Produced by Odaily

Editor | Hao Fangzhou

Produced by Odaily

Significant decline in exchange traffic;

Exchange Weekly Trends

Exchange Weekly Trends

On March 22, the Harbin Bureau of Industry and Information Technology will promote the "blockchain + new technology cluster" and build a digital asset exchange.

On March 22, Jeff Liu, co-founder of PeckShield: The total value of Bitcoin flowing directly from the dark web into major exchanges reached 216 million US dollars.

On March 22, analysis: the number of ETH transferred to the exchange exceeded the high point in 2018, which may indicate that investors want to sell ETH.

On March 22, the exchange wallet monitoring report: Huobi ranked first in total USDT deposits, Binance and OKEx ranked second and third.

On March 20, the Swiss cryptocurrency exchange Smart Valor launched the physical gold token PAXG.

On March 18, the decentralized exchange Sparkswap announced that it would close. It is reported that Sparkswap was established in 2017 and raised $3.5 million from Pantera Capital, Initialized Capital and other companies in April last year.

On March 17, data: BitMEX Ethereum futures open interest has lagged behind five exchanges including OKEx.

Exchange data statistics

Exchange data statistics

source:

source:Alexa

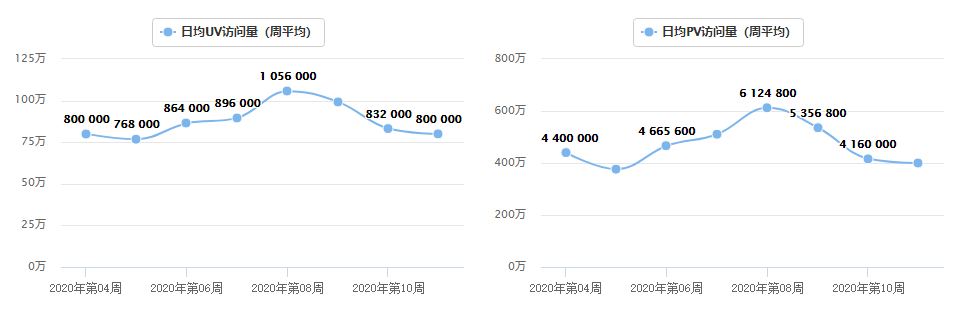

According to Alexa statistics, the Binance website UV (unique visitors) this week was 800,000/day, a decrease of 3.9% from last week; at the same time, PV (page views) was 4 million/day, a decrease of 3.9% from last week. Binance, as the leading exchange in the encryption world, occupies most of the market traffic, which shows that the overall market traffic has declined recently.

source:

source:Dapptotal

According to Dapptotal data, the total number of active users of decentralized exchanges on March 23 was 2,820 (including more than 20 decentralized exchanges such as IDEX, Tokenlon, and Uniswap), compared to 5,350 active users on June 26, 2019 The peak value dropped by 47.3%, and the number of active users dropped from last week.

(Note: According to the statistics of Dapptotal combined with the historical price trend of BTC, it is found that the number of active users of DEX users is positively correlated with the price. In December 2017, the price of BTC reached a peak of 120,000 US dollars, while the number of Dex users reached a peak of 9340; in April 2018 -The price of BTC picked up again in May, and the number of active users of DEX also picked up again; therefore, the number of users of DEX can be used as a reference indicator to judge the market trend, but in the transaction volume and number of transactions counted by Dapptotal, the research institute found that its trend There is no high correlation between the number of users and the price of BTC, so the number of users is intercepted as a reference indicator).

image description

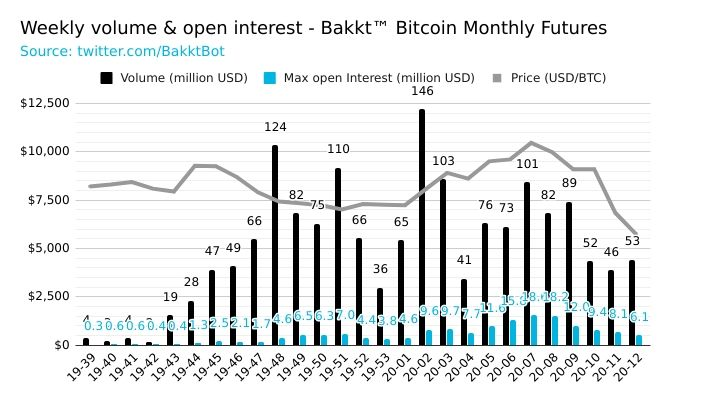

source:Bakkt Volume Bot

secondary title

Among them, the green line is the price trend of BTC, the blue line is the price trend of BNB, and the orange line is the price trend of HT.

source:tradingview

Among them, the green line is the price trend of BTC, the blue line is the price trend of BNB, and the orange line is the price trend of HT.

This week, Bitcoin is dominated by an upward rebound. The rebound of mainstream currency platform tokens is slightly larger than that of BTC. The upward pressure is relatively high, and the upward space is limited.

source:

source:aicoin

analyst point of view

analyst point of view

The market value of the platform currency may enter a period of slow growth

Platform currency has properties similar to brokerage stocks, and the characteristics of blockchain endow it with more. In addition to the destruction mechanism similar to dividends, it also has the use attribute of early platform currency to deduct handling fees. In 19 years, the IEO project raised platform currency financing properties etc. This year, most platforms even destroyed the uncirculated part, which are the key factors that are conducive to the rise of platform currency prices. And when these methods are exhausted, the new means of promoting the price of the platform currency in the future will be lacklustre. Destroying the uncirculated part is more like the last move of the "death struggle" of the platform currency. After Bitcoin fell below the $7,000 mark, the exchange Judging from the spot trading volume and futures open interest, once it enters a long-term low in the future, the bright era of "lying and earning" on the exchange will never return.

Decentralized exchanges may have been "falsified"

This week, Sparkswap, a decentralized exchange invested by crypto head capital Pantera Capital and Initialized Capital, announced that it will be closed, which is a microcosm of most DEXs. Judging from the data provided by Dapptotal, no matter in the 17-year bull market, 18-year bear market, or 2019 bull-bear transition, there has been no qualitative change in the number of users and transaction volume. Most DEXs are still decentralized in a "utopian" style Trusteeship is a selling point, the operating threshold is high, the trading experience is not good, the ideal decentralization has no market maker, the point-to-point matching system greatly reduces the transaction depth, and the user's own private key custody does not solve the problem of fund security. Uniswap has obtained a better transaction depth through the fund pool, occupying half of the DEX. Other DEXs are unable to make ends meet and are still facing the situation of continuous outflow of users. For more than three years, a large number of capital and technical geeks have poured into this field. Few achievements have been made so far.