Exchange Weekly Trends

Editor | Hao Fangzhou

Produced by Odaily

Exchange Weekly Trends

On March 16, Quedex, a compliant derivatives exchange, launched a new bitcoin contract that will expire in December 2021.

On March 15th, the Huobi perpetual contract will be launched on March 27th, and the market expects that the amount of HT burned will increase by 30%.

On March 15, Huobi burned 4,213,900 HT in February, an increase of 43.45% over the previous month.

On March 13, OKEx CEO Jay Hao: In the past 24 hours, no profitable user of OKEx has reduced their positions in advance.

On March 13, Beijing Lian'an: Under the sharp drop, the amount of Bitcoin in and out of the top exchanges increased significantly.

On March 12, the market value of the Binance stablecoin BUSD exceeded $100 million.

Exchange data statistics

Exchange data statistics

source:

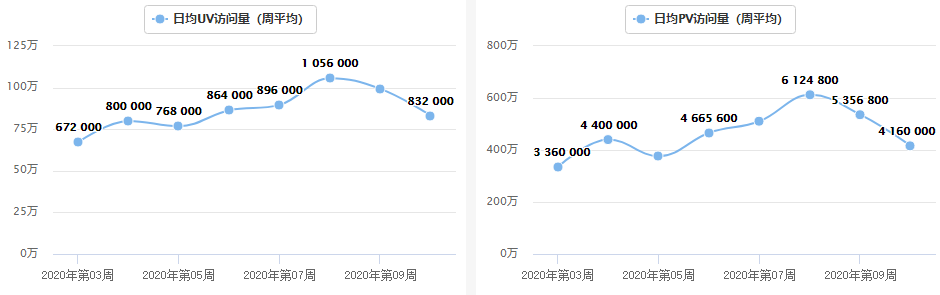

source:Alexa

According to Alexa statistics, the Binance website UV (unique visitors) this week was 832,000/day, a decrease of 16.2% from last week; meanwhile, PV (page views) was 4.16 million/day, a decrease of 22.3% from last week. Binance, as the leading exchange in the encryption world, occupies most of the market traffic, which shows that the overall market traffic has declined recently.

source:

source:Dapptotal

Note: According to the statistics of Dapptotal combined with the historical price trend of BTC, it is found that the number of active users of DEX users is positively correlated with the price. In December 2017, the price of BTC reached a peak of 120,000 US dollars, and the number of users of Dex reached a peak of 9340; in April and May of 2018, the price of BTC rebounded again, and the number of active users of DEX also rebounded again; therefore, the number of users of DEX can be used as a judgment A reference indicator of market trends, but in the transaction volume and number of transactions counted by Dapptotal, the research institute found that its trend is not as highly correlated as the number of users and the price of BTC, so the number of users is intercepted as a reference indicator.

Note: According to the statistics of Dapptotal combined with the historical price trend of BTC, it is found that the number of active users of DEX users is positively correlated with the price. In December 2017, the price of BTC reached a peak of 120,000 US dollars, and the number of users of Dex reached a peak of 9340; in April and May of 2018, the price of BTC rebounded again, and the number of active users of DEX also rebounded again; therefore, the number of users of DEX can be used as a judgment A reference indicator of market trends, but in the transaction volume and number of transactions counted by Dapptotal, the research institute found that its trend is not as highly correlated as the number of users and the price of BTC, so the number of users is intercepted as a reference indicator.

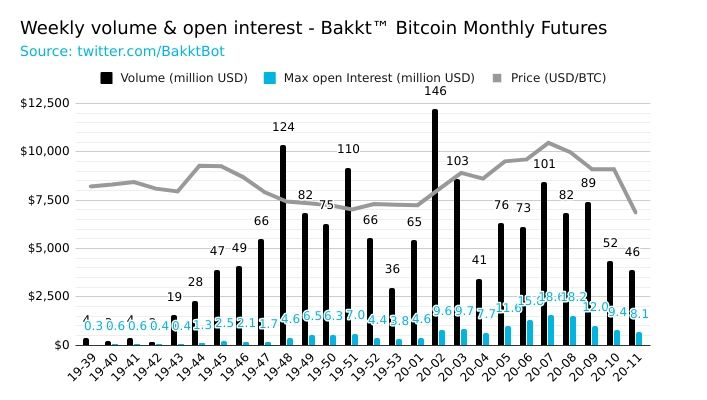

source:

source:Bakkt Volume Bot

secondary title

Among them, the green line is the price trend of BTC, the blue line is the price trend of BNB, and the orange line is the price trend of HT.

source:tradingview

Among them, the green line is the price trend of BTC, the blue line is the price trend of BNB, and the orange line is the price trend of HT.

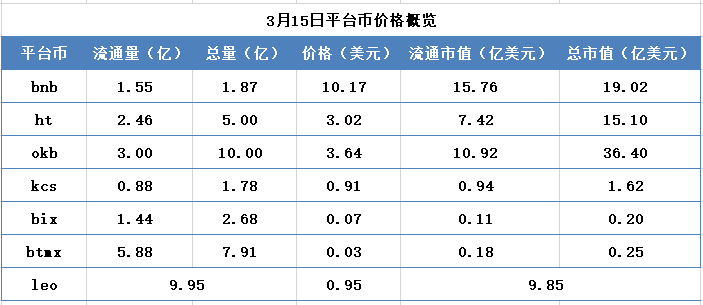

This week, the overall market is in a downward trend, with more than 30% corrections. After bottoming out, platform tokens rebounded stronger than other mainstream currencies, and the decline is generally smaller than that of mainstream currencies.

source:

source:aicoin

analyst point of view

analyst point of view

The rebound of platform currency is stronger than that of mainstream currency

Bitcoin fell by more than 50% this week. The decline of mainstream currencies is generally higher than that of Bitcoin. Compared with other mainstream currencies, platform currencies have a smaller decline and rebounded strongly after bottoming out. One is that platform currencies have certain anti-falling properties compared to other mainstream currencies. It is supported by the profits of the platform. On the other hand, it shows that the overall market still has room for downside. From a technical point of view, platform coins are generally in a relay state, and there is a possibility of making up for the decline in the future.

Exchange traffic drops significantly

Whether it is from the traffic of the head exchange website or the trading volume of overseas compliance exchanges, it has been in a continuous decline recently. One is that the overall liquidity and trading volume of the international financial market are currently severely affected by the epidemic. Second, due to the lack of attractiveness of Bitcoin compared to other trading varieties, the outflow of funds is more obvious.