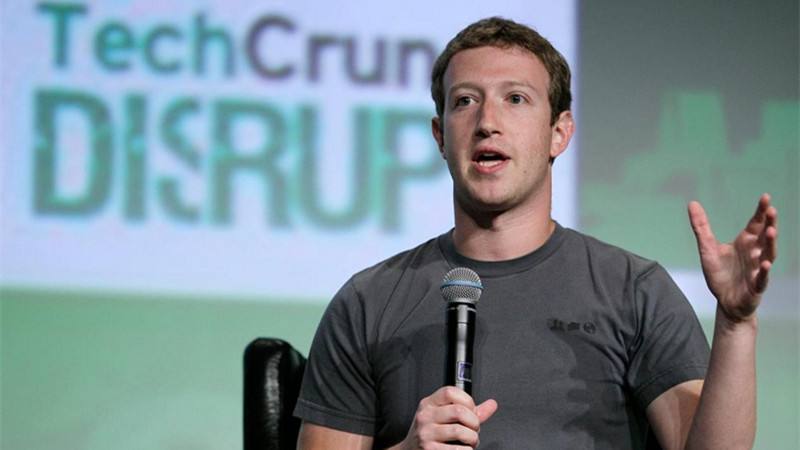

Facebook CEO Zuckerberg released his vision for the new 10-year early this morning. In his vision, he mentions generational change, new private social platforms, opportunities for decentralization, next-generation computing platforms, and new forms of governance.

But he didn't mention Libra, the encryption project announced by Facebook in June last year. Zuckerberg stated that he wants to create a new private social platform, develop decentralized technology, solve intergenerational issues, and form a new way of digital governance.

secondary title

Libra was declared a failure

In June 2019, Facebook released the Libra white paper.

In July 2019, the U.S. House of Representatives issued a formal request to terminate the Libra project.

In September 2019, France and Germany agreed to boycott Libra.

In October 2019, a quarter of the members withdrew from the Libra Association.

Just at the end of 2019, Libra finally ushered in a fatal blow. “Facebook’s Libra project is a failure in its current form and needs to be reworked to be approved,” said the Swiss finance minister.

secondary title

Regret defining Libra as a currency

Marcus said that what may be regrettable now is that Facebook had to explain to the public before it fully understood the Libra project. "The biggest criticism we get is 'Why are you rushing to release the news before you've thought through all the issues?'," Marcus said. According to Marcus's explanation, the reason for this result is also forced by the situation. As the Libra team meets with various partners, a lot of news about the project has spread like wildfire in the media. When Facebook solicited opinions from multiple parties, Marcus thought that it might be a more appropriate approach to let the public know, and Facebook might even regain the position of public opinion.

secondary title

Where does Libra go in the future?

First of all, Libra is indeed a new phenomenon, and it is a challenge that monetary authorities have not encountered in the past. Therefore, it can only be launched after allowing them to figure out the risks inside and solve the related financial stability risks. Once the circulation is realized, it will involve the financial and monetary sovereignty of a country. As part of the state's rights, private companies will not be allowed to challenge the monetary sovereignty. However, if the full power is handed over to the state for supervision, the capital involved in the enterprise may not support it. .

Secondly, the cost of launching and circulating a new digital currency may also be unbearable. Among them, the largest proportion, some people in the industry believe that it is mainly regulatory costs. As an emerging product, digital currency has greater circulation, so the difficulty of supervision will be more complicated, and the formulation of relevant regulatory policies will also face more unpredictable challenges. Various problems will inevitably put Facebook under heavy pressure. Before coming up with a feasible solution to the above problems, Libra's launch will also be difficult.

Finally, privacy and security are also insurmountable hills on the road ahead of Libra. The state of digital finance is growing wildly, the market is chaotic, and related technologies have not yet reached a mature and stable stage. There are no good solutions for privacy, security, and supervision.

How does the Libra currency comply with real-name authentication and anti-money laundering rules to avoid abuse. In view of the fact that Facebook does not pay attention to the supervision of its media platform, and the other is ineffective, the major regulators dare not expect any improvement in the cryptocurrency once it is released. While security experts interviewed said tracking cash flow online would solve the problem, it wasn't enough to reassure people. At present, Facebook has 2.8 billion users around the world. If everyone starts to use the Libra currency, the status of the US dollar and other legal currencies, as well as the sovereignty of the world's major central banks, will inevitably be weakened. The bigger threat at that time is that the Libra Association can authorize any private company representative committee to adjust Libra's reserve currency basket.

It is hard for us to imagine that the central bank role of the global central bank should be easily obtained by Facebook and others, and it is even more difficult to imagine that the organization that holds the right to issue a large amount of global currency was initiated by a private commercial organization. If Libra eventually becomes a unified global currency, any mistake, whether it is a technical risk or a moral hazard, will be a catastrophe.

From this perspective, currency naturally has political attributes, and it involves the core and most basic interests of every government and everyone, and it cannot be issued by anyone who wants to issue it.

If you have to say that Libra has its positive significance, it is that it is a mirror that allows people to have a deeper understanding of the connotation and extension of currency, have the opportunity to grasp the essence of currency more deeply, and see clearly the boundaries that currency can reach. and the power it carries. At least we can now say that money is not money itself in essence.

Therefore, in 2020, it is very unlikely that Libra will be on the world economic stage.