Editor's Note: This article comes fromNakamoto Shallot (ID: xcongapp), Odaily is authorized to publish.

Editor's Note: This article comes from

Nakamoto Shallot (ID: xcongapp)

Nakamoto Shallot (ID: xcongapp)

, Odaily is authorized to publish.

Chainalysis released an analysis report on the Bitcoin plunge. The main points of the report are as follows:

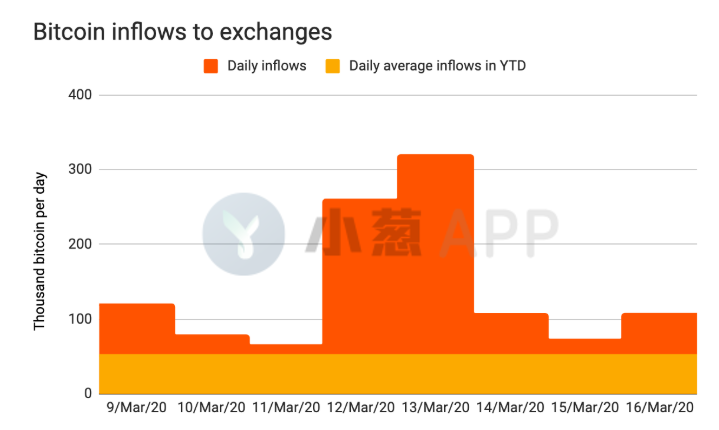

2. From March 12th to March 13th, the amount of bitcoin flowing into the exchange was 9 times the usual amount. This selling pressure caused the price of Bitcoin to drop by about 37%.

3. After March 13, the inflow of bitcoins in exchanges has dropped to twice the usual level, which indicates that the pressure on bitcoin prices has eased.

4. Large professional traders and investors are dominating the cryptocurrency market.

5. The amount of bitcoins that have flowed into exchanges over the past eight days represents approximately 5% of all available bitcoins (mined bitcoins minus all lost bitcoins), suggesting that most bitcoiners still want to hold on bitcoin.

secondary title

Since March 9, cryptocurrency exchanges have received a total of 1.1 million bitcoins in 8 days, peaking on March 12 and 13 (about 9 times the usual amount), about 475,00 more than usual bitcoins. Since the beginning of the year, an average of 52,000 bitcoins have flowed into exchanges per day until March 9.

From March 9 to March 16, 1.1 million bitcoins flowed into exchanges in eight days, 712,000 bitcoins more than usual.

Of those 712,000 bitcoins, between 40,000 and 240,000 bitcoins remain on exchanges, meaning that only 6% to 34% of bitcoin inflows have not been sold or have changed hands. Coin holders can still sell it again. In other words, most of the bitcoin flowing into exchanges has been sold, and the worst seems to be over for now.

Also, the amount of bitcoins that have flowed into exchanges over the past eight days represents about 5% of all available bitcoins (mined bitcoins minus all lost bitcoins), suggesting that most bitcoiners still want to hold on bitcoin.

secondary title

2. Who is selling Bitcoin?

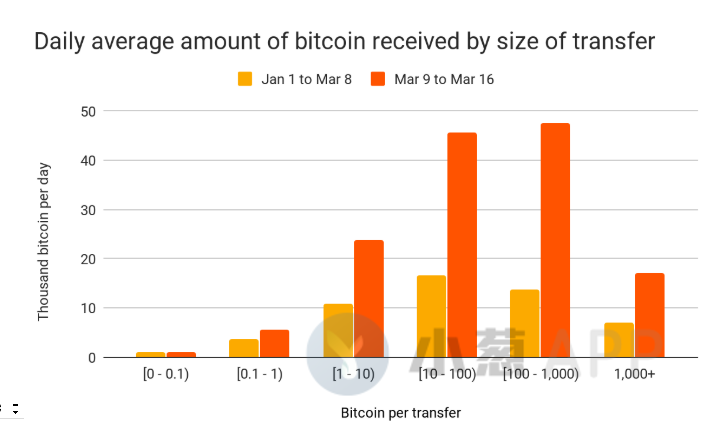

Preliminary findings suggest that professional traders have dominated most of the increased bitcoin inflows, despite a sharp increase in bitcoin microtransaction activity.