text

The "Steem Power Seizure" battle ended briefly with Binance and Huobi announcing the cancellation of voting rights, but it also triggered a deeper discussion: Is it possible for exchanges that are DPoS/PoS nodes and store a large number of user assets to embezzle liquidity? Tokens control public chain governance?

secondary title

Reversing the Steem soft fork, Justin Sun united with the exchange to "seize power" strongly

After TRON completed the acquisition of Steem, members of the Steem community worried that TRON's acquisition was retaliatory and would not bring long-term stable development to Steem.

So on February 24, the Steem community including witnesses, developers and stakeholders jointly wrote a statement stating that in order to ensure the security of the Steem blockchain, the community updated a temporary protection agreement (soft fork 22.2 upgrade) to maintain the current status and long-term development of Steemit’s shares.

Some analysts say that the Steem community developers conducted a soft fork to limit Justin Sun's voting influence. Considering Sun Yuchen's acquisition of Steemit, it is believed that he will use the tokens he holds to push Steemit in a specific direction. The soft fork can prevent the STEEM held by a specific account from voting on who will manage the network, and prevent it from possible See the way it wrests control to engage.

text

text

secondary title

Justin Sun says he took control of the Steem network for a short time due to a hacker attack

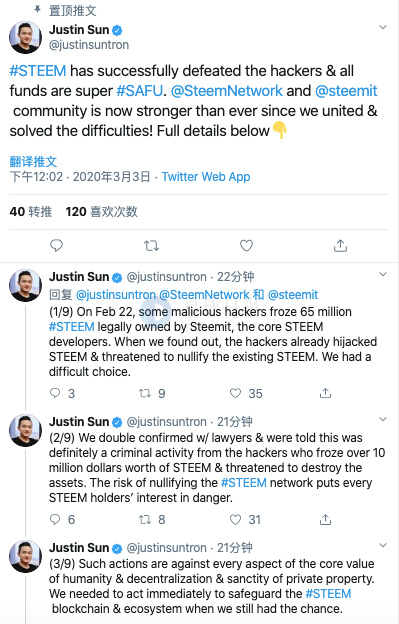

At around 12 noon on March 3, Justin Sun tweeted that he admitted the reason for his control of the Steem network, and explained that the reason for this move was that the hacker froze the STEEM of the core developer, and finally comforted everyone, "Steem has successfully defeated the malicious hacker , all funds are safe."

On February 22, some malicious hackers froze 65 million STEEM legally owned by Steem core developer Steemit. When discovered, the hacker had frozen the STEEM and threatened to invalidate existing STEEM tokens in the Steem network. "Breaking the Steem network would put everyone who holds STEEM at risk, so control of the Steem network is required for a short period of time.

Justin Sun emphasized that controlling the network in a short period of time is a "last resort" choice. He has no intention of controlling or affecting the entire Steem blockchain network. chain merged with TRON blockchain.

“Once it is determined that malicious hackers are no longer damaging STEEM and voting rights are returned to the community, we will commit to withdrawing votes as soon as possible. All exchange votes will be withdrawn soon,” Justin Sun tweeted.

Justin Sun also stated on Twitter, “Those rumors claiming that TRON maliciously took over Steemit by cooperating with exchanges are wrong, our purpose is by no means to take over the network, not only the original TOP 20 witnesses of TRON and Steem, but all parties involved Votes will be cancelled. We just want to protect your private property from hackers."

secondary title

DPoS was questioned by V God, and Binance and Huobi canceled voting rights

Sun Yuchen's approach has also been questioned by V God, the founder of Ethereum.

After the Steem incident, Twitter user Luke Stokes tweeted that users’ STEEM tokens in centralized exchanges were used by Sun Yuchen and other large exchanges to control the Steem zone network. V God replied: "Obviously, Steem's voting system has been taken over by a large exchange participating in its DPOS process. This seems to be the first actual case of 'election-buying attack' under the DPOS consensus mechanism."

