Editor's Note: This article comes fromNakamoto Shallot (ID: xcongapp), Odaily is authorized to publish.

Editor's Note: This article comes from

Nakamoto Shallot (ID: xcongapp)

Nakamoto Shallot (ID: xcongapp)

, Odaily is authorized to publish.

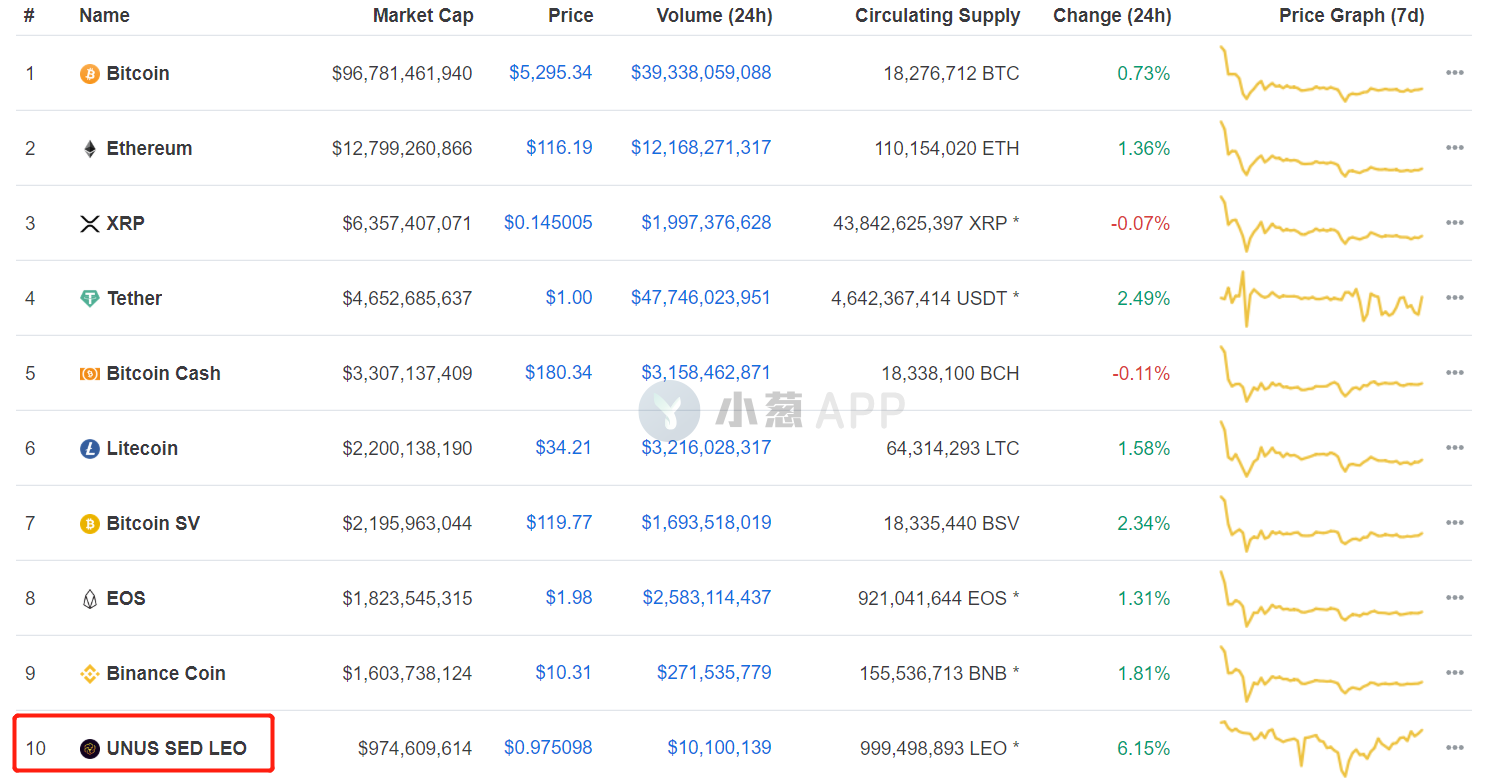

According to the latest data from Coinmarketcap, the Bitfinex exchange platform currency LEO has successfully ranked among the top ten in the total market capitalization of cryptocurrencies. In the context of the recent bloodbath in the cryptocurrency market, it was complained at the beginning of its birth that it is more like a stable currency than a platform currency. Instead, LEO took the opportunity to overtake multiple mainstream currencies.

