Exchange Weekly Trends

Editor | Hao Fangzhou

Produced by Odaily

Exchange Weekly Trends

On February 2, according to the latest report from Arcane Research, the premium of CME’s Bitcoin futures contract has been rising and has now exceeded 5%. 4.5% range.

On January 31, the crypto exchange GO.Exchange announced that it will permanently shut down on March 15.

On January 30, Zebpay closed its local cryptocurrency exchange business in India for up to a year after the Reserve Bank of India (RBI) imposed a cryptocurrency banking ban. The exchange announced on Wednesday that it will be relaunching and launching new services in India.

On January 30, Surojit Chatterjee, the former product head of Google Shopping, left the parent company Alphabet to become the chief product officer of Coinbase, the largest cryptocurrency exchange in the United States.

On January 30, the cryptocurrency derivatives exchange Deribit will launch a daily-expiring bitcoin options contract next week.

On January 29, the encryption exchange LocalBitcoins is closing long-term customer accounts in three regions: Africa, the Middle East and Asia.

Exchange data statistics

Exchange data statistics

source:

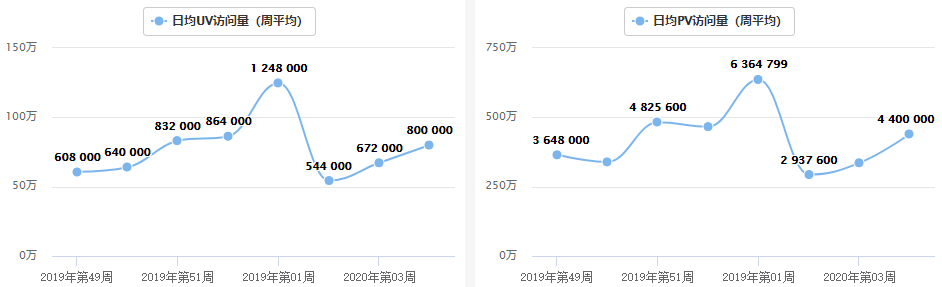

source:Alexa

According to Alexa statistics, the UV (unique visitors) of Binance website this week was 800,000/day, an increase of 19% from last week; meanwhile, the PV (page views) was 4.4 million/day, an increase of 30% from last week. Binance, as the leading exchange in the encryption world, occupies most of the market traffic, which shows that the market situation has improved recently.

source:

source:Dapptotal

(Note: According to the statistics of Dapptotal combined with the historical price trend of BTC, it is found that the number of active users of DEX users is positively correlated with the price. In December 2017, the price of BTC reached a peak of 120,000 US dollars, while the number of Dex users reached a peak of 9340; in April 2018 -The price of BTC picked up again in May, and the number of active users of DEX also picked up again; therefore, the number of users of DEX can be used as a reference indicator to judge the market trend, but in the transaction volume and number of transactions counted by Dapptotal, the research institute found that its trend There is no high correlation between the number of users and the price of BTC, so the number of users is intercepted as a reference indicator).

(Note: According to the statistics of Dapptotal combined with the historical price trend of BTC, it is found that the number of active users of DEX users is positively correlated with the price. In December 2017, the price of BTC reached a peak of 120,000 US dollars, while the number of Dex users reached a peak of 9340; in April 2018 -The price of BTC picked up again in May, and the number of active users of DEX also picked up again; therefore, the number of users of DEX can be used as a reference indicator to judge the market trend, but in the transaction volume and number of transactions counted by Dapptotal, the research institute found that its trend There is no high correlation between the number of users and the price of BTC, so the number of users is intercepted as a reference indicator).

source:

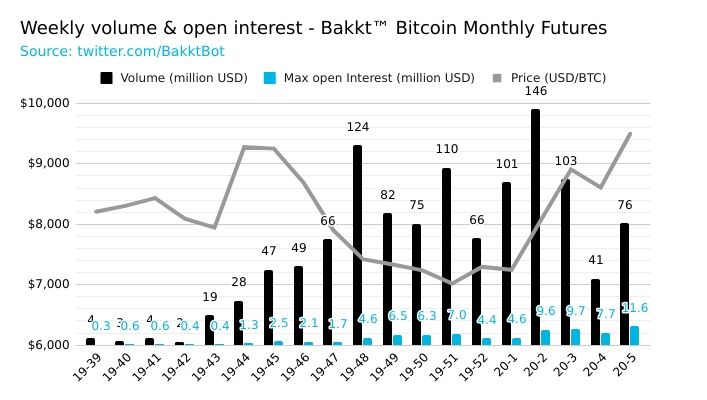

source:Bakkt Volume Bot

secondary title

Among them, the green line is the price trend of BTC, the orange line is the price trend of BNB, and the blue line is the price trend of HT.

source:tradingview

Among them, the green line is the price trend of BTC, the orange line is the price trend of BNB, and the blue line is the price trend of HT.

The trend of platform currency and BTC this week is relatively similar, and it is expected to be dominated by shock adjustments in the next few days.

source:

source:aicoin

analyst point of view

analyst point of view

The performance of platform currency is divided into two levels

Exchange traffic picks up

Exchange traffic picks up

Recently, no matter from the website traffic of Binance and DEX, or from the price performance of platform tokens, the exchange traffic has shown signs of recovery. Since the beginning of this year, affected by the halving of Bitcoin and mainstream currencies and the impact of international economics and politics, the transaction volume has soared, which is significantly better than Q4 in 2019. It is expected that the price of the platform currency will be reflected in the future.