Produced by Odaily

Editor | Hao Fangzhou

Produced by Odaily

The decline in exchange traffic has slowed;

Exchange Weekly Trends

Exchange Weekly Trends

On April 6, after the encryption ban was lifted, several exchanges in India lowered transaction fees to attract users.

On April 4, lending protocol Nuo Network will launch a DeFi exchange next week.

On April 4th, the report: CME's June contract average annualized premium rate is higher than that of retail exchanges.

On April 4, the trading volume of Bitcoin options contracts on the Deribit exchange in March set a new record.

On April 4, Coinbase reported: Highly leveraged trading positions may be related to the plunge of 312 cryptocurrencies.

On April 2, the three major exchanges such as Coinbase accounted for 19% of the Tezos pledge share, and the exchange pledge service achieved rapid growth.

On April 1, Changpeng Zhao: Binance is about to launch a mining pool business.

On March 30, OKCoin obtained the Japanese exchange license, and the globalization strategy made another success.

Exchange data statistics

Exchange data statistics

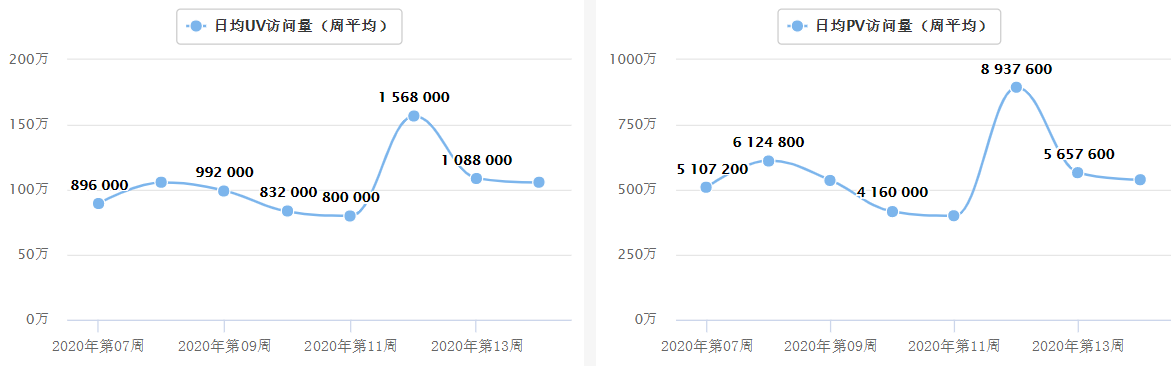

According to Alexa statistics, the Binance website UV (unique visitors) this week was 1.056 million/day, a decrease of 2.95% from last week; at the same time, PV (page views) was 5.385 million/day, a decrease of 4.8% from last week. Binance, as the leading exchange in the encryption world, occupies most of the market traffic, which shows that the overall market traffic has declined recently.

source:Alexa

According to Alexa statistics, the Binance website UV (unique visitors) this week was 1.056 million/day, a decrease of 2.95% from last week; at the same time, PV (page views) was 5.385 million/day, a decrease of 4.8% from last week. Binance, as the leading exchange in the encryption world, occupies most of the market traffic, which shows that the overall market traffic has declined recently.

source:

source:Dapptotal

Note: According to the statistics of Dapptotal combined with the historical price trend of BTC, it is found that the number of active users of DEX users is positively correlated with the price. In December 2017, the price of BTC reached a peak of 120,000 US dollars, and the number of users of Dex reached a peak of 9340; in April and May of 2018, the price of BTC rebounded again, and the number of active users of DEX also rebounded again; therefore, the number of users of DEX can be used as a judgment A reference indicator of market trends, but in the transaction volume and number of transactions counted by Dapptotal, the research institute found that its trend is not as highly correlated as the number of users and the price of BTC, so the number of users is intercepted as a reference indicator.

Note: According to the statistics of Dapptotal combined with the historical price trend of BTC, it is found that the number of active users of DEX users is positively correlated with the price. In December 2017, the price of BTC reached a peak of 120,000 US dollars, and the number of users of Dex reached a peak of 9340; in April and May of 2018, the price of BTC rebounded again, and the number of active users of DEX also rebounded again; therefore, the number of users of DEX can be used as a judgment A reference indicator of market trends, but in the transaction volume and number of transactions counted by Dapptotal, the research institute found that its trend is not as highly correlated as the number of users and the price of BTC, so the number of users is intercepted as a reference indicator.

source:

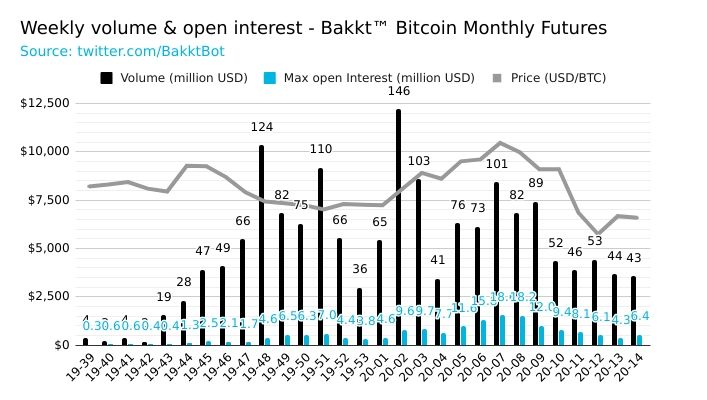

source:Bakkt Volume Bot

secondary title

source:

source:tradingview

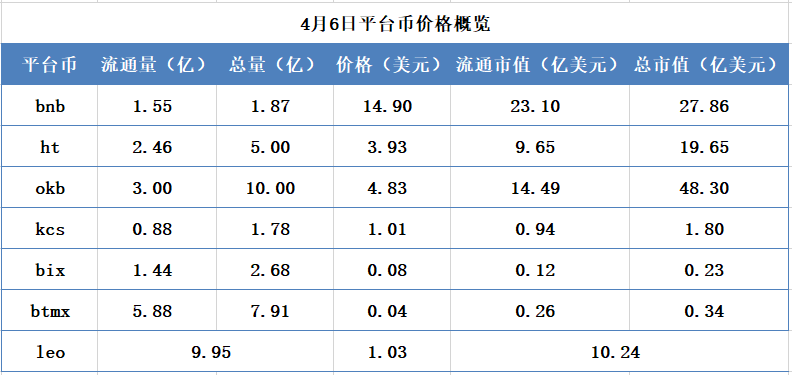

This week, Bitcoin was dominated by shocks and upward movements, and the rise of platform coins was slightly higher than that of Bitcoin.

This week, Bitcoin was dominated by shocks and upward movements, and the rise of platform coins was slightly higher than that of Bitcoin.

source:

source:aicoin

analyst point of view

analyst point of view

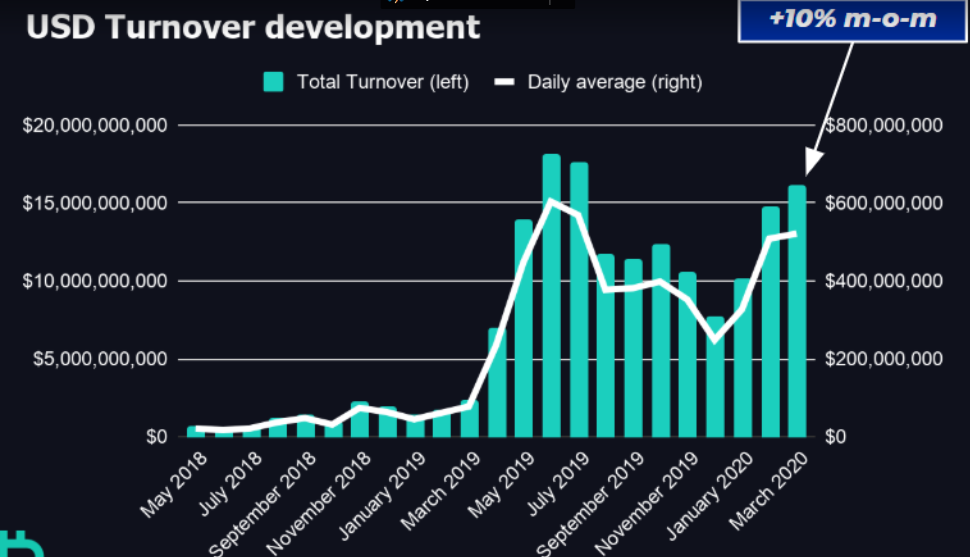

Significant growth in options trading volume

The trading volume of several major virtual currency options exchanges has seen a good increase recently, and Deribit’s USD trading volume in March 2020 exceeded 1.5 billion US dollars, making it the third highest since May 2018. This shows that traders in the current industry are becoming more mature, and the entire industry (including mines, mining machine manufacturers, and exchanges) has a need for hedging. The growth of derivatives trading volume will be beneficial to the long-term development of the market.