On May 20, 2019, the Bitfinex exchange platform currency was officially launched for trading, and LEO was released through IEO, with a total of 1 billion issued globally. Like most platform tokens, this token has a repurchase and destruction mechanism, and token holders can enjoy privileges such as transaction fees, lending fees, cash withdrawal and recharge fees.

However, since the popularity of the IEO concept was coming to an end at that time, LEO did not go out of the skyrocketing performance after the launch of IEO on other domestic platforms after the opening, and the currency price has remained stable at around US$1. And this kind of performance once made LEO a laughing stock in various social media and communities, but it has been proved that LEO has indeed maintained this stablecoin-like posture for nearly a year.

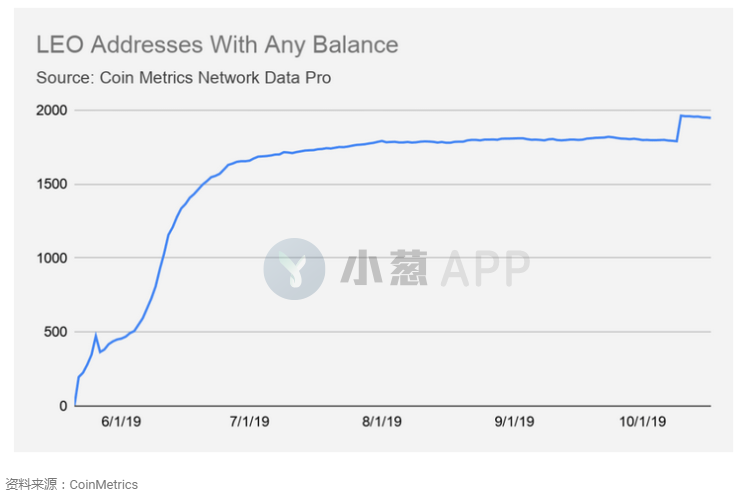

A report by Coin Metrics late last year cast even greater doubts on the prospects of LEO. The report pointed out that the addresses holding LEO broke through the 1,500 mark in the 30 trading days before the currency went online. However, in the ensuing four months, this number has not been able to exceed 2000.

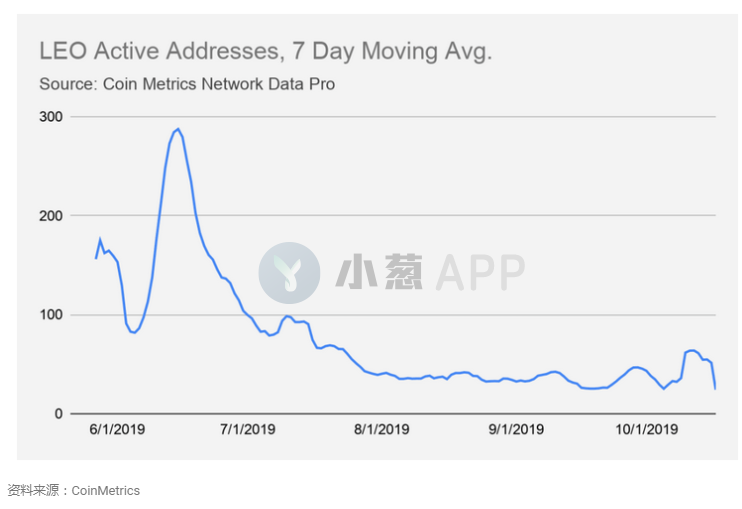

In addition, the address activity of LEO is also quite negative, and there has been a significant decline after the number of active addresses briefly reached about 300 in June last year. In late October last year, the number even dropped below 20. At that time, Coin Metrics pointed out in the report that for a currency with a market value close to 1 billion US dollars, the activity of this address is at a fairly low level.

However, with the passage of time, more and more liquid funds in the market have participated in LEO trading activities through platforms such as Bitfinex and Dragonex. Among them, the margin trading service provided by the Dragonex exchange has effectively stimulated market liquidity. It is also this relatively considerable capital inflow that allowed LEO to stabilize the currency price in the past period of time when mainstream cryptocurrencies collectively collapsed under the influence of Bitcoin's rapid dive.