Produced by Odaily

Editor | Hao Fangzhou

Produced by Odaily

Exchange Weekly Trends

Exchange Weekly Trends

On May 10, Coinbase temporarily went down amidst a brief market dip.

On May 10, according to data compiled by CryptoDiffer, liquidations across exchanges totaled $1.22 billion, with 30% coming from Huobi, 23% from BitMEX, OKEx, and Binance, and a small portion from FTX.

On May 10, the Iranian cryptocurrency exchange Bitisis BTC had a premium of about $300.

On May 9, the Japanese exchange TAOTAO: As of March this year, the cumulative trading volume of leverage and spot has reached 554.4 billion yen.

On May 9th, ICO Analytics: OKEx’s total traffic in April increased by 147%, ranking first among the most popular exchanges.

On May 7th, data: The number of ETH that has not been moved in 3-5 years has soared, and the number of ETH held by exchanges has increased significantly.

On May 7th, Xu Kun of OKEx: Giant whale addresses surpassed the bull market in 2017, optimistic about the bitcoin market in the second half of the year.

secondary title

Exchange data statistics

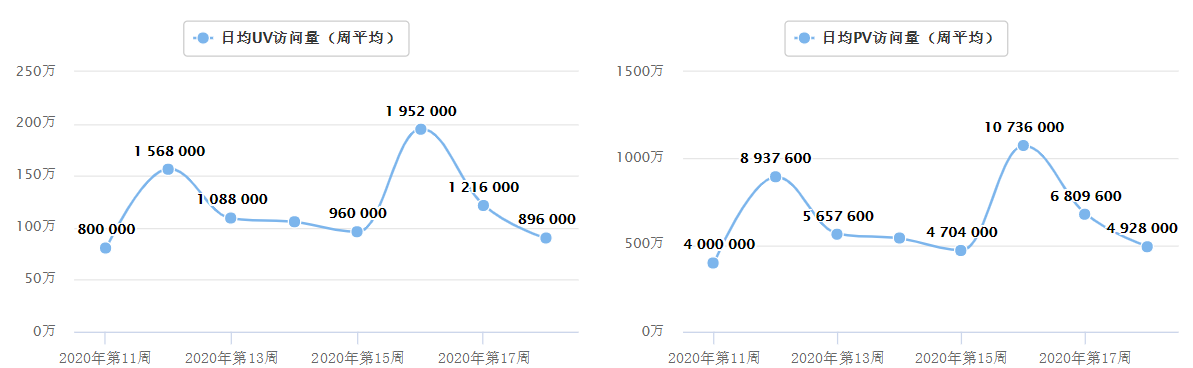

image description

source:Alexa

According to Alexa statistics, the Binance website UV (unique visitors) this week was 896,000/day, a decrease of 26.4% from last week; meanwhile, the PV (page views) was 4.928 million/day, a decrease of 27.7% from last week. Binance, as the leading exchange in the encryption world, occupies most of the market traffic, which shows that the overall market traffic has declined recently.

source:

source:Dapptotal

Note: According to the statistics of Dapptotal combined with the historical price trend of BTC, it is found that the number of active users of DEX users is positively correlated with the price. In December 2017, the price of BTC reached a peak of 120,000 US dollars, and the number of users of Dex reached a peak of 9340; in April and May of 2018, the price of BTC rebounded again, and the number of active users of DEX also rebounded again; therefore, the number of users of DEX can be used as a judgment A reference indicator of market trends, but in the transaction volume and number of transactions counted by Dapptotal, the research institute found that its trend is not as highly correlated as the number of users and the price of BTC, so the number of users is intercepted as a reference indicator.

Note: According to the statistics of Dapptotal combined with the historical price trend of BTC, it is found that the number of active users of DEX users is positively correlated with the price. In December 2017, the price of BTC reached a peak of 120,000 US dollars, and the number of users of Dex reached a peak of 9340; in April and May of 2018, the price of BTC rebounded again, and the number of active users of DEX also rebounded again; therefore, the number of users of DEX can be used as a judgment A reference indicator of market trends, but in the transaction volume and number of transactions counted by Dapptotal, the research institute found that its trend is not as highly correlated as the number of users and the price of BTC, so the number of users is intercepted as a reference indicator.

source:

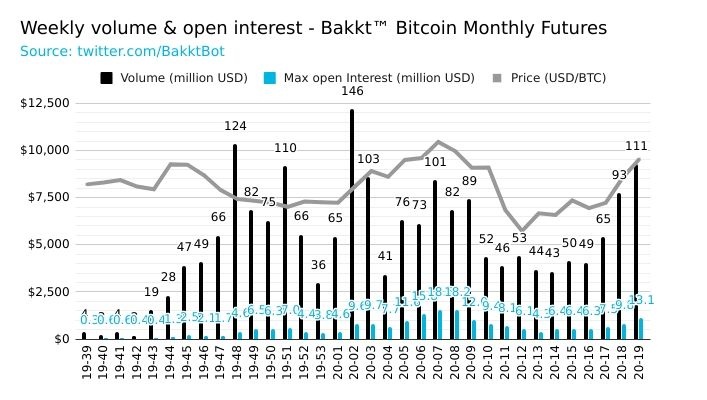

source:Bakkt Volume Bot

This week, the trading volume of Bakkt's monthly delivery contracts was US$111 million, an increase of 20% from last week; the open interest was US$13.1 million, an increase of 34% from last week.

Among them, the green line is the price trend of BTC, the blue line is the price trend of BNB, and the orange line is the price trend of HT.

source:tradingview

Among them, the green line is the price trend of BTC, the blue line is the price trend of BNB, and the orange line is the price trend of HT.

This week, Bitcoin is mainly in a downward trend, and the callback range of HT and BNB is similar to that of BTC.

source:

source:aicoin

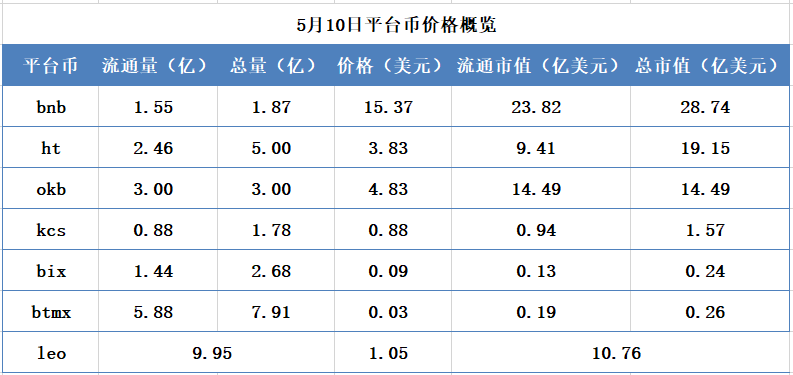

This week, the price of Bitcoin fluctuated and fell, and the price of platform tokens followed the trend of Bitcoin, with a decline of about 10%.