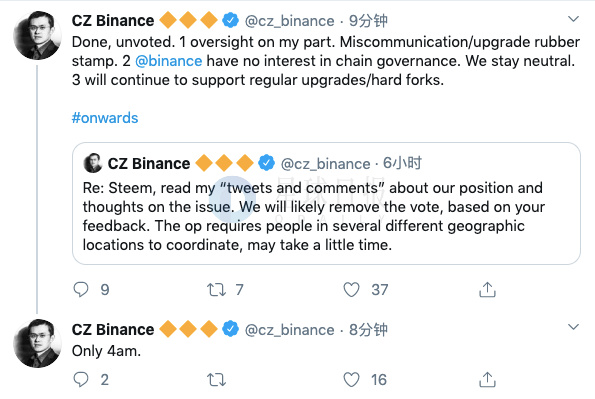

Under the pressure of V God and public opinion, Binance CEO Changpeng Zhao tweeted this afternoon to explain the "Steem struggle for power", and Binance has withdrawn his vote. Changpeng Zhao once again explained that this incident was due to his negligence and mistakenly regarded this upgrade as a routine upgrade. And finally emphasized that Binance is not interested in on-chain governance and has always remained neutral. It will continue to support regular upgrades and hard forks in the future.

After Binance canceled voting rights, Huobi also published a letter to the Steem community on Medium on the evening of March 3, announcing the cancellation of voting.

Huobi stated in a "Letter to the Steem Community": Before the Steem network had problems, Steemit and Tron had already asked us for support. We have been informed that the Steem network is at risk of being attacked, an issue that directly affects our users' assets. So we worked with Steemit and Tron to better understand the situation and carefully assess the existing risks. Based on the information we have received, and out of an abundance of caution, we believe it is in the best interest of our users and the entire network to help Steemit and Tron. But we have always intended to give voting power back to the community so they can decide what the network needs. Therefore, we removed the vote and will always support the user's decision.

secondary title

Should exchanges vote for users?

The exchange may not be interested in participating in governance, but the possibility that the exchange can easily control the governance of the public chain still makes users feel uneasy. After all, "whether you want to do evil" and "whether you can do evil" are two different things.

When we study the governance mechanism of Steem, this kind of "worry" is very reasonable.

