Written by: OKEx analyst Yan Song

Written by: OKEx analyst Yan Song

The market trading sentiment is strong, and the global bitcoin derivatives trading volume exceeds 25 billion US dollars in a single day

Bitcoin’s market share has declined, but the midline bullish pattern remains unchanged

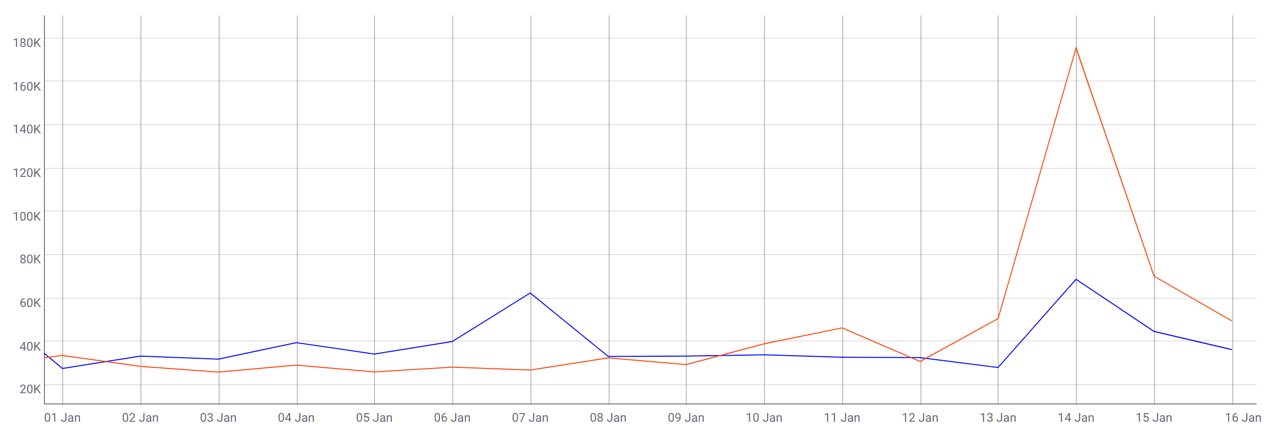

Since the beginning of the year, the return rate of Bitcoin has reached 23%, but the most eye-catching thing this week is undoubtedly the "operation" of BSV's 150% increase within 24 hours. BSV took off from around $180 on Jan. 14 and shot all the way to over $450. On the day's total market capitalization rankings, it surpassed EOS, LTC, USDT and old rival BCH one after another, rising from eighth to fourth. At the same time, 175,000 active addresses were harvested that day, more than twice that of BCH. At present, BSV has fallen to fifth in the total market capitalization rankings, one place behind BCH.

Figure 1: BSV/BCH active addresses (orange/blue) – 1/1/2020 – 1/1/2020 – Coinmetrics

Emotional side

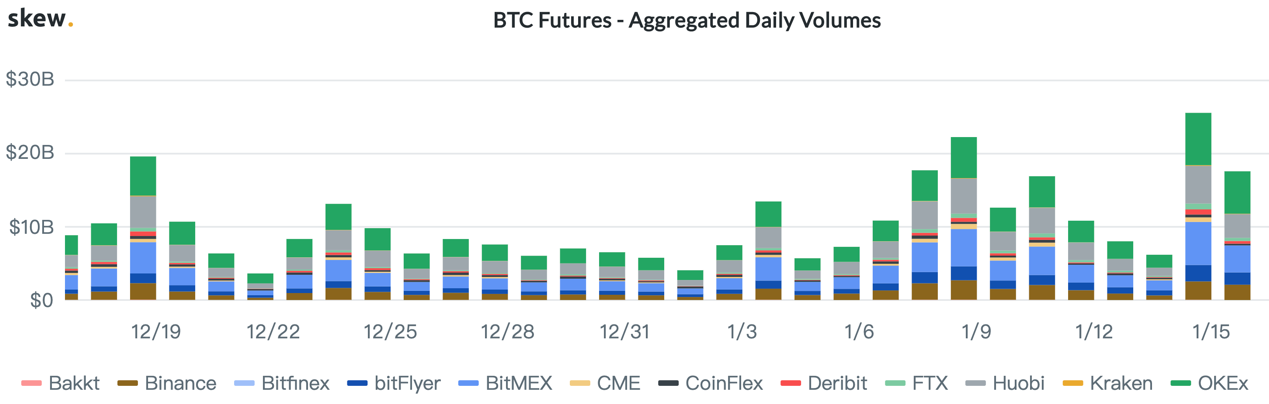

The strong trading sentiment in the market can be perceived from various aspects. Accompanied by the recovery of the market, the trading volume in the derivatives market has risen sharply. According to the statistics website Skew, the global BTC derivatives trading volume exceeded 25 billion US dollars on January 14, of which 7.1 billion US dollars came from the OKEx platform, which is also the highest trading volume day since October 26.

image description

The total amount of OKEx contract positions has exceeded 1 billion US dollars, and this value is still on the rise; in addition, the "BTC leveraged long-short ratio" of the OKEx platform has reached an astonishing 16:1, that is, the ratio of the accumulated amount of borrowed USDT to borrowed BTC has exceeded 16 , obviously a large number of participants are increasing the amount of chips in their hands in various ways to participate in it.

Figure 3: OKEx trading big data BTC leverage long-short ratio - 1/10 10:00 - 1/17 10:00

technical side

As the BSV skyrocketed this week and drove the market of mainstream currencies, the market value of Bitcoin fell rapidly. At present, the K line formed by the market value ratio has entered the oversold range in terms of RSI indicators. The last time this happened was at the beginning of 2019 . The lowest 66.3% of the market capitalization is also the lowest point since August last year (according to Tradingview data), and the current value is still on a downward trend.

image description

The cross star harvested on the daily line on January 15 shows short-term uncertainty, and there may be a few days of consolidation at this position accompanied by a continued rise in the total amount of positions. $9000 is the natural integer resistance level above; in addition, MA200 near $9070 is another visible resistance level, which is an important moving average for the long-term bull-bear boundary. If BTC can stand on this moving average, it will be a long-term positive. $8500 to $8600 will become the lower support. Due to the profit-making accumulated in the rapid rise in the previous period and the relationship between the intensive trading area above, it is difficult for us to see a unilateral upward trend again in the next few days, but the bullish pattern in the middle line remains unchanged.

image description

Figure 5: OKEx BTC Index Price Daily K-line (MA50/100/200 – Red/Yellow/Blue) - November 2019 to present

Long Volatility via Options

If BTC shows a short-term consolidation according to the expected trend, and the midline fluctuates sharply, options may be a better tool to achieve risk control and gain profits. This is the way to do long volatility. The total amount of open positions has been accumulated in the past few weeks, and when the market comes, it may form a chain of liquidation, making the price fluctuations more violent.

There are two simpler ways to go long volatility:

1. Buy a Straddle – A strategy of buying ATM at-the-money call options and put options at the same time in the next week or quarter, expecting the market to move substantially in either direction. The end result will be losing money on one trade and hoping to make a big profit on another.

The difference in expiration date is that the time loss of sub-cycle options will be relatively large, while the purchase cost of quarterly options is relatively high.

Risk warning: This article does not constitute an investment recommendation. Investment is risky. Investment should consider personal risk tolerance. It is recommended to conduct an in-depth investigation of the project and carefully make your own investment decisions.