Editor's Note: This article comes fromNakamoto Shallot (ID: xcongapp), Odaily is authorized to publish.

Nakamoto Shallot (ID: xcongapp)

Nakamoto Shallot (ID: xcongapp)

, Odaily is authorized to publish.

secondary title

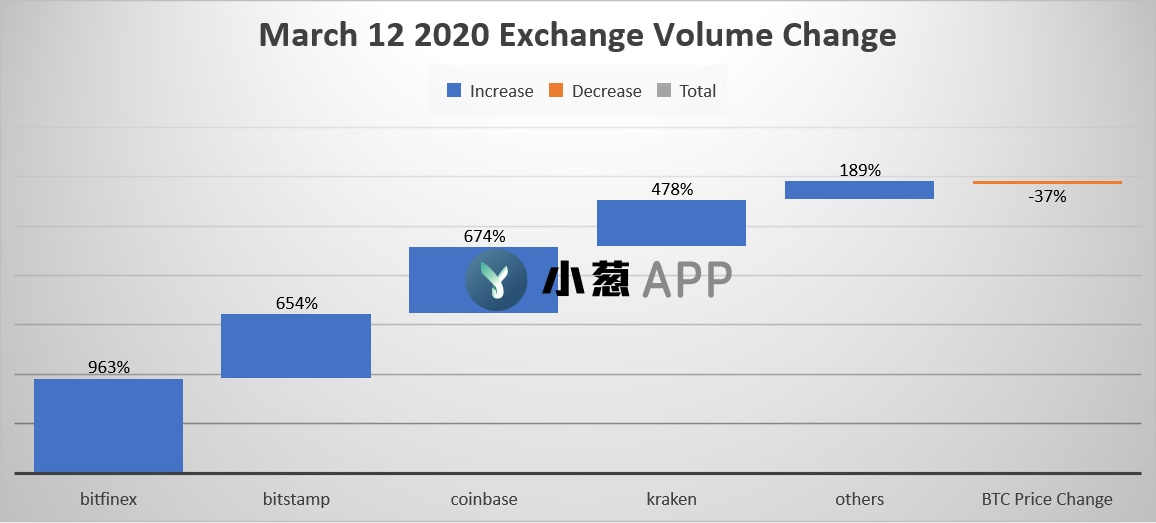

The sell-off on March 12 led to a surge in trading volume

The main source of income for cryptocurrency exchanges comes from transaction fees, so whenever trading volume goes up, their income will increase.

