Editor's Note: This article comes fromNakamoto Shallot (ID: xcongapp), Odaily is authorized to publish.

Editor's Note: This article comes from

Nakamoto Shallot (ID: xcongapp)

, Odaily is authorized to publish.

Bitcoin's (BTC) recent price drop has caught many investors off guard. However, a key indicator showed concern among Bitcoin miners weeks ago.

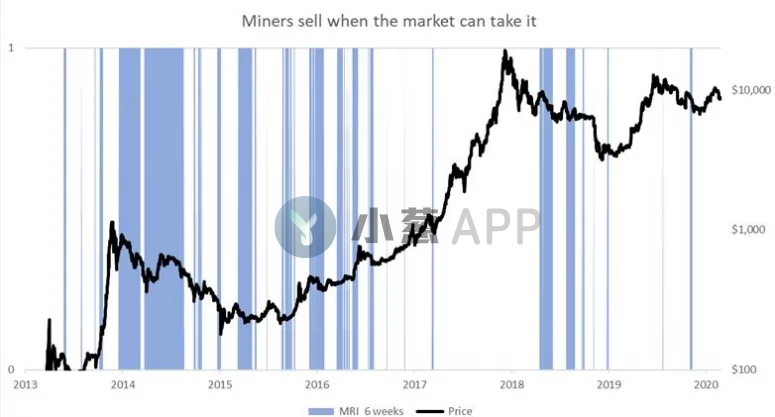

Miner’s Rolling Inventory (MRI) data, created by crypto market data firm ByteTree to measure changes in inventory levels held by major market players, has remained consistently below 100% in January, suggesting investors were more than 30% priced up during the month lack of confidence.

image description

Source: Chainalysis

However, Atlantic House fund manager and ByteTree founder Charlie Morris pointed out that miners operate on cash and always act as sellers in the market, liquidating rewards (bitcoins) for mining blocks to cover their operating costs .

An MRI level below 100 is not necessarily a bullish indicator for prices, representing miners’ concerns that the market is too weak to enter. On the other hand, an MRI above 100 reflects that the market is strong enough to withstand the selling pressure of miners.

The MRI for January was 79%, the weakest in two years, which is actually a warning sign that a bull trap is afoot. After reaching a high of nearly $10,500 in mid-February, Bitcoin has been on the decline since then.

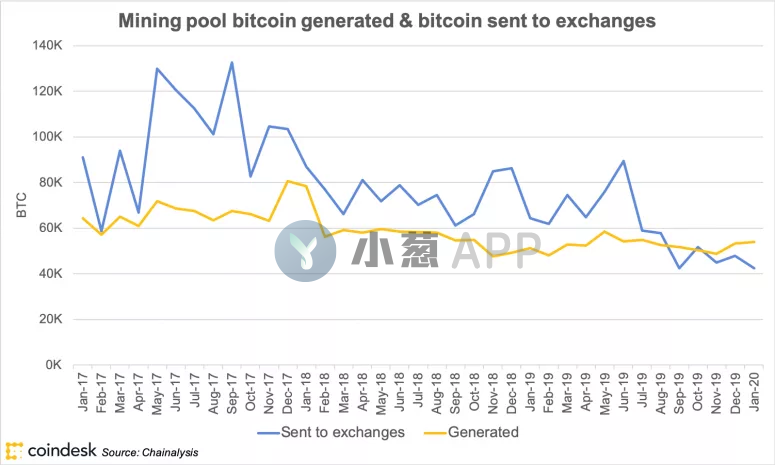

According to blockchain monitoring firm Chainalysis, miners generated 53,955 bitcoins in January, with 42,451 bitcoins flowing into exchanges, yielding an MRI figure of 79%. According to Morris, historically, when miners sell less than they mine, returns are low and when miners sell more than they mine, returns are high.

image description

In other words, miners tend to hoard inventory during bear markets and sell inventory during bull markets.

While it may seem counterintuitive to use stockpiling as a bearish signal, the analogy with traditional finance is instructive. Typically, central banks in deficit countries rely on hot money inflows to accumulate foreign exchange (usually dollars) reserves.

Likewise, miners stockpile or avoid selling when they feel the market is not strong enough to absorb their selling pressure. Entering a weak market will cause prices to fall further, hurting profitability.

secondary title

Miners influence the market

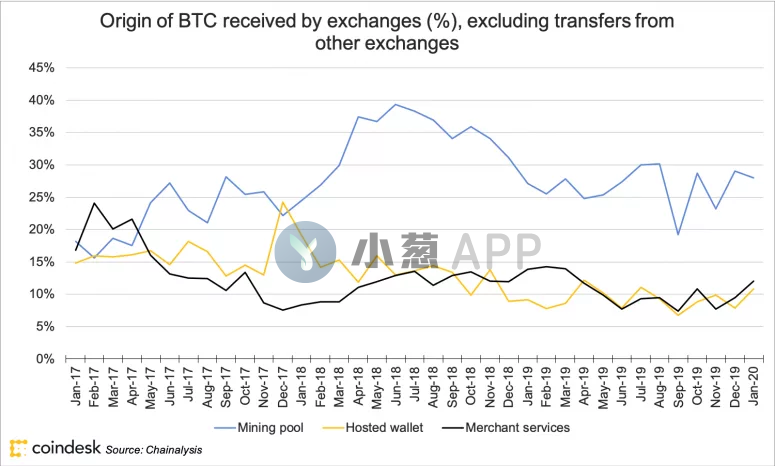

In the cryptocurrency market, miners have the greatest influence on price relative to other components. For example, mining pools account for the highest percentage of total Bitcoin flowing into exchanges.

image description

Bitcoin generated by mining pools vs Bitcoin flowing into exchanges Source: Chainalysis

As of January, more than a quarter of all BTC received by exchanges came from mining pools. Meanwhile, custodial wallets and merchant services (payment gateways or processors) account for just over 10% of the total BTC supply on exchanges. As a result, miners are extra careful when shipping as their actions can lead to massive sell-offs.

As Adaptive Capital analyst Willy Woo pointed out, weak miners, who suffered losses as Bitcoin fell from $14,000 to $8,000 in the third quarter of 2019, started dumping their holdings in the fourth quarter. This led to a further drop in price to $6,500 in mid-December.

As it stands, small, inefficient miners may shut down operations and sell their holdings to mitigate losses if prices continue to slide, according to mining pool Poolin.

However, some miners are still optimistic about the future price of Bitcoin and are optimistic about the expected Bitcoin halving event in May. “In the medium to long term, we are very optimistic about the price,” Xiao Yang, CEO of PandaMiner, a Chinese cryptocurrency mining and mining company, said in an interview. “Despite short-term volatility, we expect market demand to be at a relatively high level, and from a supply side perspective, it will become increasingly difficult to mine Bitcoin.”