This article comes fromThe Block Cryptosecondary title

Odaily Translator | French Fries

![]()

BlockFi Completes $30 Million Series B Funding Led by Valar Ventures

BlockFi Completes $30 Million Series B Funding Led by Valar Ventures

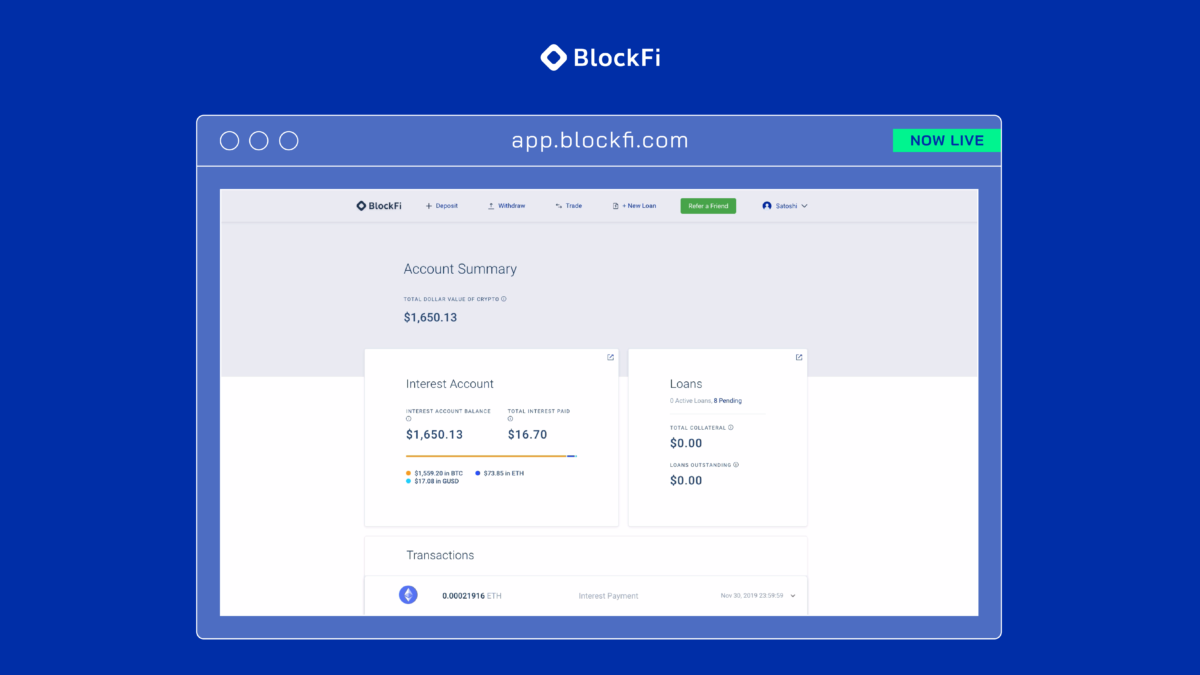

BlockFi, the New York-based crypto lending startup that quietly raised $1.55 million in 2018, disrupted the crypto world. At the time, the company positioned itself as a retail lender — a platform where users could store their bitcoin or ethereum and secure high yields. But since then, BlockFi has grown rapidly, closing an $18.3 million Series A in August 2019 before announcing a $30 million Series B today. With ample cash flow, BlockFi is looking for new opportunities, with an eye toward expanding its institutional lending business, retail brokerage business, and new bitcoin-rewards credit card business, among others.

Andrew McCormack, a partner at Valar Ventures, said in a public statement: "BlockFi has been one of the most successful companies we have invested in." , the loss rate of BlockFi's entire loan portfolio is zero. In 2019, BlockFi's revenue increased by more than 20 times.

secondary title

Transforming from a Crypto Lending Company to a Diversified Financial Services Entity

In a sense, BlockFi is not so much an encrypted lending company as it is a financial technology company, entering the market with an initial product, just like the path taken by companies such as SoFi and Robinhood. Digest traditional financial service functions, and then expand to new products bundled in the platform. “We will gradually reduce our association with the crypto lending business and slowly transform into a diversified financial services entity,” BlockFi CEO Zac Prince said in an interview.

BlockFi has launched its own retail brokerage to provide a similar service to major players such as Coinbase. The new product makes sense for users, who will no longer need to transfer funds out of BlockFi to trade. This stickiness will allow BlockFi to manage more funds and become a more attractive partner. The business, which launched last year to support bitcoin, litecoin and ethereum, has seen $10 million in transaction volume in its first month so far. BlockFi is planning to launch its own app in 2020. Prince said the success of the trading function had to some extent affected financing activity, and such businesses required higher capital reserves.