image description

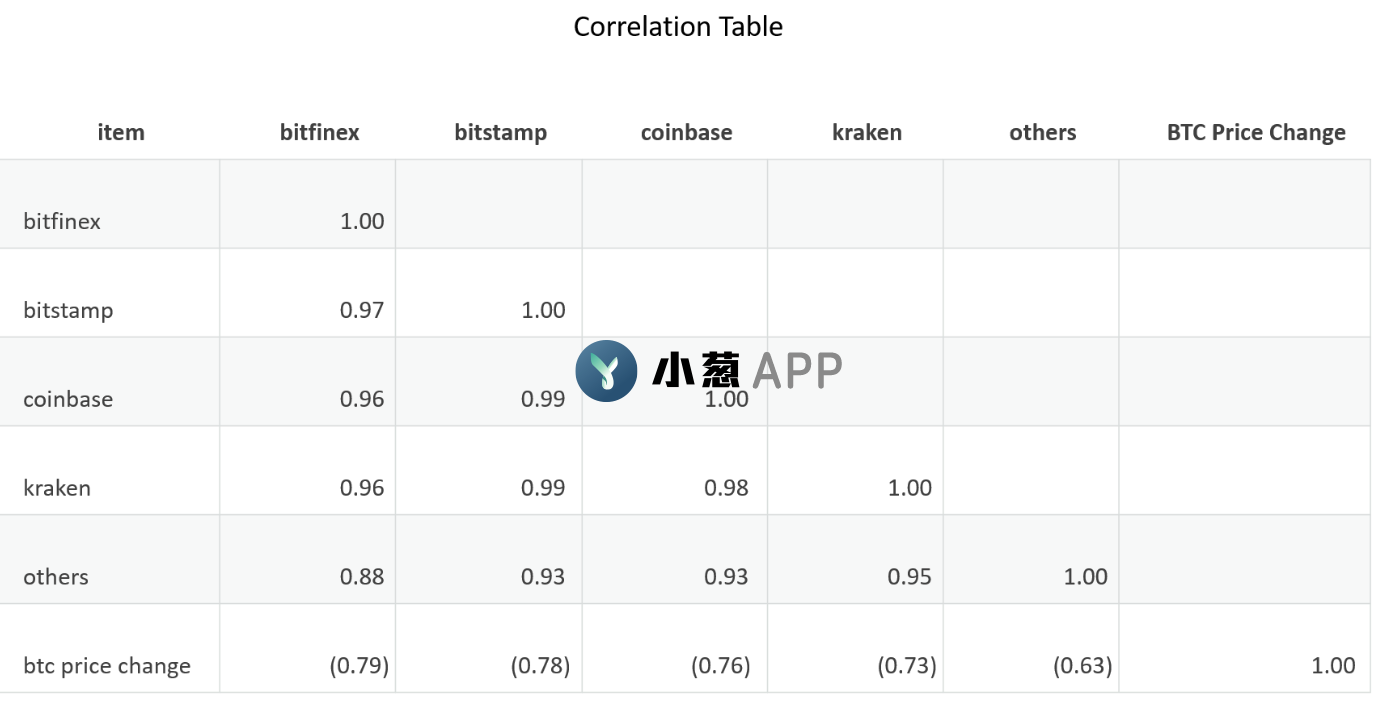

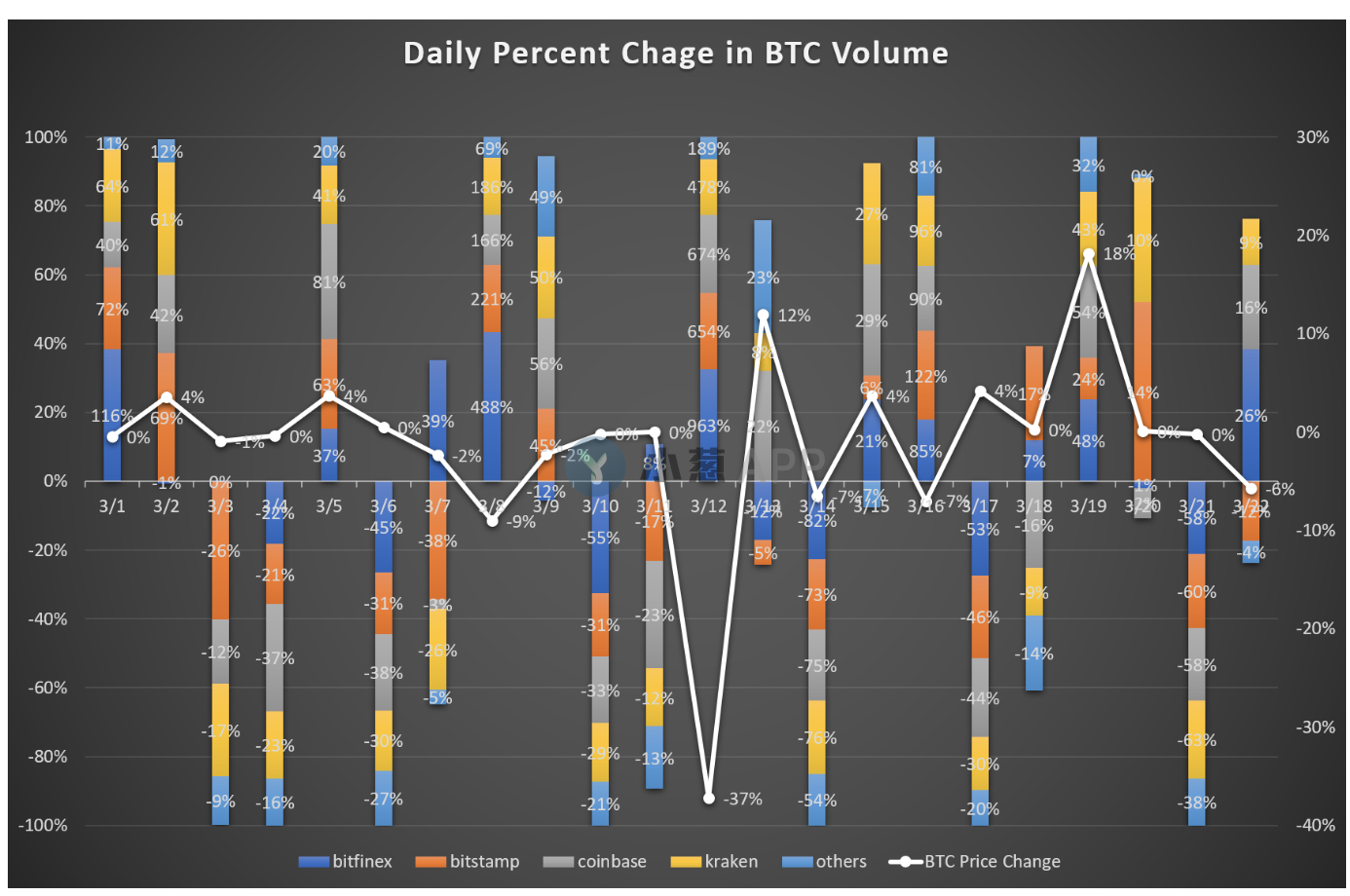

Furthermore, there is a clear correlation between price action and trading volume. According to the table below, all exchanges in the graph have a negative correlation between Bitcoin trading volume and Bitcoin price. In other words, in a bear market, Bitcoin trading volume will be higher.

