Bankrupt bitcoin exchange Mt. Gox (Mt. Gox) has finally dealt with its legacy debt issues, and more information on how it will pay debts in the future was mentioned in a document sent to debtors on the eve of the creditors' annual meeting.

According to the leaked draft, creditors can choose the form of repayment they receive, either choose to receive fiat currency, or choose to receive compensation mixed with fiat currency and bitcoin or bitcoin cash.

However, there are no other options for cryptocurrencies other than Bitcoin and Bitcoin Cash. Other cryptocurrencies will be sold, and the document specifically mentions BSV, as well as BTG and some other cryptocurrencies. Statistics show that Mt. Gox once held nearly 202,000 BSV (current market value of 35 million US dollars).

Part of it will be liquidated in fiat currency, so the sell-off of Bitcoin or BCH that investors fear will not happen, but BSV is not included in the option of repaying debtors, which means that BSV will be sold, or has already been sold.

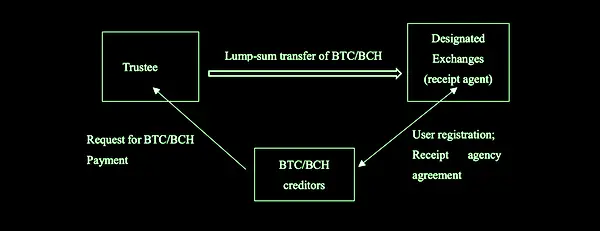

The fiat currency portion will be sent directly to the debtor's bank account in yen, dollars or euros. The Bitcoin and BCH portion will be sent to the debtor through several specific exchanges, which are not mentioned in the document at present. Overall, with a combination of BTC/BCH and fiat, debtors are expected to receive about 25% of the original amount. This makes everyone's original investment very profitable, because the price of Bitcoin has increased a lot since it was frozen in 2014.

It is currently a proposal, but generally sound, so it can be expected to be approved at the upcoming annual meeting of creditors. If the draft is approved, it means that soon, within a few weeks, all debtors will receive a payment of about 200,000 BTC, as well as BCH distributed in the form of fiat currency or cryptocurrency of their choice.