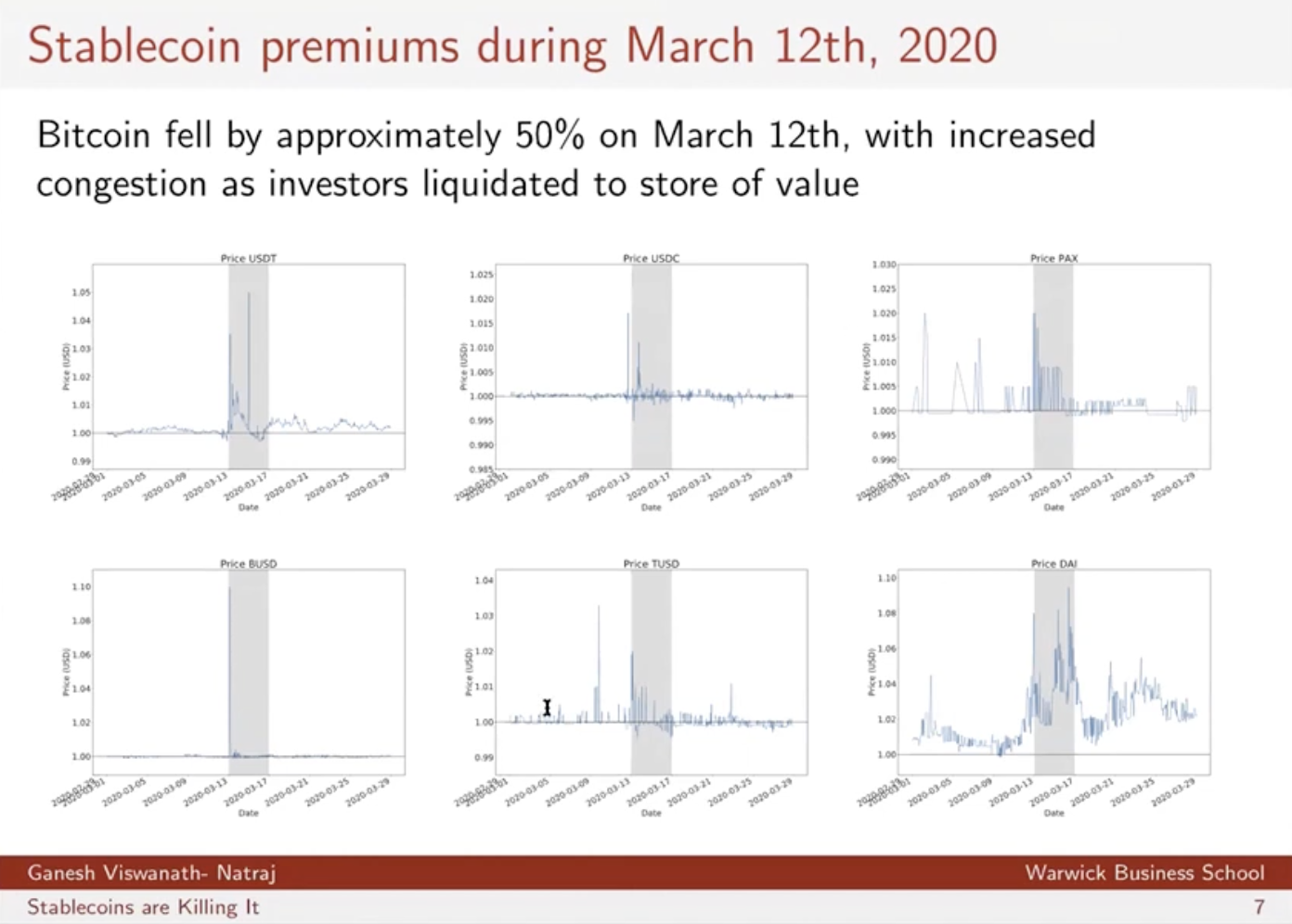

#8 Stablecoins tend to trade at a premium in times of crisis and a discount if confidence is lost

In times of crisis or violent volatility, stablecoins are often traded at a premium to preserve asset security. Stablecoins tend to trade at a discount when a stablecoin’s reserves are called into question, or there are other events that lead to a loss of confidence. This is similar to how currencies such as the peso are pegged to the dollar and trade at a discount if people think that dollar reserves are going lower. For example, Ganesh shows that when the price of Bitcoin fell by nearly 50% on March 12, 2020, the six largest stablecoins were all trading at a premium.

secondary title

#9 Ganesh’s research refutes research showing stablecoin issuance causes crypto market bubble

secondary title

#10 Regulators remain an important part of the stablecoin ecosystem

Joao said that they have always been committed to working with regulators, and as Facebook/Libra forces global regulators to pay more attention and think about stablecoins, cooperation has become easier.

Ganesh believes that regulators will continue to treat stablecoins cautiously, focusing on related issues such as reserve requirements and "bank runs." Ganesh emphasized that the widespread adoption of stablecoins in small countries could affect financial stability. Central banks could lose their power to control monetary policy, and banks could lose their power to deposit money.