Bitcoin volume on Bitfinex shows the highest correlation. Furthermore, it had the most volatile trading volume in March, with a high standard deviation of 230%.

(Sources: Cointelegraph, bitcoinity.org, Coinmarketcap)

secondary title

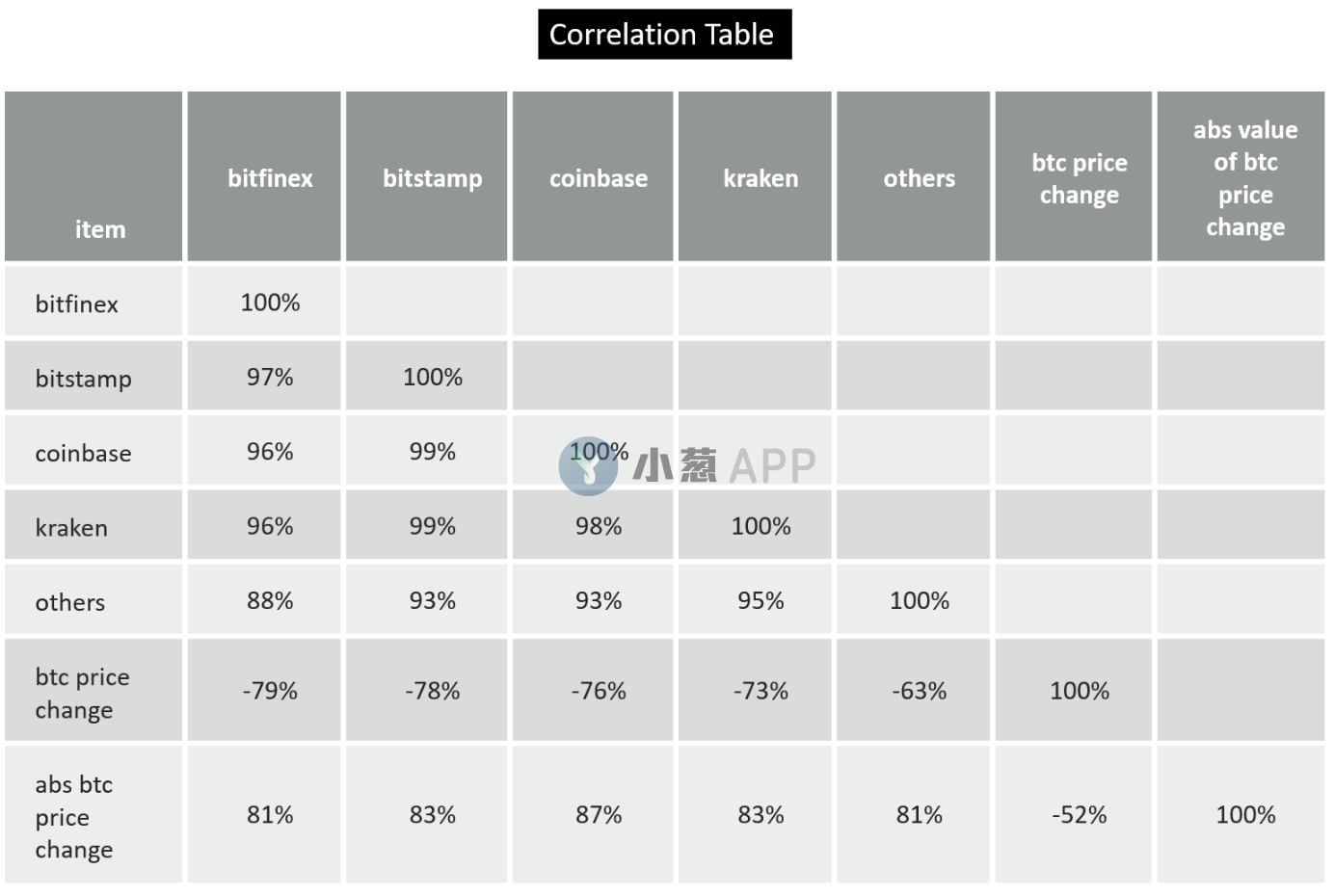

Despite the days when Bitcoin’s price was in free fall, exchanges were profitable and trading volumes performed well, especially on March 12. But the core of the exchange is still volatility, it doesn't matter whether the price of Bitcoin is up or down. The correlation between trading volume and the absolute value of price changes is even stronger.

(Sources: Cointelegraph, bitcoinity.org, Coinmarketcap)

Compared with offshore exchanges such as Bitfinex and Bitstamp, domestic exchanges such as Coinbase and Kraken in the United States have less fluctuations in trading volume and less profit during the bear market. Based on the data, it is impossible to tell whether the surge in trading volume during the sell-off was the cause of the sell-off or a follow-up to the sell-off.

image description

(Sources: Cointelegraph, bitcoinity.org, Coinmarketcap)