Exchange Weekly Trends

Editor | Hao Fangzhou

Produced by Odaily

Exchange Weekly Trends

On March 2, according to a recent report from Arcane Research, the premiums of the Chicago Mercantile Exchange (CME) Bitcoin futures contract monthly, quarterly and semi-annual contracts are declining relative to the weekly average. Futures contracts expiring at the end of March on the CME rose just 0.6%, compared with a 1.19% premium on the unregulated exchange. The June 2020 contract premium on the CME and other exchanges fell to 2.71% and 3.29%, respectively.

On March 1, Binance plans to launch options trading at the end of the second quarter or the beginning of the third quarter.

On February 29th, Huobi Global issued an announcement announcing that Huobi will destroy another 150 million HT. The 150 million HT permanently destroyed this time includes: (1) 97,342,300 HT operating part of the unissued part; (2) investment consisting of repurchases in the secondary market in the first and second quarters of 2018, and the income from voting for currency listing The investor protection fund part is 50.0756 million HT.

On February 29, the Huobi public chain test network was officially launched, and HT will be the only underlying token of the Huobi public chain.

On February 28, the OKEx second-quarter contract was officially launched, with a delivery period of up to half a year.

Exchange data statistics

Exchange data statistics

source:

source:Alexa

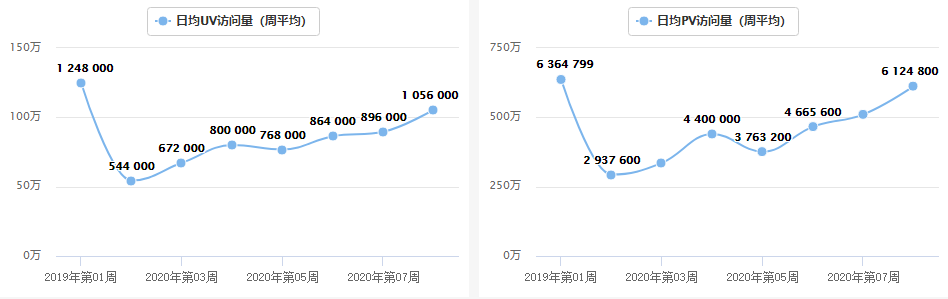

According to statistics from Alexa, the Binance website UV (unique visitors) this week was 1.056 million/day, an increase of 17% from last week; meanwhile, PV (page views) was 6.124 million/day, an increase of 18% from last week. Binance, as the leading exchange in the encryption world, occupies most of the market traffic, which shows that the overall market traffic has increased recently.

source:

source:Dapptotal

(Note: According to the statistics of Dapptotal combined with the historical price trend of BTC, it is found that the number of active users of DEX users is positively correlated with the price. In December 2017, the price of BTC reached a peak of 120,000 US dollars, while the number of Dex users reached a peak of 9340; in April 2018 -The price of BTC picked up again in May, and the number of active users of DEX also picked up again; therefore, the number of users of DEX can be used as a reference indicator to judge the market trend, but in the transaction volume and number of transactions counted by Dapptotal, the research institute found that its trend There is no high correlation between the number of users and the price of BTC, so the number of users is intercepted as a reference indicator).

(Note: According to the statistics of Dapptotal combined with the historical price trend of BTC, it is found that the number of active users of DEX users is positively correlated with the price. In December 2017, the price of BTC reached a peak of 120,000 US dollars, while the number of Dex users reached a peak of 9340; in April 2018 -The price of BTC picked up again in May, and the number of active users of DEX also picked up again; therefore, the number of users of DEX can be used as a reference indicator to judge the market trend, but in the transaction volume and number of transactions counted by Dapptotal, the research institute found that its trend There is no high correlation between the number of users and the price of BTC, so the number of users is intercepted as a reference indicator).

source:

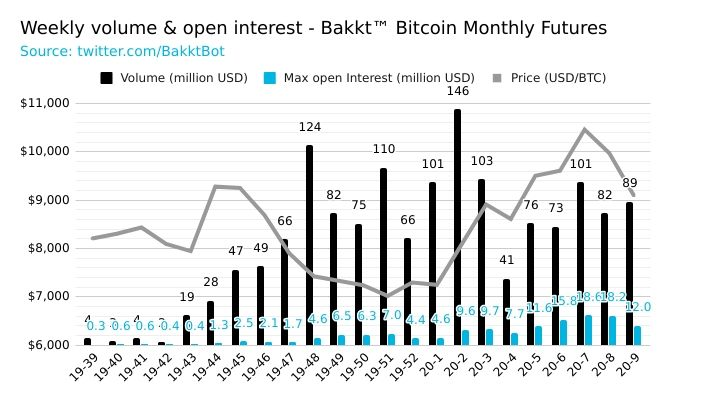

source:Bakkt Volume Bot

secondary title

Among them, the green line is the price trend of BTC, the blue line is the price trend of BNB, and the orange line is the price trend of HT.

source:tradingview

Among them, the green line is the price trend of BTC, the blue line is the price trend of BNB, and the orange line is the price trend of HT.

This week, the BTC price fluctuated downwards, among which HT performed slightly stronger.

source:

source:aicoin

analyst point of view

analyst point of view

The price of platform currency is weak, or it may indicate that the market has entered a downward trend for a period of time

The platform currency is similar to the brokerage stocks in the traditional stock market, and it is the weather vane of the market sentiment. When the price of the platform currency goes down, it means that people are not optimistic about the future expectations. It is recommended to wait and see in the near future.

The gap between long-tail exchanges and head exchanges is becoming more and more obvious

Judging from the recent price trend of platform tokens, the platform tokens of long-tail platform tokens are the first to pull back, and the decline is generally higher than that of mainstream platform tokens. Judging from the professionalism and traffic of new products launched by various platforms recently, the derivatives of mainstream platforms are more prominent. Professional, it is expected that the market will enter a downward channel, and the second-tier exchanges will enter a new round of reshuffle.