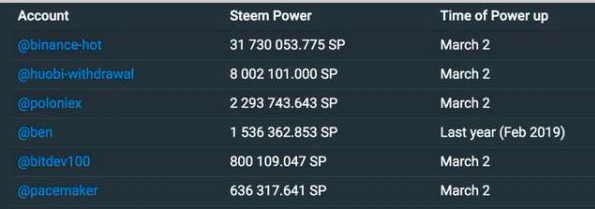

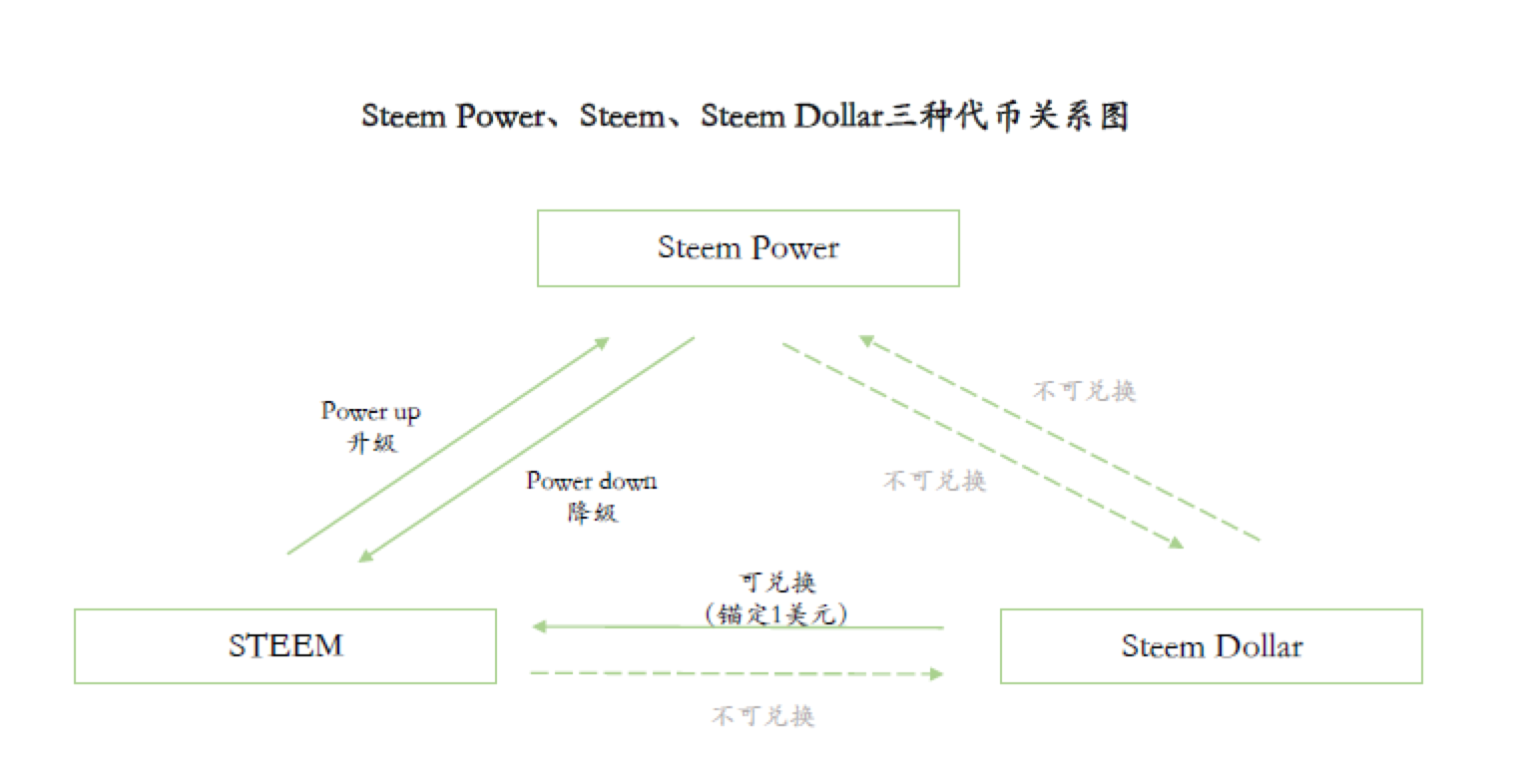

The governance right of Steem is in Steem Power, and Steem token holders can selectively power up the Steem they hold into SP (Super Node), and then vote to govern the Steem network.

Li Zipeng, a senior analyst at Standard Consensus, told Odaily, “From an operational perspective, the user’s Steem currency on the exchange is placed in the exchange address. The actual manager of Steem is the exchange, and the exchange is capable of doing so. Upgrade the Steem stored in the user's hands to SP, and then downgrade to Steem coin in Power Down after the voting is completed."

Li Zipeng continued, "But this only means that the operation is feasible. Whether the exchange has actually done this is difficult to judge, and a lawyer needs to verify it."

If the exchange really does a Power UP to exchange for SP, it is essentially misappropriating user assets, and the Steem tokens after the Power UP will be locked.Assuming that several large exchanges have really done this, it means that if users go to these exchanges to withdraw coins at this moment, there will be no coins to withdraw.

If the user's assets have flowed out of the exchange and locked up without knowing it, this obviously does not meet the exchange's asset management standards, and there is no risk control at all.

The topic that has been discussed more is that the exchange has the right to control the governance of the public chain so easily. Is there a serious flaw in the DPoS design? And, since exchanges that store assets on behalf of users have become PoS/DPoS nodes, can they exercise governance rights instead of users? Have they obtained the authorization and consent of users?

According to user feedback, most exchanges currently do not have a page or function for users to authorize the exchange to exercise their voting rights, and users do not know whether their own tokens have been voted by the exchange.

When a user deposits coins in an exchange, it does not mean that the right to participate in governance is transferred to the exchange. Unless the user chooses to stake his coin to the exchange, this is equivalent to the user pledged the coin to the exchange mining pool, and the mining pool exercises voting rights on behalf of the user, and the user is rewarded for storing coins and earning interest.

So, are the PoS/XPoS tokens that have not participated in Staking honestly staying in the wallet of the exchange, or have they been used for other purposes? We have no way of knowing. Just like before the FCoin storm, we had no way of knowing that many assets had been transferred early.

"Participating in on-chain governance" and "exercising voting rights", many retail investors will feel headaches when they hear similar terms, and they will never participate in them.

However, what is happening today should alert all asset holders that the rights you don't care about may determine the life and death of the project, and may make your tokens become worthless paper.

Odaily also calls on exchanges as nodes to provide better and clearer choices and guidelines in product design, so that users can clarify their choices or guide users to exercise their rights.