Editor's Note: This article comes fromNakamoto Shallot (ID: xcongapp), Odaily is authorized to publish.

Editor's Note: This article comes from

Nakamoto Shallot (ID: xcongapp)

Nakamoto Shallot (ID: xcongapp)

, Odaily is authorized to publish.

In order to save the U.S. economy under the impact of the epidemic, the U.S. government originally planned to pass a rescue plan worth nearly 2 trillion U.S. dollars (equivalent to 10% of U.S. GDP) on Sunday night local time in the United States. However, this economic stimulus plan failed to pass as scheduled, and the negotiations were at a deadlock for a while, which directly led to the panic atmosphere of "Black Monday" in the global financial market on Monday.

According to the "Los Angeles Times" report, although American politicians widely agree that an economic stimulus plan should be introduced to save the U.S. economy under the impact of the epidemic and help ordinary Americans resist the risk of unemployment, judging from the situation on the negotiating table in the Senate However, there are still big differences between the Republican Party and the Democratic Party of the United States on how to design and implement this plan, which led to a temporary stalemate in the negotiations. The main areas of disagreement include how much of the bailout package should go to state and local governments, and whether to allow Trump administration officials to directly decide which big businesses get "preferred treatment."

The emergency legislation ended in a tie with 47 votes against 47 votes in the U.S. Senate on Sunday night local time. Democrats believe that the current version of the rescue plan is too focused on big companies and may be used by the Trump administration. Supporting the corporate "friends" of the Republican Party, but not enough protection for working people. The Republican side accused the Democrats of playing political games.

While the impasse is widely expected to be resolved by Monday (later today) US local time, the negative impact of the weekend's unexpected shelving and doubts about the ultimate effectiveness of the stimulus has already taken hold. Dr. Roubini of Doom bluntly stated on Twitter that the Trump administration’s $2 trillion stimulus package is of very limited help to ordinary Americans. It is expected that most of this part of the funds will flow to those large and medium-sized companies. The company doesn't actually have a particularly big cash flow problem. American office workers who really need help do not enjoy the dividends of government subsidies at all.

Roubini said the U.S. government's planned stimulus policy may actually be the trigger for those unsavory history repeating itself. Movements such as the Tea Party movement in 2009 and Occupy Wall Street in 2011 are still vivid, but the U.S. government does not seem to be doing so. Learned enough lessons from it. Therefore, the question for the U.S. government now is not the position of the Republican Party or the Democratic Party, but how the U.S. government should deal with new systemic risks when the market turns from prosperity to depression.

secondary title

The crisis turned into an opportunity for Bitcoin to accelerate its maturity

At the beginning of Bitcoin's birth, its "decentralization" and "de-boundary" series of characteristics have solved the "stubborn illnesses" existing in these traditional fiat currency systems to a certain extent. Under the test of the recent crisis, although the world's major economies continue to rescue the market through various radical stimulus policies, the performance of the global stock market and foreign exchange market is not satisfactory.

Taking the U.S. stock market as an example, since the beginning of 2020, the performance of the Dow Jones Index and the S&P 500 Index has been significantly weaker than that of Bitcoin, which no institution can "inject water" and "stimulate" the market.

As the only global free market currency with a considerable scale in the world, although Bitcoin was also affected by liquidity and other issues during the crisis and fell synchronously, from a relative point of view, this currency that was born only 11 years ago "Money" has somewhat passed the initial test of a global crisis. And this is almost unimaginable in the concept of the traditional legal currency system.

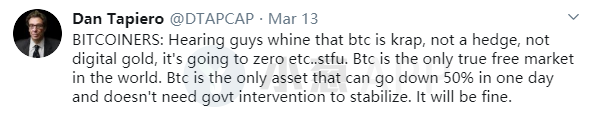

A trader named Dan Tapiero said that although many people have been complaining that Bitcoin is air, there is no asset preservation effect, it will never become digital gold and may even return to zero at any time. But the fact is that Bitcoin is currently the only truly "market-oriented" free market in the world, and Bitcoin is also the only asset that can repair itself and stabilize without any government/organizational intervention after a 50% drop.

With the rapid maturity of this real free market currency, when the crisis comes, are the people still willing to choose to trust the governments and central banks of the major economies and seek the protection of the advanced legal currency system? The answer to this question may become increasingly vague, or perhaps many people's positions have begun to waver.