Produced by Odaily

Editor | Hao Fangzhou

Produced by Odaily

The head effect of the exchange is becoming more and more obvious;

Binance website traffic has picked up significantly;

Exchange Weekly Trends

Exchange Weekly Trends

Cryptocurrency exchanges now hold 10% of Bitcoin’s total supply, according to data provided by on-chain intelligence firm Glassnode on Jan. 10. Over the past three years, the amount of Bitcoin stored in exchange addresses has increased by more than 700%.

On January 9th, the co-chairman of the Hong Kong Blockchain Association: Soon there will be a number of encrypted exchanges that will be able to operate in Hong Kong with a license.

On January 9, European investment platform BUX acquired cryptocurrency exchange Blockport.

On January 8, Binance partnered with Satang Corporation, a compliance exchange in Thailand, to open the Thai Baht deposit channel.

Exchange data statistics

Exchange data statistics

source:

source:Alexa

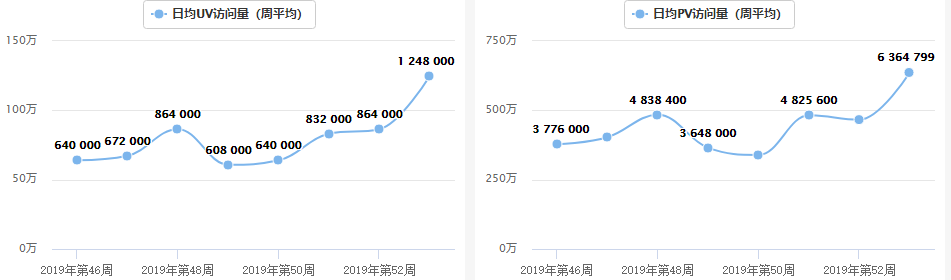

According to Alexa statistics, the Binance website UV (unique visitors) this week was 1.248 million/day, an increase of 44% from last week; at the same time, PV (page views) was 6.364 million/day, an increase of 36.4% from last week. As the leading exchange in the encryption world, Binance accounts for most of the market traffic, which shows that the overall market traffic has increased recently.

source:

source:Dapptotal

secondary title

Note: According to the statistics of Dapptotal combined with the historical price trend of BTC, it is found that the number of active users of DEX users is positively correlated with the price. In December 2017, the price of BTC reached a peak of 120,000 US dollars, and the number of users of Dex reached a peak of 9340; in April and May of 2018, the price of BTC rebounded again, and the number of active users of DEX also rebounded again; therefore, the number of users of DEX can be used as a judgment A reference indicator of market trends, but in the transaction volume and number of transactions counted by Dapptotal, the research institute found that its trend is not as highly correlated as the number of users and the price of BTC, so the number of users is intercepted as a reference indicator.

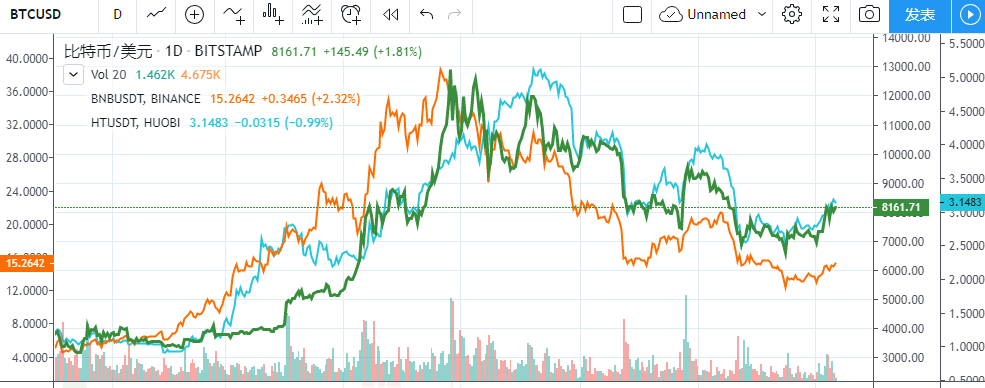

Among them, the green line is the price trend of BTC, the orange line is the price trend of BNB, and the blue line is the price trend of HT.

source:tradingview

Among them, the green line is the price trend of BTC, the orange line is the price trend of BNB, and the blue line is the price trend of HT.

This week, the price of BTC is mainly volatile, and the trend of platform currency is slightly weaker than that of BTC.

source:

source:aicoin

analyst point of view

analyst point of view

The price performance of the platform currency is lower than expected

Although the price of platform tokens has generally risen in the past week, the performance has not been as expected. In recent weeks, BTC, BCH, BSV, ETC, DASH and other halved currencies have performed well, and the transaction volume has increased significantly, while the performance of platform currencies with the attributes of securities companies is significantly weaker than the above-mentioned currencies. First, it shows that the platform currency has not yet reached The second reason may be policy risk.

The proportion of Uniswap in Dex is gradually increasing, which may indicate the direction of DEX

According to the statistics of Dapptotal, it can be found that the number of active users of Uniswap has doubled in the past half month, and the transaction volume has increased by about 2 times. It currently ranks first in the Dex rankings. Uniswap increases liquidity through liquidity pools and Takers, which is faster and deeper than peer-to-peer transactions, which may indicate the direction of decentralized exchanges in the future.